Asia Week Ahead: China’s Activity Data In Focus

China’s activity data and Australia’s labor data will be keenly watched in the coming week.

The week ahead

China’s activity data tops the list next week as industrial, retail data and more will be announced. Although upcoming reports will not capture the recent lockdowns, they could be a useful measure of the health of China's economy ahead of the closures. Aside from China data, we also have labor data from Australia and India’s inflation report. Other data reports in the coming week are Indonesia’s trade data and Korea’s MPC minutes, which could shed light on future rate hike decisions. Lastly, Japan reports core machinery orders which are expected to dip amid a slow global recovery.

China to share key economic data

We should continue to see weak growth in China's industrial production and smaller growth in fixed asset investment as this will be largely dragged down by residential projects. Retail sales could show slightly better growth due to the summer holidays, as this year’s inbound travel showed more activity than last year due to more flexible social distancing measures.

We expect no change in the 1Y Medium Lending Facility policy rate at 2.75% as the People's Bank of China (PBoC) has adopted a wait-and-see approach after it cut the rate last month. Loan growth should jump in August as the central bank has lowered interest rates and provided guidance for banks to increase lending.

Australia’s labor report

Australia’s labor market report for August is also set for release next week. The Reserve Bank of Australia has made labor market conditions a key input into its rate-setting behavior, given that official inflation and wages data are released only quarterly. In July, there was a 40,900 decline in total employment, which runs against all the anecdotal evidence of labor shortages across Australia.

We would look for many of the 86,900 full-time jobs that were apparently lost in July to be replaced, and expect some upside to the +30,000 total median with up to 55,000 jobs possibly added for the month. That could result in a further decline in the unemployment rate but we believe the current 3.4% should hold, as the employment figures and unemployment rate are not directly connected.

India’s inflation could inch up to 7% after recent reprieve

Some of the recent moderation in India's high food price inflation may be waning in response to extreme weather and other factors, which could see headline inflation nudging up back towards the 7% year-on-year level. But if energy prices remain under pressure in the months ahead, this increase in inflation may prove short-lived. India also delivers industrial production data for July. This should ease back sharply from the 12.3% YoY rate from June as reopening boosts have run their course.

Indonesia’s trade data, BoK minutes and Japan machinery orders

Other data reports in the coming week include Indonesia’s August trade data and we expect recent trends to hold. Both exports and imports should remain in expansion mode, but exports are expected to outpace imports again resulting in a hefty surplus. The trade surplus could settle at roughly $4.5bn which could support the Indonesian rupiah in the near term.

Meanwhile, the minutes from the Bank of Korea's August Monetary Policy Committee (MPC) meeting will be reported on Tuesday, revealing members’ views on future rate hike decisions. Korea also reports labor data, with the unemployment rate expected to edge up to 3.0% in August as bad weather adversely affected construction and some services.

Lastly, due to a weak global demand recovery, July's core machinery orders in Japan are expected to decline and export growth is expected to slow down in August.

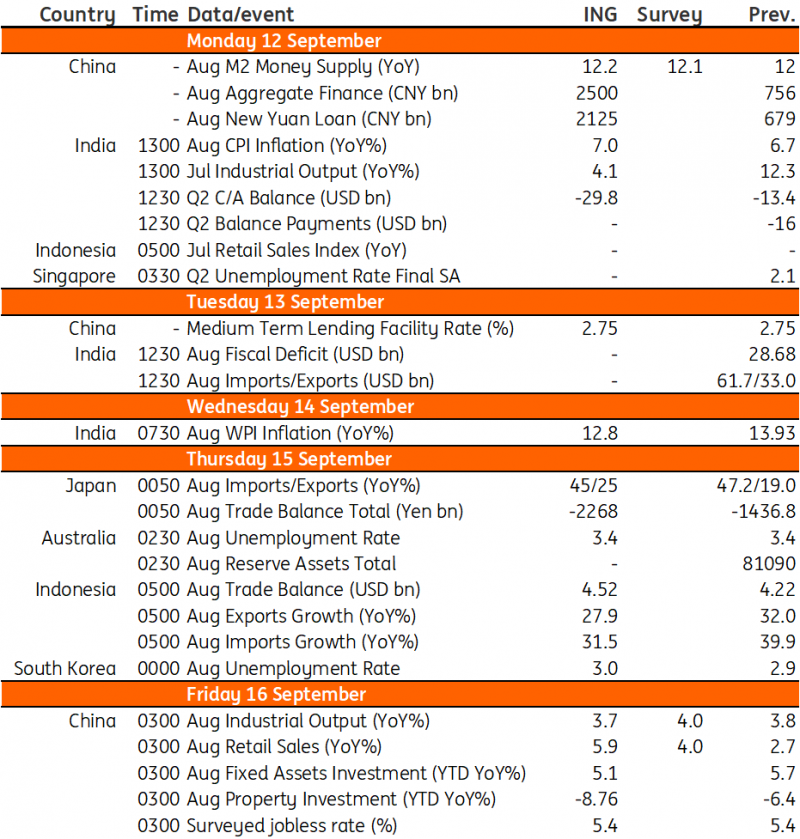

Asia Economic Calendar

Source: Refinitiv, ING

More By This Author:

FX Daily: Can The ECB Help The Euro?Taiwan And Mainland China Trade Suffers From Slump In Semiconductor Demand

EUR & ECB Crib Sheet: A Half-Point Hike Is Not Good News For The Euro

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more