Asia Week Ahead: China’s Loan Prime Rates And Singapore’s Monetary Policy, Alongside More Regional Data Releases

Image Source: Unsplash

China’s Loan Prime Rates

It is a quiet week ahead for China in the aftermath of the Third Plenum and key data releases over the past week. The People's Bank of China announces the 1 year and 5 year loan prime rates on Monday, where expectations are that the rates will remain unchanged after no change was made to the MLF this month. No major data is expected out of China for the next week.

Taiwan’s Export Orders

Taiwan is set to publish its export orders data on Monday, where we are looking for a further acceleration of export orders growth to 13.5% year-on-year in June, on the back of recent positive momentum and a supportive base effect from last year. Industrial production data is scheduled for release on Tuesday, where it is expected to continue to grow rapidly after last month’s surge to 16.1% YoY growth; our forecast looks for a slight uptick to 17.1% YoY.

Singapore’s Monetary Policy

Singapore’s central bank, the Monetary Authority of Singapore, will publish its July statement on monetary policy this week. We expect them to keep all policy settings unchanged, to narrow the forecast range for GDP from 1-3% to 2-3%, but for core and headline inflation forecasts for 2024 to remain 2.5% to 3.5%, though there is some upside risk to that view. We are anticipating that the path of the SGD NEER will remain at its current growth rate of about 0.5% quarter-on-quarter until the October meeting, when we expect it to be reduced to around a 0.25% QoQ increase.

We also get inflation data for June, which could well nudge a little higher from the 3.1% rate recorded for May, though we expect the MAS’ core rate to remain at 3.1% YoY for a fourth consecutive month.

A bounce back in industrial production of about 6% month-on-month will still likely leave the annual growth rate only just above zero (0.3% YoY). Despite some support from the strong global electronics upcycle, Singapore has lagged the rest of the region in this sector and annual growth rates are still subdued.

Korean Survey Data

Survey data is expected to improve on the back of solid gains in asset markets (equities and property) and a strong upward cycle of semiconductors. Despite improved sentiment of household and businesses, we continue to believe that domestic growth will remain a drag on overall growth. Meanwhile, the Bank of Korea will release second quarter GDP, which is expected to decelerate sharply from the previous 1.3% QoQ sa to 0.1%. Exports should be the main growth engine, but consumption and investments are likely to contract, as suggested by the monthly activity data.

Tokyo’s CPI

Normalisation of auto production, the strong performance in semiconductors, and a tourism boom will push up PMIs. We believe both manufacturing and services PMIs will stay above the 50 level. Tokyo CPI will be released just a week before the Bank of Japan’s meeting. We expect Tokyo core inflation to rise 2.0% YoY, which is above the BoJ’s target of 2%. Together with strong wage growth, a recovery in the auto sector, and retail sales, the BoJ is expected to deliver a 15bp hike at its July meeting.

India and Australia’s PMI

PMI indices are published for many economies in the APAC region in the coming week. India’s PMIs for both services and manufacturing should continue to point to strong growth in both sectors. The Australian PMIs will likely show further weakness. The manufacturing PMI may deliver a small statistical rise but will almost certainly remain in sub-50 (i.e. contraction) territory. In contrast, the services sector will point to ongoing growth, but at a slower pace.

Vietnam’s Data Dump

The coming week includes Vietnam’s “data dump” when we get data on inflation, retail sales, industrial production and trade. Probably of most interest will be the inflation numbers which are pushing up against the State Bank of Vietnam’s inflation target upper range, at a time when the currency looks expensive relative to its regional peers.

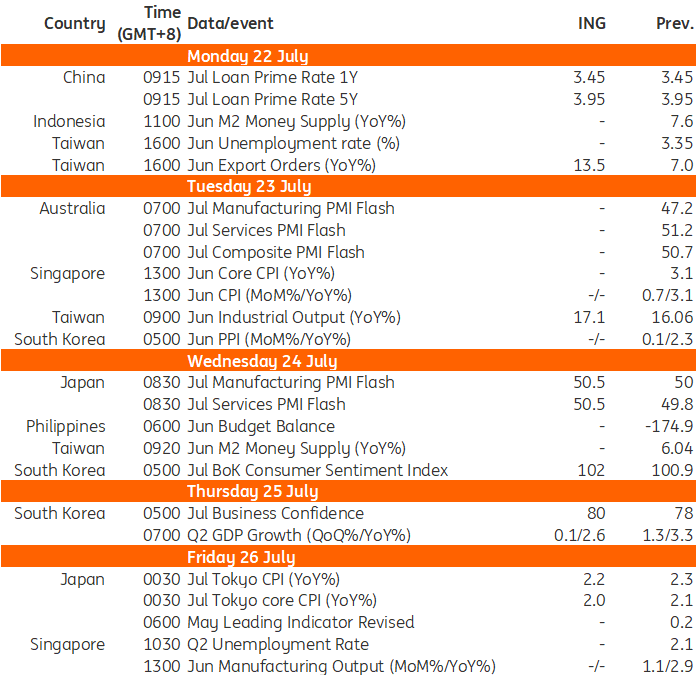

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Bank Of Canada Preview: Another One DownRates Spark: ECB Unlikely To Satisfy Doves

FX Daily: Dollar Back To Softest Levels Since March

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more