Africa, China Stocks Lead Global Equity Markets Bounce

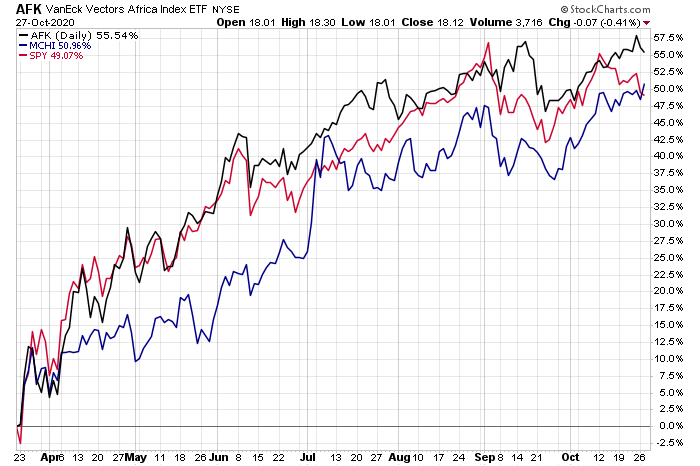

Since global markets plunged during the coronavirus crash in March, all the world’s major equity regions have posted sharp rebounds. Leading the way: shares in Africa, followed by China and US stocks, based on a set of publicly traded funds through Oct. 27.

Using the US market’s trough as a baseline (Mar. 23, 2020), VanEck Vectors Africa Index ETF (AFK) is enjoying a first-place increase with a 55.5% surge. Stocks in Africa may be overlooked by most investors, but the oversight has come at a price in the months since global equity markets swooned in late-March.

Although AFK has been a weak performer in recent years, the ETF’s upside profile has strengthened in recent months. Notably, the fund’s 50-day average rose above the 200-day average in late-August for the first time since March.

China’s shares are a close second to Africa in the post-Mar. 23 rebound via iShares MSCI China ETF (MCHI), which is up 51.0% since that trough.

Boosting demand for Chinese shares in recent months is the growing awareness that the country is expected to be the leader in the economic recovery among the major economies. Meantime, analysts remind that China’s shares continue to be underweighted relative to its economic footprint. “Global funds’ allocation in China is still not proportional to China’s economic size and the market cap of Chinese equities,” advises China Renaissance, a consultancy.

In third place for this year’s rebound among the major equity regions: US shares: SPDR S&P 500 ETF Trust (SPY) is up 49.1% since the March bottom.

The question is whether the global bounce in equities has run out steam? With coronavirus cases rising in the US and Europe, there’s a risk that a new wave of infections is underway and so the global economy faces a new threat in the months ahead.

In the US, the economic outlook is also clouded because prospects for a new fiscal stimulus package has been delayed, perhaps until next year. “Resurgence in the COVID cases combined with the fact that we are going to have to wait even longer to get a fiscal policy package put together certainly has investors on edge,” says Michael Arone, chief investment strategist at State Street Global Advisors.

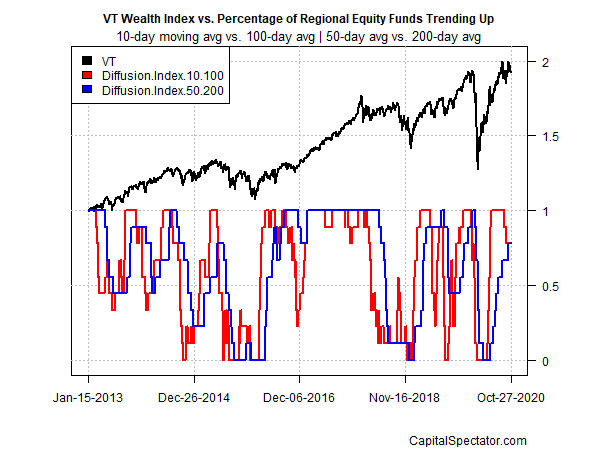

Profiling the funds above through a momentum lens currently indicates that the strong bullish momentum of late has faded, based on 10-day vs. 100-day moving averages. As recently as mid-September, all the funds listed above were posting bullish momentum for the short-term profile. As of yesterday’s close, that ranking has slipped to seven of the nine funds reflecting upside momentum – the same number of funds exhibiting a bullish medium-term trend.

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!