Are Chinese Stocks Un-Investable?

After the great financial crisis, China’s appetite for commodities and technology fueled a global economic recovery. The rest of the world recovered and then grew, largely on the back of China’s incredible transformation.

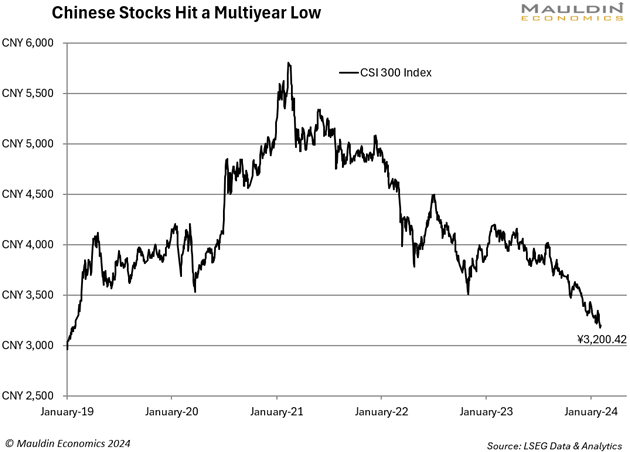

Ever since the pandemic, the US economy has surprised nearly everyone, while China’s economy has stalled. A real estate crisis is unfolding there, which could erase the savings of China’s new middle class, and Chinese stocks recently hit a multiyear low.

From where I sit, the risk-reward ratio for Chinese stocks looks bad.

To start, anytime you invest in a Chinese company, you’re investing alongside the Chinese Communist Party. Since he came to power in 2013, Xi Jinping has amplified the CCP’s influence over “private” Chinese companies. In effect, no business in China is private the way you or I think of a private company, with clear laws and boundaries separating it from the government.

The US-China Economic Security Review Commission summed this up well:

China’s government has developed numerous avenues through which to monitor corporate affairs and direct nonstate firms and resources toward advancing the Chinese Communist Party’s (CCP) priorities. Within this expanded framework of government control, traditional definitions of state control in an entity no longer apply because any entity may be compelled to act on behalf of the Chinese government’s interest, regardless of the state’s formal ownership.

Chinese law explicitly requires people and organizations within the country to “support, assist, and cooperate with national intelligence efforts.” (I’ve mentioned this when sharing my concerns about TikTok and digital privacy.)

Investors also need to consider China’s accounting practices. Chinese companies don’t use GAAP or International Financial Reporting Standards. They generally use Chinese Accounting Standards, sometimes called China GAAP, which makes analyzing them more challenging.

Then you have the transparency issues. Over 250 Chinese companies trade on major US exchanges. Regulators had to threaten to suspend trading under the Holding Foreign Companies Accountable Act to get the Public Company Accounting Oversight Board (PCAOB) access to audits of US-listed Chinese companies. We’ve made some progress here, but the PCAOB reviews late last year led to an unprecedented $7.9 million in sanctions against auditors PwC Hong Kong, PwC China, and Shandong Haoxin.

None of this was too concerning when China’s markets were roaring higher. The CCP was happy to take foreign dollars to build its businesses and infrastructure. Everyone won.

But with China’s financial markets under pressure, and the real estate buoying its middle class at risk, do you really want to invest alongside a government that can change the rules at will and without notice?

Earlier this week, Chinese brokerages restricted certain types of activities by domestic institutional investors. I won’t bog you down with the technicals—the takeaway is that brokerages are trying to limit short selling, which could lead to distortions in Chinese stock prices. It may also signal that there’s too much leverage in the market, which can lead to bigger price swings.

I’d argue there are better opportunities in emerging markets.

You might be invested in China and not even know it. Many popular emerging markets ETFs are heavily weighted towards China:

- iShares Core MSCI Emerging Markets ETF (IEMG) – 21.87%

- iShares MSCI Emerging Markets ETF (EEM) – 24.54%

- Vanguard FTSE Emerging Markets ETF (VWO) – 28.30%

- SPDR Portfolio Emerging Markets ETF (SPEM) – 25.32%

- Schwab Emerging Markets Equity ETF (SCHE) – 29.28%

Ex-China ETFs like the iShares MSCI Emerging Markets ex China ETF (EMXC) are popping up as more investors become aware of this. The number of new ex-China equity funds reached a record annual high last year.

More By This Author:

Industrial Size SurplusGoing Bang!

Clashing Crises