Asia Week Ahead: China Trade Figures, The RBI Decision And Regional Inflation

Image Source: Unsplash

The coming week features China's trade report, growth figures from Australia, India's central bank meeting, and regional inflation readings.

China’s trade data to reflect weakness in the economy

China will release its trade numbers as well as the Caixin Service sector PMI next week. The official PMIs released recently were weaker than expected. That weakness is likely to be reflected in the trade data, too. Exports are likely to edge up a little due to seasonal factors but will remain negative on a year-on-year basis at -3.9%. For imports, these are likely to be affected by weak demand due to the end of the holiday period, and growth should be modest at 0.9% YoY.

China’s official service sector PMI indicated that growth of service activity has slowed. We expect the Caixin Service PMI to remain at 50.3.

Australia's third-quarter GDP growth to moderate and RBA to hold rates steady

For the Reserve Bank of Australia, following the recently much lower-than-expected inflation figures for October, there is surely no chance that the RBA will increase rates again following its November 25bp hike in the cash rate target. While we have probably already seen peak rates in Australia, there is still a chance of a final rate hike at the end of the first quarter of 2024, when base effects could make it hard for inflation to continue to decline unless the monthly run rate moderates a lot by then.

After the 0.4% quarter-on-quarter growth in the second quarter, we think Australia’s growth will moderate to 0.3% in the third quarter, which is consistent with a 1.2% YoY growth rate but a little stronger than the consensus view. Net exports will probably be a drag on growth in this quarter, though that may be partly offset by a higher inventory build.

Private investment will likely post a modest growth rate, and construction has also been quite good. Meanwhile, consumer spending – which has been slowing quite consistently – may be a little stronger than expected following some positive retail sales for the third quarter.

Reserve Bank of India to keep repo rates the same for now

There is very little chance that the Reserve Bank of India will alter its policy repo rate from the current rate of 6.5% at its forthcoming meeting, and that is even though India’s inflation rate has been on the downside recently.

Much of the downswing owes to erratic food price movements, and there is a good chance that the inflation rate edges back into the upper end of the RBI’s 2-6% range over the coming months.

South Korean date set to show faster inflation and GDP

November CPI inflation and third-quarter GDP revision data will be released next week. Consumer inflation is likely to accelerate further to about 4% YoY. Gasoline prices are expected to drop substantially but likely be offset by rising prices of fresh and manufactured foods.

Third-quarter GDP (0.6% QoQ sa) is not expected to be revised from the updated results.

Philippine CPI to edge lower

Stabilizing prices for the all-important staple of rice should help bring headline inflation down to 4.4% YoY (from 4.9%). Declining gasoline and diesel prices should also help inflation edge closer to the central bank’s 2-4% inflation target band.

This could give the previously hawkish BSP Governor some reason to consider extending his current pause, although his comments from last week suggest that Governor Remolona is open to tightening further should inflation flare up again.

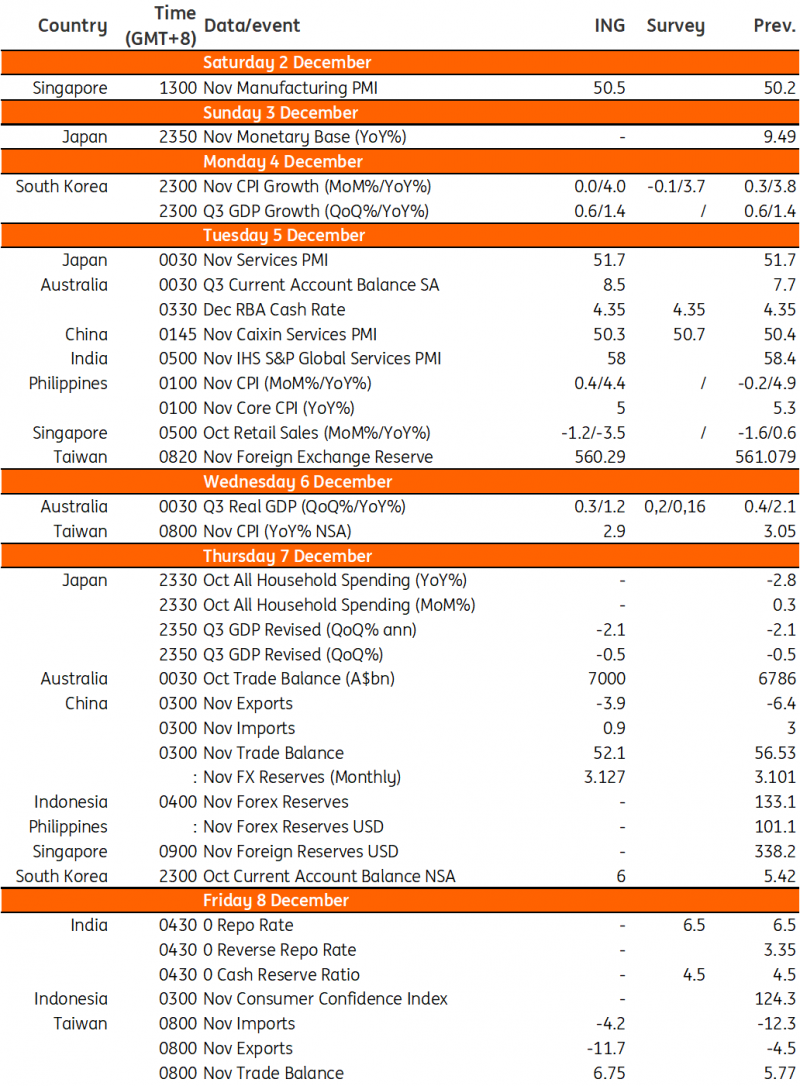

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

A Slow Start To The Climate Transition For The Dutch Retail Sector

FX Daily: Short-Term Rates Argue Against Another Big USD Leg Lower

Asia Morning Bites For Friday, December 1

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more