Asia Week Ahead: A Series Of Inflation Reports

Image Source: Pexels

The coming week features several inflation readings, a Bank of Japan meeting, and Korea's third-quarter GDP report.

Inflation reports from Australia, Singapore, and Japan

Australia is expected to release its 3Q22 CPI inflation data next week. We don’t think the 6.1% inflation reading in 2Q22 was the peak, and look for the inflation rate to increase to 6.4%YoY, following a 1.0% QoQ increase. The Reserve Bank of Australia has already stated that it expects inflation to rise further, so this doesn’t necessarily imply any deviation from their recent slower pace of tightening at forthcoming meetings, or for that matter, the outlook for the AUD.

Singapore's inflation will be reported on Tuesday and we expect both headline and core inflation to heat up further. Headline inflation could hit 7.6% while core inflation will likely accelerate to 5.2% which should keep pressure on the Monetary Authority of Singapore (MAS) to stay hawkish in the near term.

In Japan, CPI inflation excluding fresh food is expected to climb to 3% in October as the weak JPY translates to domestic inflation. Unlike other major economies, Japan’s PMI and labor market report are expected to show continued recovery, aided by the reopening boost and government stimulus packages.

Korea’s growth to decelerate while sentiment indices point to a challenging outlook

We expect the 3Q22 GDP in Korea to decelerate to 0.1%QoQ sa (vs 0.7% in 2Q). The trade component should contribute negatively to growth for 3Q, mainly due to high commodity prices, while private consumption likely lost its steam after purchasing power faded.

Meanwhile, the consumer and business sentiment surveys will provide a bleaker outlook for the current and coming quarters. Weakness in asset markets, such as housing and equity, likely hurt consumer sentiment while businesses should be cautious given the slowdown in global demand and the weak KRW.

The BoJ to keep rates unchanged despite JPY weakness

Next week also features the Bank of Japan policy meeting and we expect them to stand pat despite the recent JPY weakness. Governor Kuroda could however warn that the recent currency movements would have a negative impact on the nation’s economy but we doubt the JPY depreciation will trigger any changes in the BoJ’s policy stance.

Taiwan's industrial production is likely stable

Taiwan's industrial production growth should be fairly stable at around 3.5%. A further weakness in demand for semiconductors might not have been reflected in this data but we might see weaker growth later in the year.

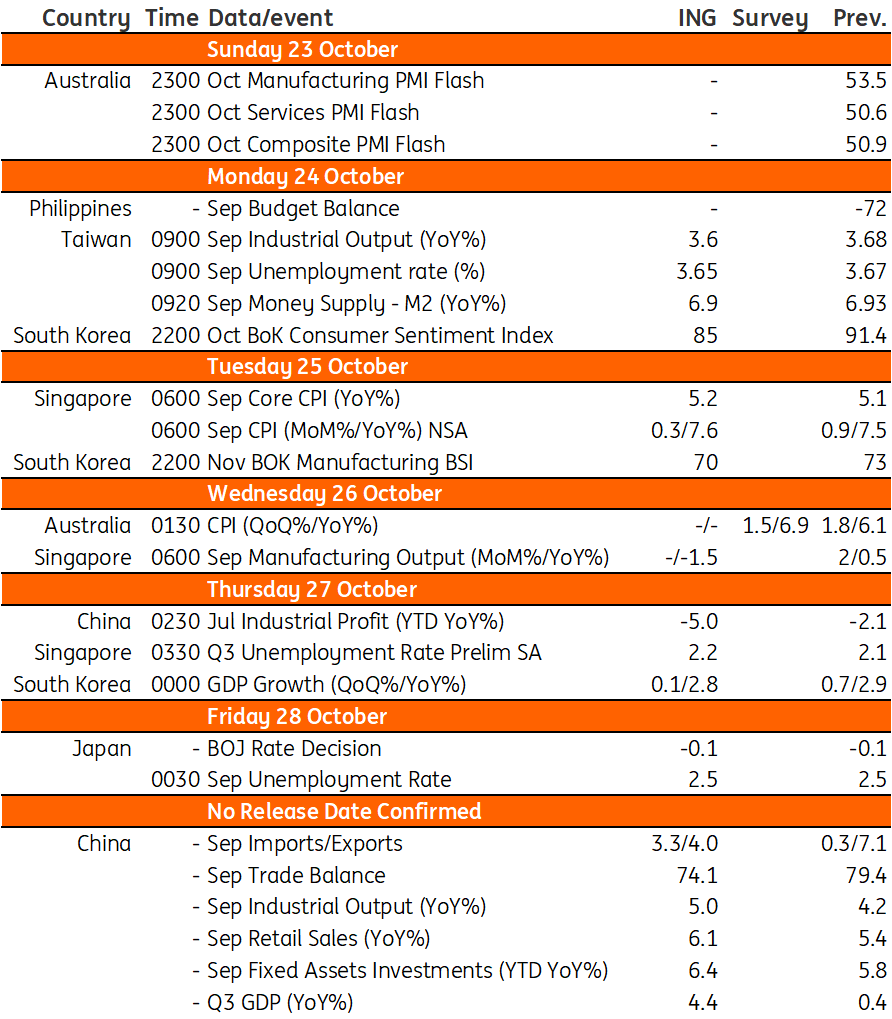

Asia Economic Calendar

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Falling Gas Prices Fuel Optimism

Rates Spark: Relentless And Potentially Dangerous

Turkey’s Central Bank Surprises With 150bp Rate Cut

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more