Asia Week Ahead: Growth And Inflation Reports From Major Economies

Image Source: Pixabay

Next week’s Asia calendar features GDP data from India and Australia, inflation from Australia, Japan, and Indonesia, Singapore’s retail sales, and PMI data from Korea, Japan, China, and Taiwan.

India’s economy not slowing anytime soon

High-frequency activity indicators for the fourth quarter showed little sign of slowing in India, and as a result, we are looking for the year-on-year growth rate to come in at 4.0% or even higher. Substantial base effects make the interpretation of a single quarter’s data virtually impossible. But a figure of 4.0% in the fourth quarter will deliver a growth rate of 6.7% for India for the calendar year of 2022 and put it on course to achieve around 6.3% for the fiscal year that ends in March 2023.

We anticipate another year of growth in the region of 6% in 2023 following a supportive budget which contains a big increase in capital investment in infrastructure.

Inflation to remain resilient in Australia

The end of 2022 was characterized by extensive flooding in some parts of Australia, and we would not be surprised to see this have some impact on the 4Q22 GDP numbers that are due on 1 March. Tighter monetary policy will likely exert a slight drag on the economy, especially from the more interest-sensitive parts of the economy, such as housing. We anticipate GDP growth of 0.5% quarter-on-quarter (2.5% year-on-year), which will still deliver a respectable 3.6% growth rate for the full year 2022.

Australia also releases January CPI inflation data. The December figures provided a rude shock to those who thought that inflation had peaked, with the unprecedented 27% month-on-month increase in holiday prices the culmination of the economic re-opening colliding with seasonal holidays. We do anticipate some unwinding of that result, though there is likely to be plenty of residual strength in other parts of the CPI result to limit the decline in the inflation rate from 8.4% to 8.2% YoY (0.3% MoM).

Trade, PMI, and industrial production data from Korea

In Korea, we expect exports to deepen their contraction further in February mainly due to the sharp decline in semiconductor exports. Meanwhile, manufacturing PMI is expected to rise marginally on the back of the optimism surrounding China’s reopening but remain below 50. Given sluggish exports in January, we expect January’s industrial production to decline but retail sales could rebound as severe weather may have boosted weather-related consumption. So, a weak start to the quarter will likely weigh on the first quarter's GDP, which could translate into a contraction.

PMI, jobless rate, and Tokyo CPI from Japan

With a relatively late reopening of the economy, Japan should continue to recover on the back of the government support program. Thus, we believe that service PMI and hiring are expected to improve. However, January’s cold wave probably had a negative impact on manufacturing activity and consumption, thus we foresee a decline in the January industrial production numbers. Meanwhile, Tokyo CPI inflation is expected to come down quite sharply to a 3% level from the recent peak of 4.4% due to the government energy subsidy program and base effects.

China PMI data to be released next week

In China, we expect manufacturing activity to pick up in February as factories resumed work after the long holiday. Services PMI however could dip to just above 50 after the spike in spending related to the holiday which was likely offset by an increase in financial and real estate services.

Upcoming Taiwan manufacturing PMI

In the coming week, Taiwan is set to release manufacturing PMI. We expect the numbers to move higher from 44.3 to 47.0 in February after the Chinese New Year. Export orders for semiconductors, however, were still in contraction, which is not a good sign for the prospects of manufacturing activity.

Indonesia’s core inflation to stay flat in February

Headline inflation in Indonesia could tick higher to 5.4%YoY but the core inflation reading is expected to remain flat in February. Bank Indonesia (BI) cited slowing inflation as one of the main reasons for pausing at its most recent policy meeting. Price pressures have eased somewhat but BI might refrain from cutting policy rates until we see a more pronounced slide in core inflation.

Singapore retail sales to slip in January?

Retail sales in Singapore are expected to post a modest contraction in January after a surprise gain in December 2022. The implementation of the latest round of goods and services tax may have had a negative impact, although solid department store sales may have provided a boost to overall retail sales.

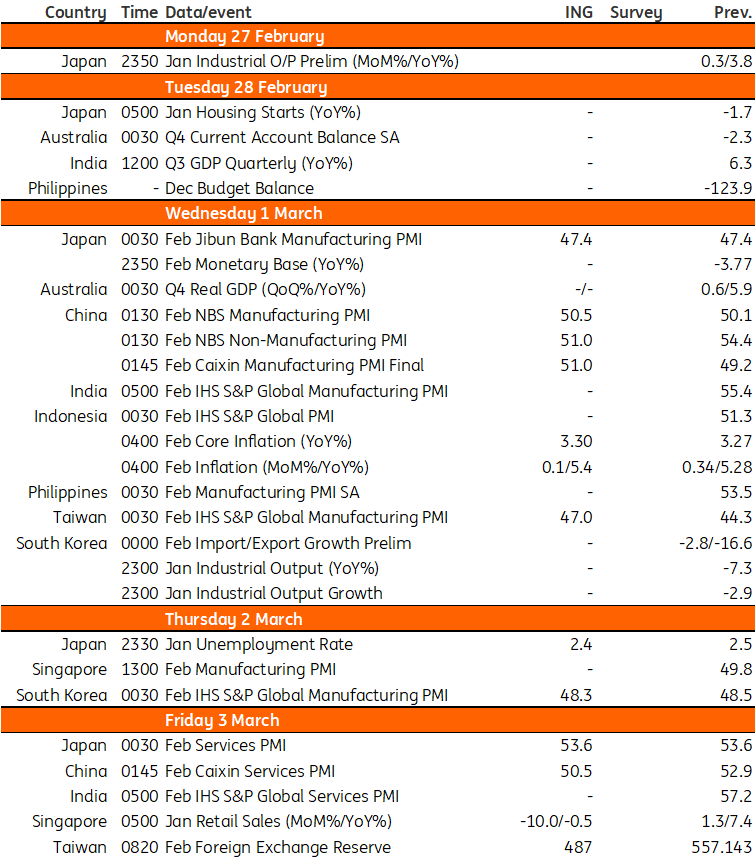

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Geopolitics Sees Pro-Risk Trades Unwind

South Africa: Key Takeaways From The 2023 Budget

Central Bank Of Turkey Cuts Rates And Commits To Supportive Financial Conditions

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more