Asia Morning Bites For Friday, Aug 2

Image Source: Unsplash

Global Macro and Markets

- Global Markets: US Treasury yields have kept on falling, helped on their way by a weak manufacturing ISM index. 2Y US Treasury yields are down a further 10.9 basis points, repeating their post-FOMC decline, and 10Y yields are now down to 3.976% after a decline of 5.4bp. Markets are now more than fully pricing in rate cuts at each of the following four FOMC meetings starting from September. This hasn’t hurt the USD particularly, and EURUSD is back below 1.08 now at 1.0790. The AUD has also lost ground to the USD and dropped below 65 cents, while the JPY has made modest further gains to 149.11, and Cable has slumped to 1.2735, helped on its way by yesterday’s Bank of England cut to Bank Rate.

Asian FX has been quite mixed. USDCNY has risen to 7.2450 but most of the rest of the Asia pack has followed the JPY stronger, led for once by the MYR and TWD. It looks like there are multiple opposing gravitational pulls on smaller Asian currencies at the moment. US equities reverted to selling yesterday. The S&P 500 fell 1.37% and the Nasdaq dropped 2.3%. Chinese stocks also fell yesterday, though not as much as those in the US.

- G-7 Macro: As noted above, the US Manufacturing ISM index was very weak. The headline survey index fell further into contraction territory (46.8 from 48.5), and there were sharp drops in new orders and employment components of the survey. The prices paid index rose, however, so there are still some price pressures for the Fed to worry about even if the macro evidence points to further cooling. Jobless claims numbers also showed signs of rising, adding to the signals of a cooling labour market ahead of today’s non-farm payrolls report. The consensus forecast for payrolls is for a 175,000 increase in employment, and no change to the unemployment rate of 4.1%. Average hourly earnings are predicted to drop a further 0.2pp to 3.7% YoY. See here for more on the latest US data.

-

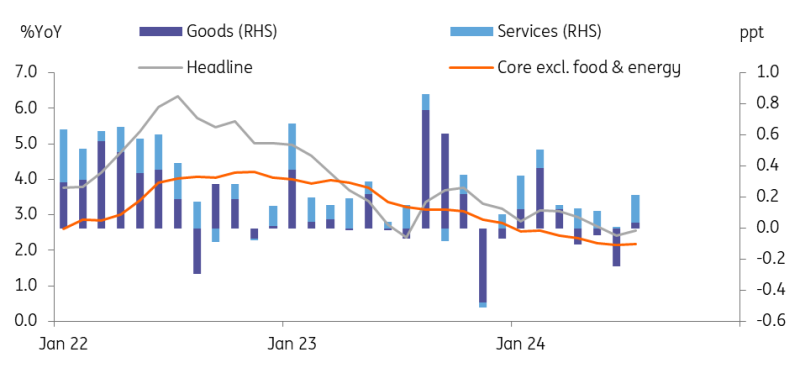

South Korea: Consumer prices ticked up to 2.6% YoY in July (vs 2.4% in June, 2.5% market consensus). Price increases in food and energy were most notable but service prices also gained. Core inflation excluding food and energy stayed at 2.2% YoY for the third consecutive month. Compared with the past month, headline inflation rebounded 0.3% MoM NSA (vs -0.2% in June, 0.3% market consensus). As expected, bad weather conditions pushed up fresh food prices and the reduction in fuel tax cuts sent gasoline prices higher in July. Service prices rose ahead of the summer holiday season, mostly in travel and leisure-related prices.

Although consumer inflation picked up in July, it is set to cool sharply to around 2% from August onwards, mainly due to base effects. Therefore, we expect the Bank of Korea's policy focus will gradually shift from price stability to financial stability. At the last meeting, Governor Rhee Chang-yong expressed concern that any signals of policy easing could stimulate housing prices and lead to rising household debt.

We maintain our long-standing call for a BoK cut in October but see risks building around our call. The recent rise in house prices and household debt could push back the first cut. To stabilize the housing market, policy coordination is a must, thus we also need to monitor how the government reacts to the recent rapid rise in house prices. We also see that growth conditions have softened recently. Restructuring in the construction sector is still ongoing, while the household delinquency ratio is rising rapidly. As for the payment problems of e-commerce companies, this is unlikely to escalate into a major issue, but the fact that it is happening is a sign of weak domestic demand. Thus, sluggish domestic growth could trigger BoK rate action sooner rather than later.

South Korea inflation reaccelerated in July

Source: CEIC

What to look out for: S Korea July CPI, Australia PPI, Singapore PPI

August 2nd

S Korea: July CPI

Japan: July monetary base

Australia: July PPI

Singapore: PMI

US: July non-farm payrolls

More By This Author:

Bank Of England Cuts Rates And There Are More To Come This YearAsia Week Ahead: Keep An Open Mind On Rate Surprises

Higher Unemployment In Eurozone Threatens Consumption Recovery

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more