Asia Week Ahead: India’s GDP And Regional PMI Reports

Image Source: Pixabay

Regional PMI reports will be the highlight next week, while inflation in Australia could be flat.

Australia's CPI inflation is likely to steady while retail sales rise

Australia’s inflation is likely to stay close to last month’s rate of 5.4%, kept elevated by higher electricity tariffs this month and offsetting lower gasoline prices. Surprises to the figure may come from recreation, where holiday prices (hotels etc.) already rose sharply in June and may be due to a correction.

July retail sales could rise by about 0.4% month-on-month after the -0.8% decline in June. That would still mean that sales were growing a little more slowly than prices, indicating a real terms decline that would be in keeping with the service sector PMI, which dropped into contraction territory in July and worsened again in August.

Likely disappointing PMI numbers from the region

Major players in the region will be releasing their manufacturing PMI reports. Next week we will see both the official and Caixin manufacturing PMIs released. We expect these figures to show a further deterioration, as we await more substantial support from the government to boost domestic demand while global demand remains weak.

One positive next week would be that the non-manufacturing PMI may still register a modest expansion even if the index edges lower, as it is still the summer holiday season when many families travel and boost business.

China’s economic struggles may also be reflected in figures from the rest of Asia, especially strategic trade partners like Korea, Japan, and Taiwan. With some better news from the important semiconductor sector, PMI for these regions may be slightly higher but remain below the 50 threshold for expansion.

Meanwhile, Korea has slashed its production of vehicles and semiconductors, which could contribute to a sustained decline in industrial production. Korea will continue to see its exports struggle due to weak semiconductor and oil exports.

Japan’s production numbers may fare slightly better, possibly posting a slight monthly gain on the back of improved global supply conditions for vehicles.

India's second-quarter GDP to grow 7.8%

India's GDP growth in the second quarter should come in at about 7.8%. The main drivers for growth are government investment in infrastructure and a recovery in private investment. However, declining exports and erratic monsoons may weigh on agriculture's contribution to growth.

Inflation in Indonesia to inch up slightly

August inflation in Indonesia will likely inch up to 3.4% year-on-year, up slightly from last month’s 3.2%. The slight uptick in inflation could be traced to transport and food costs, but it should be short-lived as high transport inflation is set to moderate by September after the base effect kicks in.

Meanwhile, core inflation should settle at 2.5%YoY, well within the target band of Bank Indonesia (BI). Despite moderating inflation, pressure on the Indonesian rupiah has forced BI to provide support for the currency and not cut policy rates.

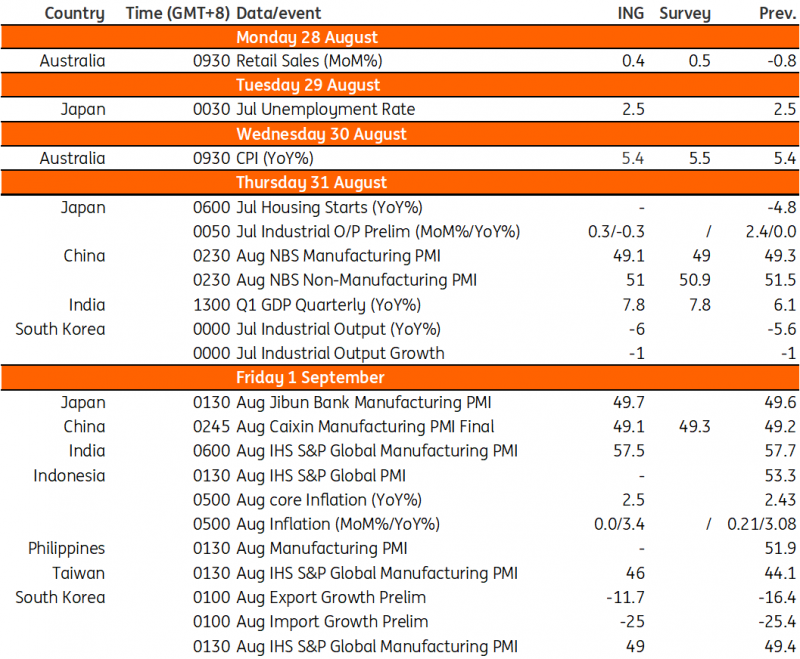

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Lagarde Faces A Harder Test Than Powell

Turkey’s Central Bank Announces Surprise Rate Hike

BRICS Expansion: The Saudi Surprise Adds Momentum To The De-Dollarization Debate

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more