Image Source: Pixabay

Concerns over escalating US-China trade tensions are rising as China hits back against US tariffs with retaliatory measures. South Korea's January unemployment data and a rate decision in the Philippines will also be in focus over the coming week,

China: Retaliatory measures, still leaving room for de-escalation

The big thing to watch in the coming days is if and when China and the US hold their high level meeting. At the time of writing, the US has implemented an additional 10% tariffs on Chinese goods entering the country, though exemptions on goods already in transit could take some time before the first products are actually subject to these new tariffs. China has also announced retaliatory tariffs set to take effect on 10 February, which seems to open a short timeline for potential talks to de-escalate.

In terms of data releases, China will release its January CPI inflation data on Sunday morning. We're expecting a modest uptick in the year-on-year number to around 0.4% YoY, as we expect food inflation to see an uptick from the Lunar New Year effect, but non-food inflation is likely to remain weak as price competition remains cutthroat. The People's Bank of China is also set to publish January’s credit activity data sometime in the next week.

South Korea: Unemployment data amid a quiet week

The unemployment rate is expected to have fallen in January. We think the domestic political situation has stabilised, while Lunar New Year-related jobs may have increased before the long holiday at the end of January. In addition, the government's efforts to support growth may have led to an increase in public service jobs at the start of the new fiscal year.

Philippines: Inflation in the target range, forecasting a 25bp rate cut

January CPI inflation stayed well within the Bangko Sentral ng Pilipinas (BSP) target band of 2-4%. The real policy rate at 2.5%+ remains high, especially when GDP growth is expected to remain below the government’s target of 6-7%. Overall, we expect the BSP to cut again by 25bp in its upcoming policy meeting.

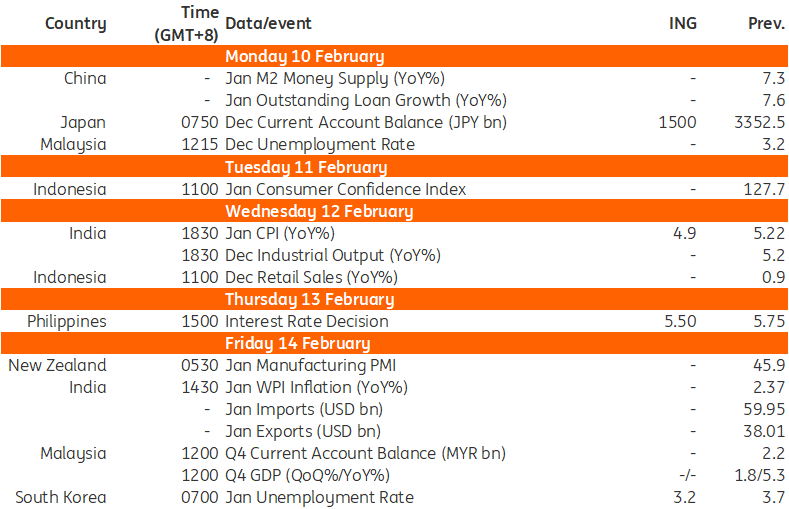

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

FX Daily: Payroll Revision Risk The National Bank Of Poland Governor Sees No Scope For Interest Rate Cuts In 2025 But His Tone Was Softer Rates Spark: Bessent And Payrolls Key As We End A Tumultuous Week

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.