6 Biotech Stocks For Maximum Gains And Minimum Risk

The third quarter is off to a tumultuous start. The “No” vote in Greece over the weekend has brought new volatility into the market and this is an event that could very well rock the market for weeks until some sort of solution is worked out. Meanwhile, the plunge in Chinese equities during the past three weeks have evaporated over $2.5 trillion in market value even with the Chinese leadership stepping in to arrest the decline. Given the amount of high-interest margin loans fueling the market over the past year; this could get ugly if equities continue to decline in the Middle Kingdom.

Closer to home, Puerto Rico announced last week that the massive $72 billion in debt obligations the island commonwealth owes is “not payable” and wants creditors to step forward to renegotiate the country’s debt. This could easily roil the municipal bond market given how many state focused municipal bond funds hold Puerto Rican debt due to its triple tax-exempt status.

Given this, I want to talk about one of the sectors that I know well and write about often. This is the biotech sector, an area that has been one of the strongest areas of the market over the past five years and has easily outperformed the S&P 500 throughout 2015 as well. I have been getting an increasing amount of questions around my investments and recommendations in this space from my readers on SeekingAlpha, Real Money Pro as well as my subscribers to Biotech Gems (shameless plug).

Let me start with a note of caution because as much as it pains me to say it; the sector is overdue for a correction. This is especially true in the small cap space. The top gainers among individual stocks in the first half of the year is completely dominated by the small cap biotech equities of which many have risen 300%, 400%, or even 500% in the first half of the year. Anecdotally, three of seven biotech/biopharma stocks that have been in Small Cap Gems portfolio (shameless plug two) since it was launched in July of last year have more than tripled. Not to look a gift horse in the mouth, but the sector is overdue for at least a decent correction as trees do not grow to the sky.

The last major pullback we had in the sector started in March of 2014 and lasted for six to eight weeks. Large Cap biotechs generally lost 20% to 30% of their value over that timeframe. Small caps were hit even harder with many smaller names losing 50% of 70% of their market capitalization in a relatively short amount of time.

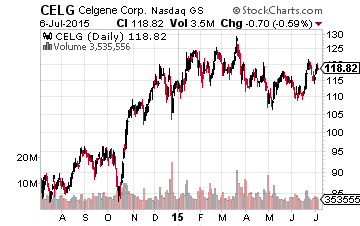

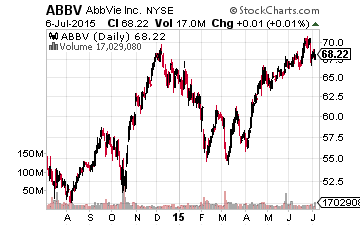

I always stress to my subscribers that 50% to 75% of their allocation to the sector should be in the large cap part of the sector to lower volatility and mitigate risk. The percentage depends on their own personal risk tolerances and preferences, although I would be leaning to the top end of that range right now. I would also love to add to some of these high quality names selling at attractive valuations should they drop five to 10% in a general decline. Some of the larger cap biotech stocks I have on my “shopping list” include Gilead Sciences (NASDAQ: GILD), AbbVie (NYSE: ABBV) and Celgene (NASDAQ: CELG).

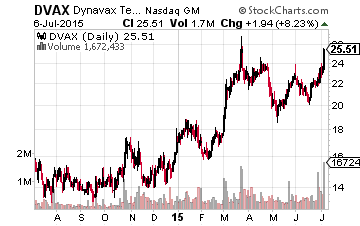

I am cautious on the small cap part of the sector at current levels and am patiently taking small positions incrementally for the Biotech Gems portfolio in this space as I believe we could well have lower entry points in the sector by the end of summer. I am still happy to put money to work in two kinds of companies within this subclass. The first is stocks that have visible near term catalysts on the horizon. One of these is Dynavax Technologies (NASDAQ: DVAX) which is up nicely since the last time I profiled the company here on Investors Alley. It’s over 8,000 person Phase III trial for its hepatitis B vaccine HEPLISAV – B should have results announced sometime in the third quarter or early in the fourth. I believe there is a high probability of success and this should be a $600 million a year opportunity.

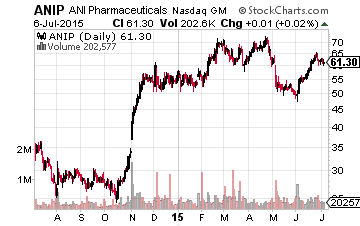

I also don’t mind buying small biopharmas that have fast growing revenue and earnings growth that are selling at a discount to that growth. ANI Pharmaceuticals (NASDAQ: ANIP) is one name I recently profiled that fits that criteria. A newer name I took a position during the market’s initial plunge on Monday is Pernix Therapeutics Holdings, Inc. (NASDAQ: PTX).

Thanks to recent acquisitions Pernix’s revenues should go from just over $120 million in FY2014 to over $275 million in FY2016. Earnings are projected to go from 18 cents a share to over $1.00 a share over that time span. At just over $5.50 a share, PTX is selling at just over five times 2016’s projected profits and five times this year’s projected EBITDA.

Disclosure: Positions: Long ABBV, ANIP, CELG, GILD & PTX, DVAX

This time, be prepared by investing in ...

more

You state "I believe we could well have lower entry points in the sector by the end of summer." If you believe that why are you recommending these picks now? I am confused. Thanks, Carol

I woud guess he is speaking to those of us who watch and plan. I gather from your comments you day-trade?