Asia Week Ahead: Australian Inflation Data Plus Regional GDP Reports

Image Source: Unsplash

The coming week features several GDP reports and sticky inflation out of Australia and Singapore.

Sticky inflation figures and an RBA decision

Australian retail gasoline prices were down more than 8% month-on-month in December. Feeding this figure through to the transport component, we could see a smaller increase in the aggregate monthly price level of 0.2% MoM in December, down from an increase of 0.8% MoM in November. This should bring the December inflation rate down to 6.9% year-on-year, and the fourth quarter inflation rate down to 7.0%. With inflation still high, however, we expect the Reserve Bank of Australia (RBA) to continue with another 25bp rate hike at its meeting on 7 February.

Singapore core inflation to inch higher

Singapore is also expected to release the December 2022 inflation reports next week. Headline inflation has started to decelerate, and the latest reading could settle at 6.5% year-on-year with base effects kicking in. Core inflation, however, could still accelerate slightly to 5.2% YoY from 5.1% in the previous month. Price pressures could fade later in the year given the recent bounce in the Singapore dollar but core inflation should still be much higher than the central bank’s target of 2%.

GDP reports from Korea and the Philippines

Korea's fourth quarter GDP report and surveys are scheduled to be released next week. We expect GDP to contract by -0.3% quarter-on-quarter (seasonally adjusted) on the back of sluggish exports and domestic demand. Monthly activity data suggest the manufacturing and service sectors weakened quite significantly in the fourth quarter with the terms of trade deteriorating further. Meanwhile, forward-looking survey data is expected to remain soft. Closely-watched gasoline and utility prices rose from January, and this should hurt consumer sentiment while the slowdown in external demand and weak exports could suppress business sentiment.

Similarly, the Philippines reports fourth quarter GDP and trade data next Thursday. We expect another quarter of strong growth for the Philippines, supported mostly by an extended run of “revenge spending” during the holiday season. GDP growth in the final quarter of 2022 should settle at 7.5% YoY which should bring full-year growth to 7.7% YoY. This will be faster than the official growth target of 7.5%, however, 2023 presents several challenges which could push the trajectory of growth down sharply.

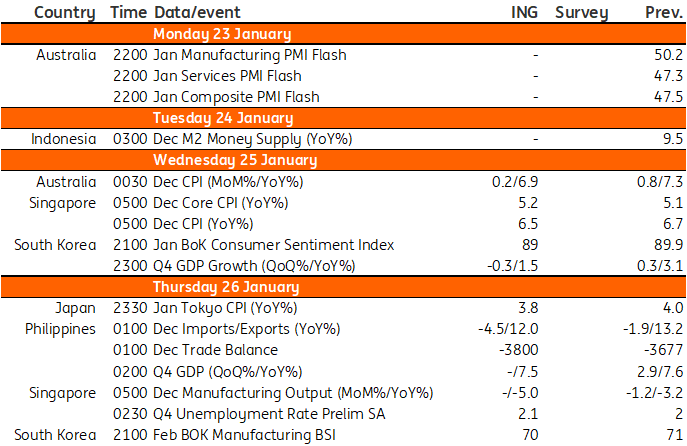

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

Poland: Labor Market Remains Firm But Cooling Is Evident

FX Daily: Looking For Some Balance

FX Daily: Dollar On Unstable Ground

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more