Image Source: Pixabay

China’s loan prime rates, Taiwan’s export orders and unemployment orders, Japan’s headline inflation data, and Indonesia’s BI rate will be in focus throughout a quieter week across Asia.

China: No changes for loan prime rates in a quiet week ahead

It’s a quiet week ahead for China. The loan prime rates will be announced on Wednesday, where no change is expected after the People's Bank of China has so far held rates unchanged this month. There are no major data releases expected in the next week.

Taiwan: Export orders and unemployment rate

Taiwan publishes its export orders data on Wednesday afternoon, where we are expecting export orders to moderate slightly to around 2% growth. Taiwan also publishes its unemployment rate on Friday, which is expected to remain stable at around 3.4%.

Japan: Headline inflation data and PMIs

Japan's data should show that activity is gradually returning to normal, recovering from several one-off production disruptions. Reflecting this, PMIs should improve. The manufacturing PMI is expected to remain below the neutral level, while the services PMI should rebound, supported by temporary tax cuts and higher income growth.

Exports are expected to rebound by 1.7% yoy after falling by -1.7% in September, while imports are expected to decline by -4.5% amid falling global commodity prices. Meanwhile, we expect headline inflation to ease to 2.3% year-on-year in October, but mainly due to last year's high base. Monthly growth should pick up to 0.6%, combined with the end of the energy subsidy programme and solid increases in services prices.

Indonesia: BI rate to keep unchanged

We see a higher probability of Bank Indonesia keeping rates unchanged. While we do see room for rate cuts, they are likely to be delayed given the recent weakness in Asian currencies and current domestic policy focus on IDR stability.

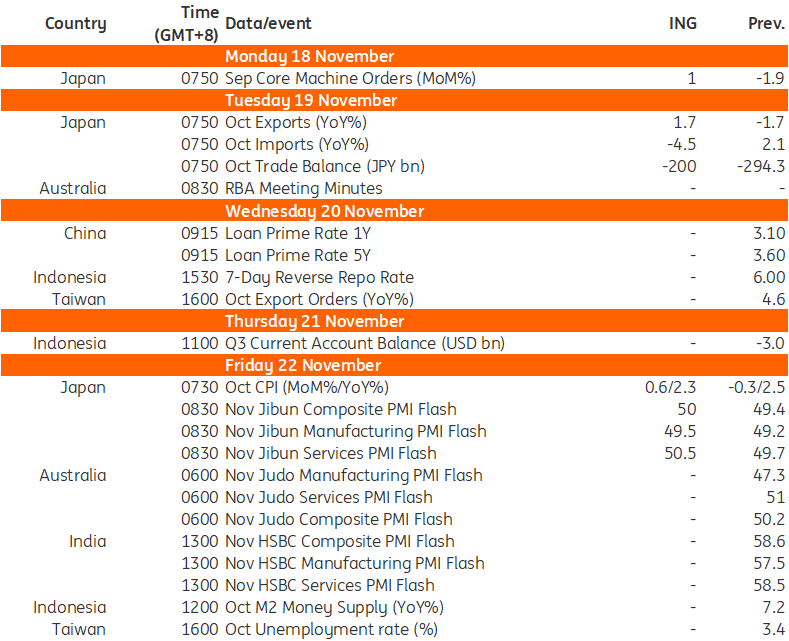

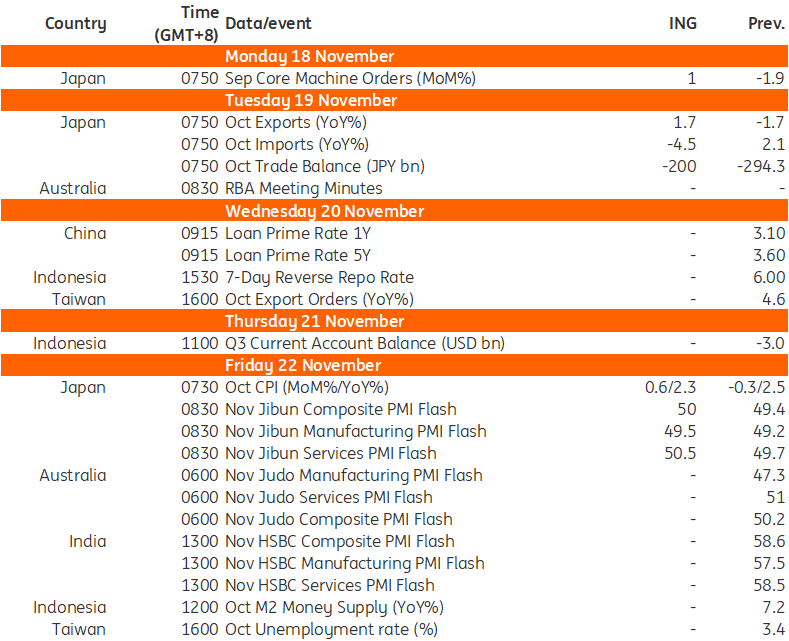

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Polish Inflation Rises As Energy Price Freeze Extended Into 2025

FX Daily: Powell Keeps Market Cautious On The Fed

The Commodities Feed: European Gas Surges On Latest Supply Risk

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.