Are US Consumers Finally Feeling The Pinch?

Image Source: Unsplash

Late-Day Rally: S&P 500 Sees Best Month Since February

The S&P 500 surged nearly 1% on Friday in wacky month-end trade, marking its best month since February. The index had dipped earlier in the session, weighed down by the big tech stocks, but managed a strong finish as a report indicated that inflation isn’t worsening.

The S&P 500 climbed 0.8%, closing out its sixth winning month in the last seven. This key benchmark for the US stock market’s health hit an all-time high late in the month, recovering all its losses from a challenging April.

Meanwhile, the Dow Jones Industrial Average soared almost 575 points, or 1.5%. In contrast, the Nasdaq composite, dragged down by some faltering tech giants, slipped slightly by 0.1%. After the inflation report, the yield on the 10-year Treasury dropped to 4.50% from 4.55% on Thursday. Earlier in the week, it had climbed above 4.60% amid concerns about weak demand from recent Treasury auctions, which had previously put pressure on stocks.

The two-year Treasury yield, which more closely aligns with expectations for Federal Reserve actions, fell to 4.87% from 4.93% on Thursday.

As the next Fed meeting approaches, virtually no one expects an immediate rate cut. However, according to CME Group data, traders are betting with an almost 85% certainty that the Fed will cut rates at least once before the year ends.

Buckle up; it’s going to be an exciting ride!

FOREX MARKETS: A Tale of Stability and Anticipation

Last week, forex markets remained relatively stable despite a slew of soft economic data, including a disappointing US GDP and a slightly dovish PCE deflator. The US dollar stayed in a tight range as these data points did little to alter expectations for Fed rate cuts significantly. Essentially, the Fed doesn’t feel any urgency to decide when to support a rate cut. The dollar closed out the week right in the middle of its week-long trading range. However, if momentum is accurately read, it’s inching towards critical support in the 104.35-40 area. A close below this could douse this year’s dollar bull trend with a wet blanket.

Hawkish Fed whispers, and poor bond auctions drove higher yields last week. It seems paradoxical that the US dollar is a holding firm despite the government's struggle to fund it through these auctions. This could become a more significant issue if subsequent auctions also falter. For now, the dollar benefits from higher yields, but if these yields result primarily from weak bond demand, this relationship might weaken over time.

Yen is still in the Hot Seat: The Carry Trade Frenzy

The yen feels the heat as traders hold on to the carry trade, lured by low FX volatility. With EUR/JPY over 170 and GBP/JPY trading above 200, it’s like the yen has wandered into a heavyweight match and is taking serious hits.

The Bank of Japan (BoJ) is under pressure to enter the ring. The 2-year JGB yield has jumped 3 basis points to 0.37%, its highest since June 2009, spurred by BoJ Board Member Seiji Adachi hinting that a rate hike might be the BoJ's secret weapon to combat yen weakness if it starts affecting inflation. The BoJ's NEER is down nearly 8% from its January peak, suggesting that the yen’s slide might be pumping up inflation more than anticipated.

FX traders are eyeing a 15 basis point increase, with a July rate hike looking increasingly likely. It’s like watching the BoJ prepare for a dramatic showdown, ready to boost the yen. The yen's tumble might be wild, but the BoJ is finally gearing up to hit back.

The Roadblock: Mrs. Watanabe and the Hedge Funds

A major roadblock for the Bank of Japan is convincing retail forex traders (aka Mrs. Watanabe) and the hedge funds to abandon their beloved carry trade. This could become a significant issue if US yields keep climbing, making the sell USD/JPY signal less about the slight upticks in JGB yields and more about the broader appeal of higher US returns.

Analysts might call range trading markets boring, but traders see them as money in the bank.

Trader Insight: Market Reactions and Future Predictions

The only downside I see for the short US dollar vs the Euro into the next Fed meeting is the expected adjustment in the 2024 dot plot from 3 to 2 rate cuts, but I think that is already baked into the cake. However, you can bet your bottom dollar that after the mid-month meeting, Fed Chair Powell will remind everyone that future rate cuts will be "data dependent." It's one of those catchphrases that drive traders up the wall, but data dependency is in the DNA of central banks. Similarly, ECB boss Christine Lagarde will quickly echo this sentiment after Thursday's meeting.

With one-month-traded EUR/USD volatility plumbing the depths near 5%, we desperately need something to shake the trees. A softer-sounding Fed would undoubtedly ease the intense US dollar angst and make life easier for central banks worldwide. But I think we're at a significant junction. The next big move in EUR/USD out of the 1.08-1.09 range could be the trendsetter for the year-end.

Considering my views, I believe we’ll move to 1.10 after the ECB cuts rates and adopts a "one and done" stance. Last week’s higher-than-expected EU inflation data will likely give the hawks on the board the leverage to hold sway.

OIL MARKETS: Oil Futures Take a Hit Amid Weak Demand

Oil futures slumped this week following data that pointed to weak fuel demand, persistent inflationary pressures, and a slowdown in Chinese manufacturing activity. After two months of growth, China’s Manufacturing Purchasing Managers' Index (PMI), released by the National Bureau of Statistics, slid back into contraction territory in May. This decline raises fresh concerns about the stalling recovery of an economy expected to drive around a third of oil demand growth this year. Keep an eye out for the Caixin manufacturing PMI for May, scheduled for release on Sunday, which could add more fuel to the fire.

