Asia Week Ahead: China’s 20th Party Congress Is The Highlight

Image Source: Unsplash

China’s 20th Party Congress is the main event in the region in the coming week, followed by China’s GDP report.

The week ahead

In the coming week, we get a relatively limited number of reports from the region, although we have a flurry of data from China and the much-anticipated 20th Party Congress will be held on 16 October. There should be a lot of buzz and market talk following the congress meeting.

China data and 20th Party Congress in focus

The major event in the coming week will be the 20th Party Congress to be held this Sunday. There will be a lot to talk about this event in the market.

Meanwhile, China will release its 3Q22 GDP report and activity data for September on Tuesday. We expect improvements in GDP growth from 0.4% year-on-year to 4.4%YoY given that fewer lockdowns were implemented in the third quarter. Retail sales, industrial production, and fixed assets investments should grow slightly faster in September compared to a month ago. However, property investments and home prices should continue to be in a dire situation with buyers still adopting a wait-and-see approach, although we did note more home transactions by the first week of October.

We expect policy rates for the Medium-term Lending Facility (MLF) to be released on Monday and the Loan Prime Rate (LPR) on Thursday. We expect both rates to stay the same as the People's Bank of China seems to be injecting funds into policy banks rather than into commercial banks to help local governments address problems associated with uncompleted residential projects. Traditional monetary policy accommodation of interest rate cuts may not the best solution for now.

Trade reports from India and Indonesia

In India, September trade figures will have benefited from the drop in crude prices that saw brent crude falling below $90/bbl at times in the month. The US$28bn trade deficit for August will probably fall to something closer to $26bn.

Meanwhile, Indonesia reports August trade numbers next week. We expect both exports and imports will sustain double-digit gains. Exports will continue to benefit from elevated commodity prices while imports should rise further on improving domestic demand. The overall trade surplus will remain substantial, settling at around $5.5bn for the month.

Australia’s jobs figures

Australia releases September labor market data. The August figures were pretty solid apart from a small uptick in the unemployment rate to 3.5%, and firm labor data will make it awkward for the Reserve Bank of Australia, which scaled back the pace of its rate hikes at the October meeting – though this may be even tougher after third-quarter inflation is released a week later on 26 October.

Japan’s inflation to stabilize at 2.7%

Consumer inflation in Japan is expected to stabilize at 2.7% YoY in September (vs 3.0% in August) and the monthly gain should have slowed mainly due to the decline in global oil prices. Also, we expect the trade deficit to narrow in September with imports growth slowing at a faster pace than exports.

Bank Indonesia to stay hawkish, but will we see another surprise?

Bank Indonesia meets next week and will likely tighten monetary policy again. Accelerating inflation and depreciation pressure on the Indonesian rupiah will likely convince Governor Perry Warjiyo to hike aggressively and increase policy rates by 50bp.

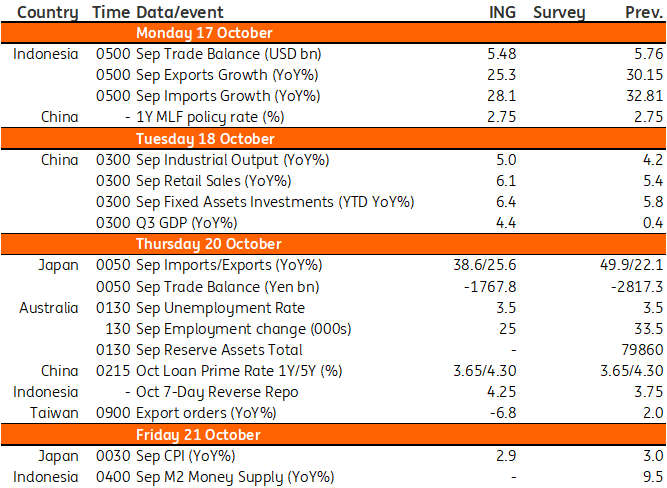

Asia Economic Calendar

Image Source: Refinitiv, ING

More By This Author:

Rates Spark: Keeping Up The Hawkish PressureIndia: Inflation Creeps Higher

WASDE Update: U.S. Supply Cuts

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more