Asia Morning Bites For Friday, May 17

Image Source: Unsplash

Global Macro and Markets

- Global Markets: US Treasury yields on Thursday reversed some of the declines they experienced after this week’s CPI result. 2Y yields rose 7.2 basis points, while the 10Y yield rose a more modest 3.5bp taking it to 4.375%. Fed speakers again suggested that rates would need to remain higher for longer. There was also an interesting comment from Loretta Mester, echoing a point we have made in this note on several occasions. She noted that short-term readings on inflation expectations have risen, and added that higher rates are here to stay for now. Bostic was also hawkish. EURUSD has pulled back from the 1.09 level and is now 1.0868. Most of the G-10 currencies were fairly flat on the day, making only slight gains against the USD. The JPY had a more volatile session, dropping to a little over 153.50 before drifting back up to 155.38 after the weak GDP data. There wasn’t much movement in Asian FX yesterday. The KRW opened strongly after the mid-week holiday and there were also solid gains from the THB. USDCNY is 7.2214 ahead of today’s China data dump. US equities lost a little ground on Thursday. The S&P 500 and the Nasdaq lost a little over 0.2% on the day. Chinese stocks did better. The Hang Seng rose 1.59% and the CSI 300 rose 0.39%. Talk of a local government property-buying scheme may have helped sentiment.

- G-7 Macro: Yesterday’s US macro data was fairly uninteresting. Jobless claims were close to expectations, though housing starts were weaker. Industrial production for April was also published. This was flat from the previous month, which was also revised down to just a 0.1% MoM gain. Manufacturing production declined by 0.3% MoM. There is virtually no data today worth a look.

- China: China’s key monthly activity data is scheduled to be published this morning. Markets are hoping to see a slight recovery in the April data. First up is 70-city housing prices, which we will closely watch to see if there are any signs of prices bottoming out. A smaller sequential fall of average prices combined with stabilization or an increase in select cities would be well received. Markets have been increasingly hopeful of a bottoming out of the sector in recent weeks as a slew of supportive policies have rolled out, including scrapping purchase restrictions and plans to directly purchase units in specific cities. Shortly after housing, China’s key industrial production, retail sales, fixed asset investment, and unemployment data will be released. We are generally in alignment with the market consensus expecting to see a modest increase in YoY growth in April in the activity data, and are looking for 5.6% YoY growth in industrial production, 4.8% YoY in fixed asset investment (FAI), and a recovery to 3.9% YoY for retail sales in April.

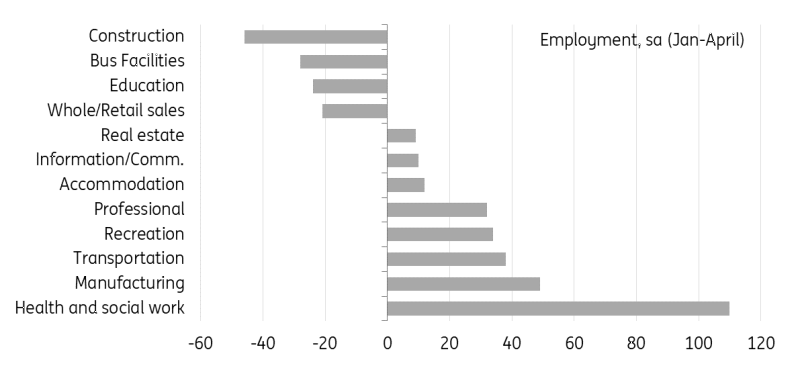

- South Korea: The unemployment rate remained at 2.8% in April for a second month in line with the market consensus and showing the resilience of labour market conditions. The industry details showed that job growth was mainly driven by manufacturing, while construction and services weighed on overall employment growth. Manufacturing added jobs for the third month in a row (37k in April), while construction shed jobs over the same period (-22k in April). Among services, only travel-related services – accommodation and restaurant (27k), transportation (6k), and recreation (36k) – showed employment growth. But other key services such as whole/retail sales jobs, falling for the past three months (-17k in April), real estate (-3k), business facilities (-7k), education (-17k), all shed jobs. We believe that the strong domestic demand growth in 1Q24 was temporary, and we expect the recovery trend to be uneven (strong exports vs weak domestic growth) in the current quarter, thus the quarterly growth is also expected to decelerate. As for Bank of Korea (BoK) policy, together with the strong 1Q24 GDP, healthy labour market conditions give the BoK room to focus on curbing inflation for the time being. Today’s outcomes support our view that the BoK’s first rate cut is likely to come early in the fourth quarter.

- Singapore: Singapore's April non-oil domestic exports (NODX) fell 9.3% year-over-year, roughly in line with the market consensus of an 8.9% YoY drop. Downbeat NODX will likely be mirrored by weak industrial production and weigh on growth in the second quarter.

Korea: Manufacturing has added jobs for three months in a row

Source: CEIC

What to look out for: China industrial production and retail sales

-

Singapore NODX (17 May)

-

China industrial production, retail sales, fixed assets (17 May)

-

US leading index (17 May)

More By This Author:

Why Supply Constraints Are Clouding The Skies For AirlinesAsia Week Ahead: Regional PMI Figures Plus Two Central Bank Meetings

The Commodities Feed: IEA Sees Weaker Demand

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!