Asia Week Ahead: Central Bank Decisions Plus RBA Minutes To Close Out 2023

Image Source: Unsplash

As we approach the end of the year, activity in Asia will be relatively light, so we are previewing all data until year-end. The last few highlights of 2023 include rate decisions from China, Japan, and Indonesia, while Korea will release its survey on Business Sentiment.

China LPR is expected to remain on hold amidst pressure on the CNY

China will decide on its benchmark lending rate, the 5Y LPR. With the CNY still under depreciation pressure, there is little chance that the LPR will be reduced on this occasion. Were we to see some broader-based USD weakness, then this might return as a possibility. Until then, rates will remain unchanged.

RBA minutes likely to keep options open

The Reserve Bank of Australia's minutes of the “no change” December policy meeting could push back at the market’s view that rates have definitely peaked. While peaked rates are also our view, we still believe that there is some upside risk of a further hike in the first quarter of next year – a view supported by recent strong labor data. The minutes will probably go large on “uncertainty” and “risks” to leave the door open to whatever materializes.

Taiwan export orders could claw back to positive year-on-year growth

Taiwan will release its November export and industrial production in the next two weeks. Export orders may claw their way back to a positive year-on-year rate in November, after registering a -4.6% YoY rate in October. The semiconductor cycle is showing further signs of recovery, which will help. We are expecting export orders to grow at 4.2% YoY. Industrial output will follow suit and grow at 1.0% YoY.

BoJ expected to tone down hawkishness as inflation cools

The Bank of Japan is due to meet for the last time this year. We expect the BoJ to maintain all its major policy settings, though the overall tone about future policy at the press conference and statement could start to soften.

Consumer inflation will drop substantially thanks to the government’s energy subsidy programs, and inflation is likely to decelerate to 2.7% YoY in November from 3.3% in October.

Industrial production activity will slide modestly, despite stronger output in the IT sector. The production interruptions of several major car makers will be the main driver of the decline.

Korea surveys to show mixed sentiment

South Korea will release multiple survey results in the last week of the year. The survey outcomes are expected to signal a slowdown in domestic growth. Consumer sentiment could dampen further with the recent tightening of mortgages and weak property market condition. Manufacturing sentiment will likely improve due to the turnaround of the semiconductor cycle, but non-manufacturing sentiment could slide.

We expect industrial production to rebound modestly as indicated by upbeat data for manufacturing, supported by gains in automobile and semiconductor industries. Inflation will likely stabilize further in December. Gasoline prices should decline further but will be partially offset by price rises in services and manufactured food prices.

Bank Indonesia likely to pause

Bank Indonesia is expected to keep policy rates untouched at 6% at its meeting next week. BI Governor Perry Warjiyo indicated that inflation may accelerate next year and that policy rates may need to remain at current levels to ensure price stability.

On the other hand, BI may prefer to refrain from hiking rates further next week with an eye to supporting growth momentum. GDP growth recently slipped below market expectations so the central bank may want to resort to other tools to support the IDR before it considers raising rates again.

Singapore inflation to dip but remains relatively elevated

November inflation could dip to 4% YoY in Singapore, down from the previous month due to favorable base effects.

Despite the slowdown, inflation remains elevated ahead of the scheduled implementation of the Goods and Services Tax (GST) early next year. We expect core inflation on the other hand to hover about 3.2% YoY.

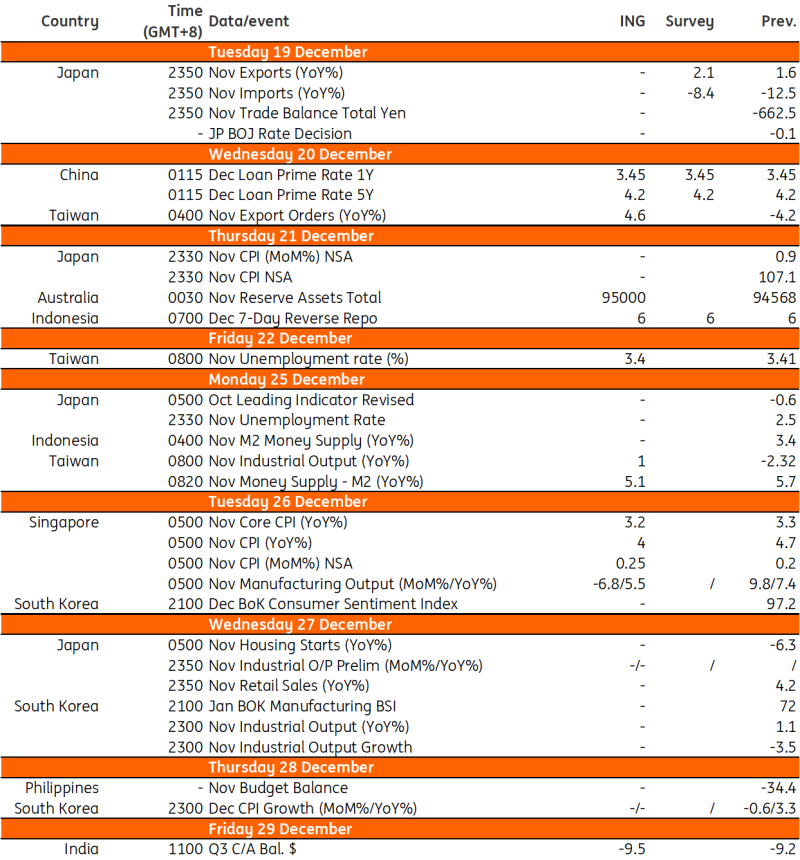

Key events in Asia next week

More By This Author:

Bank Of England Pushes Back On Calls For Early 2024 Rate CutsFX Talking December: Calibrating The Turn

FX Daily: Fed Brings Tidings Of Comfort And Joy

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more