Asia Week Ahead: Inflation Readings From China And India

Image Source: Unsplash

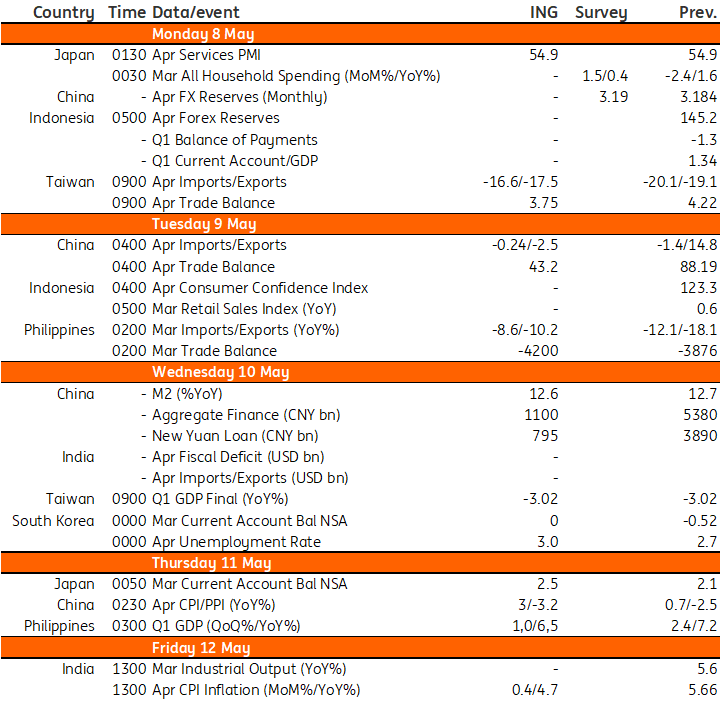

Next week’s data calendar features several inflation reports from China, India, and the Philippines. Meanwhile, we will also get trade data from China and Taiwan plus labor data from South Korea.

Inflation to ease in India

April inflation data in India will likely show another steep decline, taking the inflation rate closer to the mid-point (4%) of the Reserve Bank of India’s (RBI's) inflation target. We expect the CPI index for April to rise by 0.4% month-on-month. That is a full percentage point lower than the comparable increase in April 2022 and should take the inflation rate down to 4.7%.

At these levels, a debate about the timing and extent of future easing of the repo rate by the RBI will likely start, and this could weigh on the Indian rupee, though any such change would ultimately be supportive of growth. We still expect easing to commence later this year, perhaps as early as the third quarter.

Trade data from China and Taiwan

China and Taiwan will release trade data next week. Due to weak external demand, we are expecting exports for both economies to slow. However, we note that China’s electric vehicle exports could see an increase on a yearly basis as Chinese car manufacturers are looking to export as their key strategy, on top of organic growth in the domestic market.

Jobless Rate to rise in Korea

The jobless rate in Korea is expected to rise in May with sluggish construction and manufacturing hiring. Meanwhile, the government's job program likely added more jobs.

Loan growth and price figures from China

Next week, China will also announce loan growth, which should be growing mildly starting from April as Chinese banks usually book loans in the first quarter. Slower loan growth in April should not be interpreted as low loan demand as most of the loans for the year have already been booked.

Meanwhile, China should continue to show modest CPI inflation, and weaker manufacturing activities should continue to put deflationary pressures on PPI.

Philippine GDP to slow as inflation bites

The Philippines will release first-quarter GDP data next week and we are expecting a year-on-year expansion of 6.5% down from 7.2% previously. Growth will be supported by household consumption, although we note a slowing trend as elevated inflation saps some purchasing power. Meanwhile, capital formation will likely be subdued given moderating bank lending after Bangko Sentral ng Pilipinas (BSP) sustained rapid-fire rate hikes. GDP growth should continue to decelerate in the coming quarters as still high inflation and the fallout from central bank rate hikes take hold.

BSP will see both inflation and GDP data ahead of its policy meeting on 16 May.

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Tense Markets, But Dollar Bear Trend Should Win Out

Rates Spark: No Peak Rate In Europe, Not Yet Anyway

FX Daily: Transatlantic Divergence Keeping EUR/USD Bid

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more