Asia Week Ahead: Japan’s Month-End Data, Plus China’s PMI

Image Source: Unsplash

At the end of January, Japan will publish its month-end data, with the Bank of Japan paying particular attention to service prices. Additionally, China’s PMI data and South Korean exports will be under close scrutiny.

Japan: easing inflation and modest retail sales growth expected

There will be the usual month-end data dump from Japan. Inflation, labour, industrial production and retail sales will be released on the last day of January. The Tokyo CPI is expected to ease from 3.0% year-on-year in December to 2.6% YoY in January, as the government resumed its utility subsidy programme from January.

The Bank of Japan (BoJ) should keep a closer eye on service prices, which are expected to rise steadily on the back of improved household income conditions. Tight labour market conditions are expected to persist, with the unemployment rate remaining at 2.5%.

On the activity side, industrial production is expected to rise 2.6% month-on-month in December, mainly due to a technical payback from motor vehicle production, and a solid increase in core machinery orders suggests a rebound in machinery production. Meanwhile, retail sales growth is likely to gain, but at a slower pace, in December.

South Korea: January exports are likely to fall due to holidays

Trade data for January will be released on Saturday. Both exports and imports are expected to contract sharply in January mainly due to unfavourable calendar effects. The timing of the Lunar New Year usually causes volatility in January and February trade figures. This year, January trade should be more adversely affected due to an additional public holiday announced by the government.

Despite the sudden drop in exports, we expect a rebound in February. We believe that the working day-adjusted average export growth should remain positive but at a slower pace.

China: manufacturing PMI, industrial profits, and MLF decision

China enters the start of the Lunar New Year holiday period next week, and as a result, most of the key releases have been set for next Monday. The last major data release before then is the January PMI data out on Monday, one of the few indicators that is not released alongside February data. We are expecting a small uptick in the manufacturing PMI to 50.3, up from 50.1 in December.

Also out on the same day is China’s December industrial profits data, which is likely to show industrial profits declined in YoY terms in 2024, and the MLF decision, which is expected to remain unchanged at 2.0%.

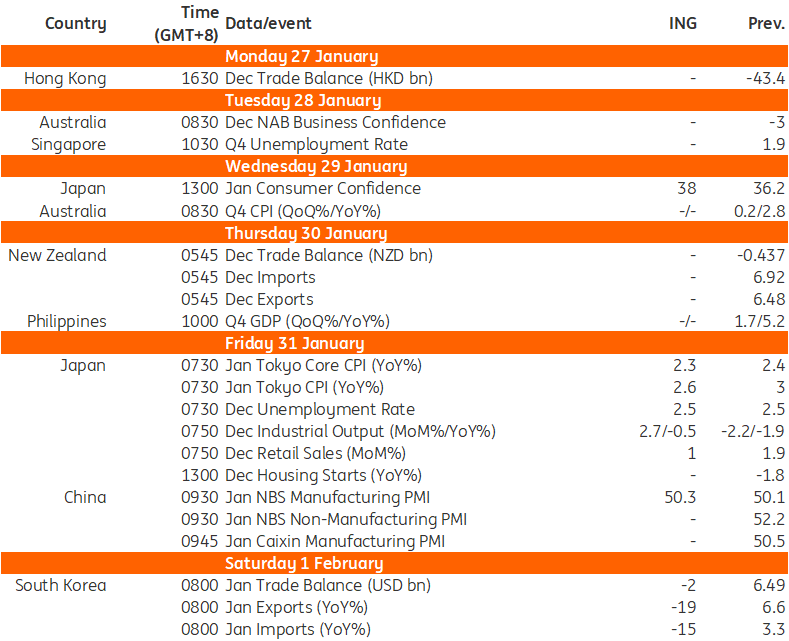

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

FX Daily: Market Still Mulling Over Trump’s First WeekKorea: Fourth Quarter 2024 GDP Up Just 0.1 Percent Yet The Worst Seems To Be Over

Rates Spark: Lots To Get Excited About… Next Week

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more