Asia Week Ahead: Keep An Open Mind On Rate Surprises

Image Source: Pixabay

It’s set to be a week where central banks will probably stick to their guns, but there are upside rate risks in Australia and downside risks in India. Inflation data everywhere will generally be a bit stickier than desired, and recent typhoon effects may mean more of that in the months ahead. But exports, including from China, will remain supportive.

China and Taiwan: Trade data to remain supportive, inflation to edge higher

China is set to release its trade and inflation data in the upcoming week. Solid export demand has supported growth in the first half of the year, though the last few months of survey data have shown new export orders contracting. July's data is likely to see export growth remain in high single-digit or low double-digit growth amid a supportive base effect, and there is some possibility of some frontloading of exports ahead of tariffs. We expect a modest recovery of import growth as well after a surprise year-on-year contraction in June, but the strength of imports will likely remain uneven and skewed towards demand from the AI race and hi-tech self-sufficiency drive. Inflation is likely to trend a little higher in July on the back of recovering pork prices which should contribute to a smaller drag from food price inflation, we expect CPI inflation to move higher to around 0.6% YoY.

Taiwan is also scheduled to release its trade and inflation data in the week ahead. Trade growth will most likely moderate after very strong June reads of 23.5% YoY and 33.9% YoY for exports and imports respectively. Exports may cool to high single-digit or low double-digit growth while imports are likely to show stronger growth in the high teens. We are looking for inflation to edge up a little from 2.4% to 2.5% YoY in July, as house prices continue to move higher and existing pressures from food and healthcare prices remain.

Australia: RBA our rate hike call looking "optimistic" now

Our rate hike call for this coming Reserve Bank of Australia meeting has taken a knock following the publication of the second quarter of 2024 and June CPI data. We still feel that a case for a 25bp rate hike can be made as monthly run rates for inflation remain too high, and we're therefore sticking with this call – but we do so with very low conviction now. The RBA may instead prefer to keep its options open and give a soft landing a greater chance by leaving rates unchanged. We live in hope that we are right, but are realistic about the prospects...

India: Reserve Bank likely holding fire, though don't rule out a cut

It is a busy week in India, with PMI indices and a Reserve Bank of India meeting. We’ve been tracking food prices which play a large weight in India’s inflation basket and expect to see a sharp drop in headline inflation when it is released in a little over a week. Until then, the RBI will likely stop short of any rate cuts but is clearly looking for an opportunity to do so. As long as the USD remains under weakening pressure and the inflation data plays out the way we think it will, then an October rate cut is definitely within reach and we cannot absolutely rule out a cut on 8 August. PMI data should continue to reflect strong growth.

Philippines: July inflation - rice prices remaining elevated

So far, the cut in rice tariffs in early July seems to have had no discernible impact on Philippine retail rice prices, and the recent typhoons may push other seasonal food prices higher in the meantime, so we may need to wait to see the impact of lower tariffs on food prices and inflation more generally. We think that probably puts a lid on Bankgo Sentral ng Pilipinas' ambitions to front-run the Federal Reserve with rate cuts as soon as this month, though conditions are becoming more favorable, and BSP could well still see a window for easing in the fourth quarter of 2024.

GDP for the second quarter of 2024 released at the end of the week will likely show growth running close to 7% YoY, though this will be mainly a base-effect driven result, and quarter-on-quarter growth will likely come in a little below 1%, lower than the 1.3% growth recorded for the first quarter of the year. Trade data for July could show a slightly smaller deficit from June, which may provide a little support to the PHP in what is currently a fairly supportive environment.

Elsewhere in Asia...

Japan: The results of the spring wage negotiations should continue to be reflected in paychecks. We expect wage growth to accelerate to 3% YoY in June, but it won't keep up with high inflation and real cash earnings are therefore likely to remain negative.

Singapore: Retail sales are averaging a little over 2.5% YoY growth and are likely to register something similar in June. July could see a pickup as European tourism increases over the summer school holiday months.

Indonesia: Seccond quarter GDP from Indonesia will, as always, come in at about 5% YoY. The lack of plausible volatility in these numbers means that they can be largely ignored. GDP growth may indeed be about 5%, but we should not imply anything from this publication.

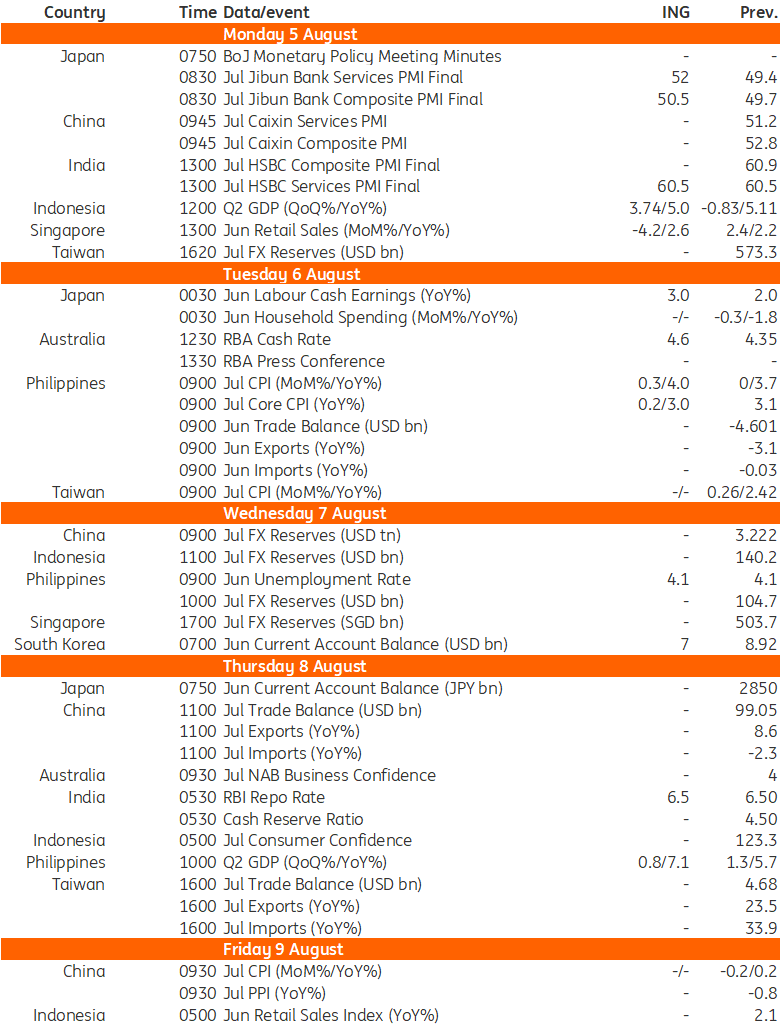

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Higher Unemployment In Eurozone Threatens Consumption RecoveryFX Daily: A Softer Dollar Is ‘On The Table’

The Commodities Feed: Geopolitical Risks Reignite

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more