Asia Week Ahead: Flurry Of Data From Japan And Korea

Inflation in Australia to accelerate?

Next week Australia will release its CPI data and we should see a bounceback in consumer prices. Based on our data, we expect to see a moderate increase in food, alcohol and tobacco prices last month. Rising oil prices add to the mix. The only good news is probably on holidays, where we expect a dip in flight costs and hotel prices. Overall, we expect inflation to rise from 4.9% to 5.2% year-on-year.

Caxin China PMI

The Caixin Manufacturing PMI for China beat expectations last month and came in at 51.0 – just above the threshold that indicates expansion rather than contraction. This was due to an upturn in overall sales despite a further drop in business abroad. With no concrete fiscal stimulus boosting the economy and the end of the summer holidays, but some slightly better indications from the latest month’s data deluge, it is likely that this number will remain close to, or perhaps creep a little higher from last month’s figure.

Flurry of data out from Japan

In Japan, we think solid consumption and service activity will likely support inflation staying above the 3% range. We believe that core inflation excluding fresh food and energy is expected to accelerate further in September with private service prices rising.

Meanwhile, thanks to strong activity in services, the jobless rate is expected to edge down in August. Industrial production in Japan will also likely rebound from the previous month’s decline mainly due to a pick-up in motor vehicle production.

Sentiment in Korea likely on the downtrend

We think both consumer and business sentiment indices in Korea could deteriorate. Business confidence should weaken on the back of sluggish exports and growing uncertainty over the near-term economic outlook. For consumers, weak domestic equity performance and the recent tightening of mortgage measures might have hurt sentiment.

Singapore inflation to edge lower

Singapore reports August inflation next week. We expect headline inflation to dip to 3.9% year-on-year, down from 4.1%YoY from the previous month. Favourable base effects and softer growth momentum will likely translate to a dip in CPI inflation. Core inflation will likely be flat at 3.8%YoY.

Meanwhile, industrial production will likely still be in the red. We could see the tenth consecutive month of contraction for industrial production, tracking the sustained weakness of non-oil domestic exports (NODX). NODX recently posted another month of contraction as global trade grinds lower. Industrial production should stay challenged for as long as NODX is in contraction, with weaker industrial activity seen to weigh on GDP growth.

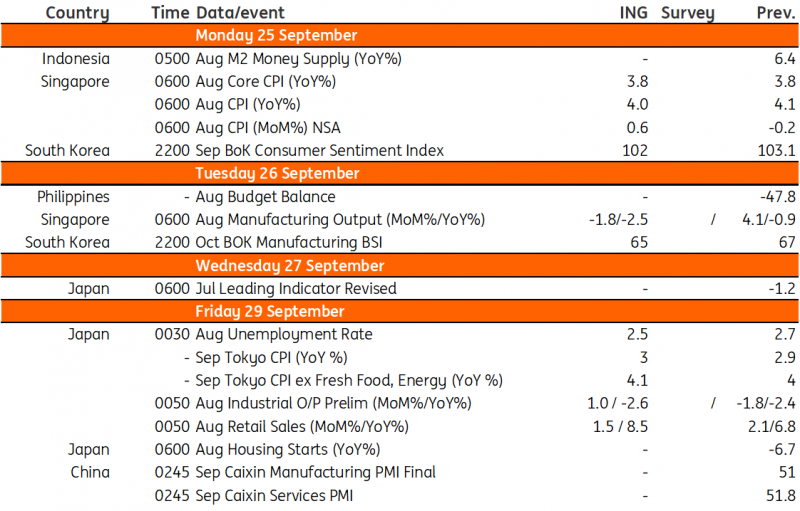

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Key Events In Developed Markets For The Week Of Sept. 24

Czech National Bank Preview: Last Meeting Before First Rate Cut

Key Events In EMEA For The Week Of Monday, September 25

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more