Looking ahead, the OPEC+ coalition is expected to extend production cuts into the year's second half at their next meeting in Vienna on Sunday. While some notorious overproducers in the group may be less enthusiastic about output curtailments, they might still support an extension on paper. However, the real impact will depend on the follow-through in the physical markets in the second half of 2024.

THE MARKET REPORT

Finally, the US economic data is starting to show clear signs that consumers are feeling the pinch. With savings running dry, prices skyrocketing, the job market cooling down, disposable incomes taking a hit, and interest rates still high, saving in 2024 is becoming impossible. It's like trying to fill a bucket with a hole in it—good luck keeping it full!

Since last July, the Federal Reserve has stubbornly held onto its tight grip with a funds rate of 5.25%-to-5.50%. The only time since the 1970s that the Fed clung to a peak rate this long was right before the Great Recession, from June 2006 to June 2007, at 5.25%. Let’s hope history doesn’t decide to hit replay!

This week brought a flurry of reports hinting at a slowdown in US growth. It kicked off on Thursday with the second estimate of first-quarter GDP, which showed a hefty 0.5 percentage point downward revision in real consumer spending to 2.0%. This aligned with our predictions and dropped the annualized first-quarter real GDP growth to 1.3% from a lacklustre 1.6%. For context, the second half of 2023 boasted a growth rate of 4.2%. Talk about a tough act to follow!

Friday’s April personal income and spending report confirmed the slowdown with actual disposable income and consumer spending declines. We expect this dampening trend in income and demand to linger over the US economy throughout the year. It's like trying to run a marathon with a backpack full of bricks. Eventually, we anticipate that Federal Reserve rate cuts will ease financial conditions and revive demand by 2025. Real consumer spending growth is forecasted at a moderate 2.0% annualized in the second quarter before slowing to a modest pace between 1.5% and 2.0% in the latter half of the year. Slow and steady wins the race—or so they say.

The larger-than-expected widening of the US goods trade deficit in April to -$99.4 billion from -$92.3 billion suggests export growth might turn negative in the second quarter. Global sluggishness, a strong dollar, and lower oil prices weigh heavily on net exports. As if that weren't enough, pending home sales plummeted by 7.7% in April, hinting at a sharper-than-expected decline in residential investment. Consequently, we've revised our second-quarter GDP growth forecast to 1.4% from 1.7% and nudged our third-quarter estimate to 1.3%. Combining these with the first quarter's downward revision, the annual US GDP growth for 2024 is projected at 2.2%, down from 2.5% in 2023 and, on a Q4/Q4 basis, down to 1.4% from 3.1%. On the bright side, even this less rosy forecast is better than 2022, when inflation was skyrocketing, and the Fed was on an interest rate hike spree. So, there's your silver lining!

Cooling consumer demand and below-potential GDP growth should keep consumer inflation on the Fed’s desired downward trajectory. Interestingly, the Fed's preferred inflation measure, core PCE, saw its smallest increase of the year at 0.2%, maintaining the year-on-year rate at 2.8%. However, substantial year-on-year inflation improvements will be hard to come by this year due to the significant drop in inflation in the fourth quarter of 2023, making comparisons trickier. It likely won't be until 2025 that year-on-year consumer inflation accurately reflects the current moderating demand. Nonetheless, the slowing economic activity and labour demand this summer should pave the way for possible rate cuts in September and December. Looking ahead to next Friday's May Employment Report, I’m gravitating to a nonfarm payroll growth of 170k, slightly down from 175k in April and a noticeable slowdown from the first quarter’s average of 269k.

CHART OF THE WEEK

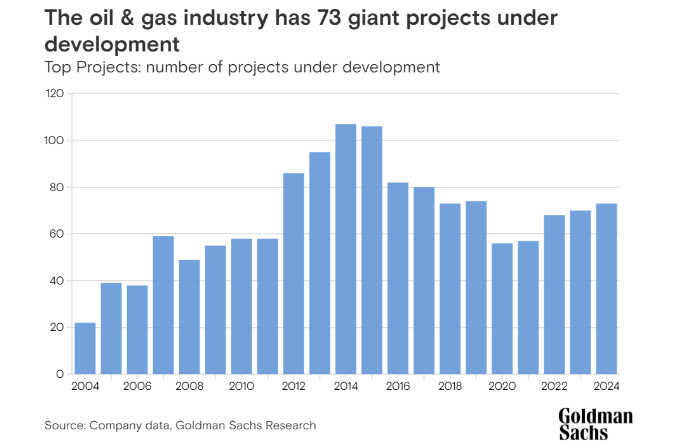

The oil and gas industry is undergoing a major transformation. Growth in oil investment is showing signs of eventually peaking in non-OPEC countries. In contrast, investment in liquefied natural gas (LNG) is expected to increase more than 50% by 2029, according to Top Projects, Goldman Sachs Research's 21st annual energy sector analysis. The report projects the global gas market to grow 50% during the next five years.

More By This Author:

The Dollar's Dance And The Data Dilemma

US Market Rollercoaster: Between A Rock And A Hard Place

Who Brought The Skunk To The Garden Party ?