Asia Week Ahead: RBA Meeting And Regional PMI Readings

Image Source: Pixabay

The Reserve Bank of Australia (RBA) will likely revert to heftier rate hikes, while PMI reports from across the region could indicate differing growth outlooks.

Regional PMI reports out in the coming days

China will release PMI data next week and we expect slight gains for both manufacturing and non-manufacturing activity. Given the start of the export season, factories should be busier than during the previous month. Meanwhile, the Golden Week in early October – a seven-day holiday when tourists and shoppers flock to sites and shops – should bring some temporary recovery for retailers and restaurants.

For Taiwan, manufacturing activities should continue to be weak due to a fall in demand for semiconductors, laptops, and smart devices. Soft demand should keep the manufacturing PMI well below 50. For the same reason, capital outflows from the Taiwan stock market will likely lead to a mild fall in foreign exchange reserves.

RBA to revert to heftier rate hikes

The coming week also features Australia’s November central bank rate meeting, where after the big upside miss to 3Q22 inflation, we think the bank will have to return to 50bp of tightening after it dropped to just 25bp at the October meeting.

Early returns from Japan’s reopening

Japan’s activity is expected to continue recovering due to the reopening and revitalization of the auto industry. Both industrial production and retail sales are expected to grow. Improved economic activity should keep respective PMIs above 50, suggesting positive momentum for the nation’s recovery in the near term.

Korea weighed down by slowing trade activity

In Korea, activity data should be soft due to slowing trade data, although the projected dip should be partially offset by gains in the automobile sector. This trend should be reflected in September’s industrial production data. Industrial production in September will likely record a contraction for the third consecutive month with persistent inventory stocking.

Korea’s services sector should continue to recover but at a slower pace than during the previous months. Meanwhile, investments are expected to remain positive, as suggested in solid equipment imports. On the other hand, exports could record a small gain in October, but the trade deficit will likely still widen. We are now concerned as exports next year will likely turn negative with unfavorable base effects.

Retail sales from Singapore and Australia

Australian retail sales for September may reflect the high prices of many food items as shown in the recently published inflation numbers for 3Q22. This could bias the month-on-month figures higher, though adjusted for inflation we would expect to see spending growth beginning to slow down.

In Singapore, retail sales are expected to slow on a month-on-month basis as fast-rising prices weigh on purchasing power. The return of foreign visitors may provide some support, but overall momentum is clearly slowing.

Inflation in the spotlight

Inflation in Indonesia and the Philippines will likely heat up further. Indonesia’s recent price increase for subsidized fuel is expected to push transport costs higher. Meanwhile, Philippine inflation will likely move past 7% after food prices rose sharply due to crop damage from recent typhoons.

In Korea, we can expect to get CPI inflation and the October MPC meeting minutes. Headline inflation is expected to accelerate again in October mainly due to the rise in utility rates and the weak Korean won, but October’s number should still be below the July peak of 6.3%.

Other key data releases: India’s budget figures

India releases deficit figures for September. The numbers have been running a little on the high side on a cumulative basis, so a figure equal to or lower than last year’s number for September (INR 58,842 Crore) would help to put India’s public finances back on track to meeting the 6.4% deficit target for the fiscal year.

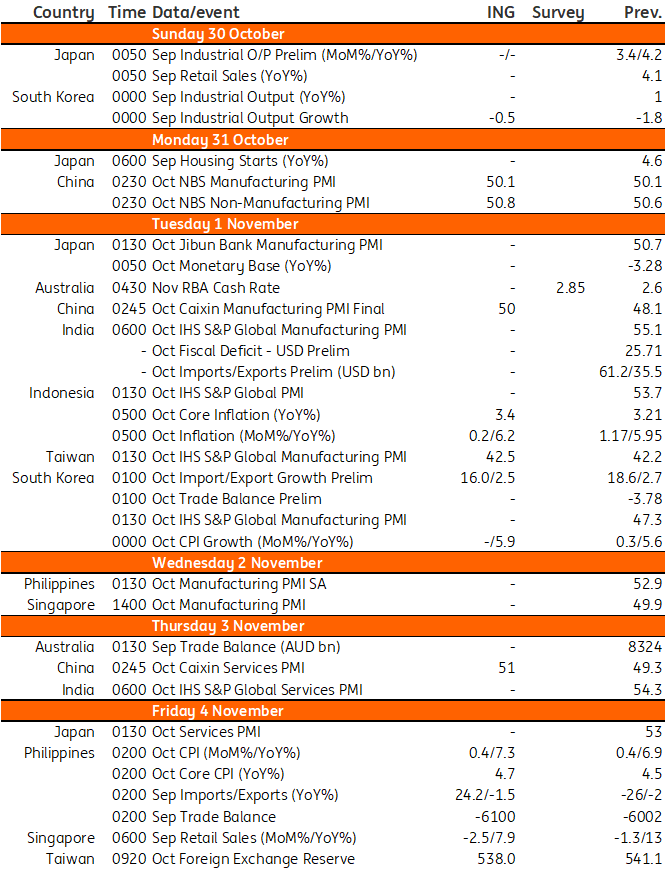

Asia Economic Calendar

Image Source: Refinitiv, ING

More By This Author:

Rates Spark: The ECB Confirms The Market Bias

U.S. GDP Is Back In The Black

Rates Spark: First Balance Sheet Tweaks

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more