Asia Week Ahead: Inflation Data From Australia And Japan

Image Source: Pixabay

Next week’s data calendar features inflation numbers from Australia and Japan plus activity data from Korea and China.

Has the time come for a pivot by the Reserve Bank of Australia (RBA)?

A further unwinding of the holiday-induced surge in travel and recreation prices in February, together with some lower food prices, will partly offset higher gasoline prices and some stickiness in other subcomponents to bring inflation in Australia back below 7% in February. If so, it will support the RBA’s recent hints that rates are close to a peak, with one more 25bp hike looking like the most likely outcome now, taking the cash rate target to 3.85%.

Positive signs for Japan’s economy

We think Japan’s economy is on the road to recovery. Inflation seems to have finally passed the peak. Tokyo CPI inflation is expected to slow down further, stabilizing energy prices and base effects. Labor markets continue to tighten mainly in the service sector. Manufacturing activity should rebound in February as snowstorm disruptions normalize.

Upcoming survey and activity data from Korea

Survey and monthly activity data will be out next week. We believe that recent developments in global banking probably hurt consumer sentiment. On the other hand, China’s reopening could help businesses be more optimistic for the future.

Meanwhile, production activity among industries should continue to diverge; we expect auto production to rise firmly on the back of good demand for electric vehicles while semiconductor production declines due to sluggish global demand for IT products.

China PMI data

China is going to release PMI data next week. We expect a month-on-month fall in export orders but an expansion of domestic orders in the manufacturing PMI index. This is because of the slowing demand for goods in export markets. Non-manufacturing PMI should post slower growth as the recovery of the Chinese economy has been gradual. Real estate activities are included in the non-manufacturing PMI index. The recent increase in home transactions should support the non-manufacturing PMI index, but it should not be seen as a growth factor.

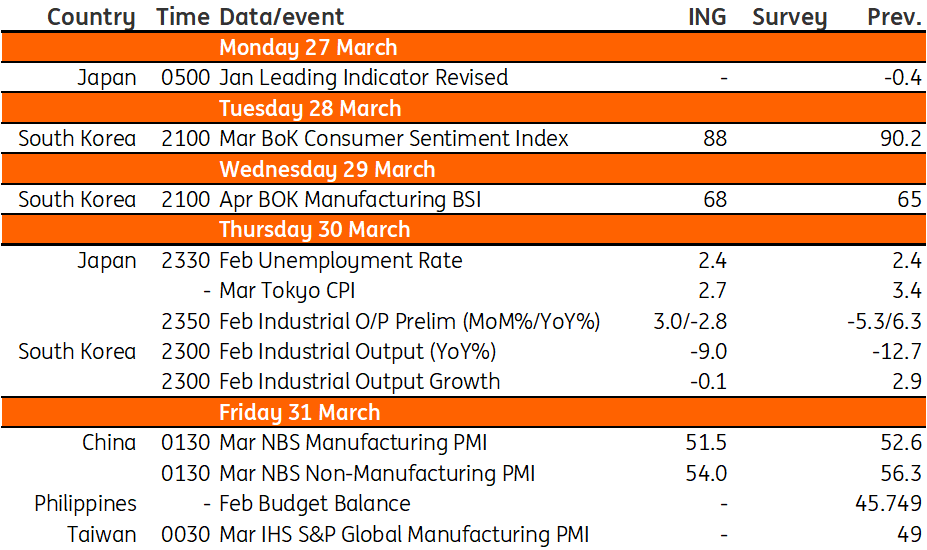

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Trading Places

Central Bank Of Turkey Keeps Policy Rate On Hold

Bank Of England Tightening Likely Done As It Hikes By 25bp

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more