A Challenging Year Ahead For Dutch Hospitality

Spending per restaurant visit is on the rise in the Netherlands, despite consumer confidence remaining subdued. We still think there's reason to remain cautious as hotel and restaurant entrepreneurs in the Netherlands battle against high purchasing, personnel and energy costs along with persistent staff shortages.

The number of business closures and bankruptcies in the Dutch hospitality industry is set to rise once again this year.

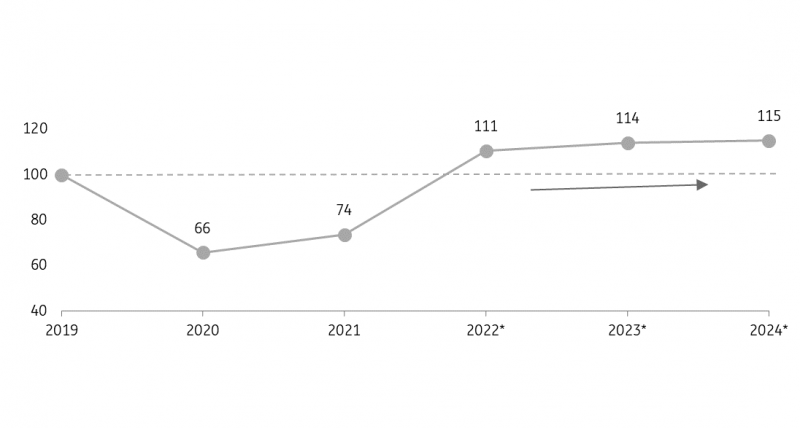

A return to stable growth for Dutch hospitality

Growth expectations for the hospitality industry in 2023 and 2024 are looking fairly positive. After the major catch-up last year, we expect volume growth of approximately 3% for 2023. This is, in part, a recovery from the Covid-19 pandemic – after all, the hospitality industry in the Netherlands was still facing restrictions in the first two months of 2022.

Now that almost all travel restrictions have been lifted worldwide, the number of foreign tourists visiting the Netherlands is also expected to increase this year. For 2024, we expect a minimum volume growth of around 1%, due partly to lower economic growth and a slight rise in unemployment.

After three turbulent years, the hospitality industry will return to a more stable growth path in 2023

Volume growth in the hospitality industry in the Netherlands, index 2019=100

CBS, forecasts 2023 and 2024 ING Research (May 16, 2023)

Spending per restaurant visit begins to climb

Despite a strong start earlier this year, times are still challenging for the hospitality industry. Relatively high inflation resulted in historically low consumer confidence at the end of 2022, and although we saw some improvement in the first quarter of 2023, levels remained subdued.

So far, the hospitality industry has not particularly been affected. Consumers continue to spend in the hotel and restaurant sector for the time being, thanks in part to the extensive financial support package from the government for households and higher (minimum) wages. The most recent ING transaction data shows that on average, consumers spent about 7% more per restaurant visit in the first quarter of 2023 compared to the previous year.

The number of debit card transactions in restaurants and cafés, on the other hand, has remained relatively flat since the second quarter of last year. The number of cash transactions in March and April this year, for example, was almost identical to the same period a year earlier.

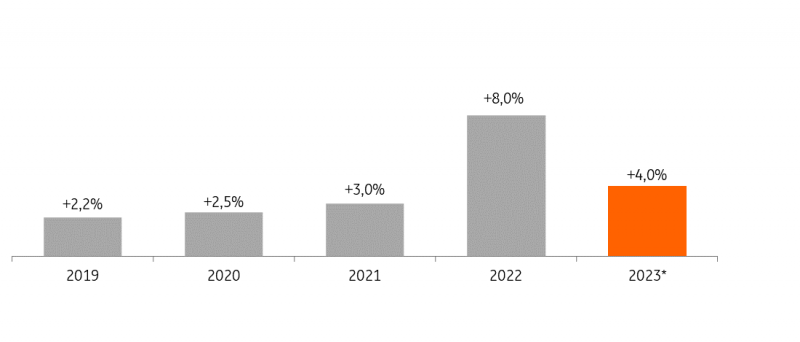

Prices expected to increase by an average of 4%

The relatively high inflation rate also weighs heavily on the hospitality industry. Six out of ten hotel and restaurant entrepreneurs report food, beverage, energy and personnel price increases that are worrying for the company, according to figures from CBS, a Dutch statistics agency.

As with many other sectors, the hospitality industry is not immune to the need to hike prices. This is often necessary to partly offset higher energy, purchasing and personnel costs. While energy costs are falling, personnel costs are rising due to wage increases. Restaurants and cafés will have to raise their prices further this year as a result, and we're expecting to see an average increase of 4%.

In 2023, on average 4% higher prices at restaurants and cafés.

Consumer price index (cpi derived) for restaurants and cafés

CBS, forecast 2023 ING Research (May 16, 2023)

Higher prices not entirely on the guest's plate

It's not always possible for the hospitality industry to pass on the higher energy, purchasing and personnel costs to customers in full – just one in three hotel and restaurant entrepreneurs are able to do so. This is significantly lower than in other sectors, as restaurants and cafés in particular struggle to put the prices completely at the customer’s expense. After all, if the price of a beer or a meal becomes too high, customers simply consume less or even stay away. Hotels are slightly less price sensitive in this area and can pass on the higher costs slightly more easily to their guests.

More business closures ahead for 2023

For hotel and restaurant entrepreneurs who can only partially charge higher costs to customers, the remainder is often charged to the profit margin. Pressure has been applied for some time now – especially on restaurants and cafés – as a result of stronger competition in recent years, brought on by significant growth seen in the number of catering establishments. On top of that came the mandatory closures during the pandemic, which further eroded profit margins (especially in 2020).

Now that the time has come for hospitality companies to repay their tax debts accumulated during the pandemic, financial problems could be on the horizon. It's therefore expected that the number of business closures and bankruptcies in the hospitality industry will be significantly higher this year than in 2022.

More By This Author:

FX Daily: Dollar Grinding Higher

Poland: Drop In Retail Sales Adds To Disappointing April Data

Eurozone PMI Dropped In May Due To Manufacturing Contraction

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more