5 Reasons Why Sensex Slumped 949 Points Today

Indian share markets witnessed huge selling pressure today and ended deep in the red.

Benchmark indices extended Friday's fall as investors continued to adopt a cautious approach given the uncertainty around the Omicron virus and the upcoming RBI policy meeting on 8 December 2021.

At the closing bell, the BSE Sensex stood lower by 949 points (down 1.7%).

Meanwhile, the NSE Nifty closed lower by 284 points (down 1.7%).

UPL was among the top gainers today.

IndusInd Bank and Tata Consumer Products, on the other hand, were among the top losers today.

The SGX Nifty was trading at 16,944, down by 309 points, at the time of writing.

Both, the BSE Mid Cap index and the BSE Small Cap index ended down by 1.4%.

On the sectoral front, telecom stocks, IT stocks, and FMCG stocks were among the hardest hit.

Shares of Zee Entertainment and Vodafone Idea hit their respective 52-week highs today.

US stock futures are trading on a positive note today with the Dow Futures trading up by 150 points.

The rupee is trading at 75.42 against the US$.

Gold prices for the latest contract on MCX are trading up by 0.1% at Rs 47,933 per 10 grams.

Here are 5 Factors Why the Stock Market Plunged Today

Omicron spreads legs: Omicron remained a concern as the variant spread to about one-third of US states, though there were reports from South Africa that cases there had mild symptoms. The cases have also surged manifold in India.

Several cases of the Omicron variant have sprung up in India with Maharashtra, Rajasthan, and Delhi reporting new cases on Sunday. Currently, India's tally stands at 21.

Tapering to accelerate: Fed policymakers look likely to accelerate the wind-down of their asset purchases when they meet later this month as they respond to a tightening labor market and move to open the door to earlier rate hikes than they had projected.

FIIs slow down: Concerns over rising omicron cases and valuations seem to have weighed on foreign institutional investor (FIIs) inflow. FIIs net sold shares worth Rs 33.6 bn in the Indian equity market on Friday.

Weak global cues: China tech shares tumbled today, with a key gauge closing at its lowest level since launch last year as concerns mount over how much more pain Beijing is willing to inflict on the sector.

The Hang Seng Tech Index closed down 3.3%, its biggest decline in nearly two months, to the lowest level since before its July 2020 inception.

The decline also tracks Friday's 9.1% plunge in the Nasdaq Golden Dragon China Index, which was the biggest decline since 2008, on worries that Didi Global Inc.'s delisting would put pressure on other Chinese firms to follow suit.

Overall, Asian stock markets ended on a negative note today.

The Hang Seng and the Shanghai Composite ended down by 1.8% and 0.5%, respectively. The Nikkei ended down by 0.4% in today's session.

Profit booking: Apart from the above, losses were also seen as the share market succumbed to profit-booking.

In news from the realty sector, Godrej Properties was among the top buzzing stocks today.

Realty firm Godrej Properties today said it has entered into a joint venture (JV) with TDI group to build a luxury housing project in Central Delhi.

In a regulatory filing, Godrej Properties informed that the project would have a development potential of about 1.3 lakh square feet saleable area.

Godrej Properties said it has entered into a joint venture with the TDI group to develop an ultra-luxury residential project in Connaught Place (CP), one of the most premium locations within the central business district of New Delhi.

Mohit Malhotra, managing director (MD) and chief executive officer (CEO) of Godrej Properties, said,

- As we continue to strengthen our presence in Delhi, we are happy to add this project to one of downtown Delhi's most desirable locations.

This will be the company's third project in Delhi, he added.

Godrej Properties is developing a housing project at Okhla, while it will soon launch a luxury housing project at Ashok Vihar in the national capital.

In the Delhi-NCR property market, the company is also developing multiple housing projects in Noida, Greater Noida, and Gurugram.

Kamal Taneja, MD of TDI InfraCorp, said,

- We are proud to be associated with Godrej Properties to deliver this uber-luxury project and we look forward to this association.

Mumbai-based Godrej Properties is expanding its presence across four major cities - Delhi-NCR, Mumbai Metropolitan Region (MMR), Pune, and Bengaluru.

It is buying land parcels and entering into joint ventures with landowners to add projects for future development.

Godrej Properties' share price ended the day down by 3% on the BSE.

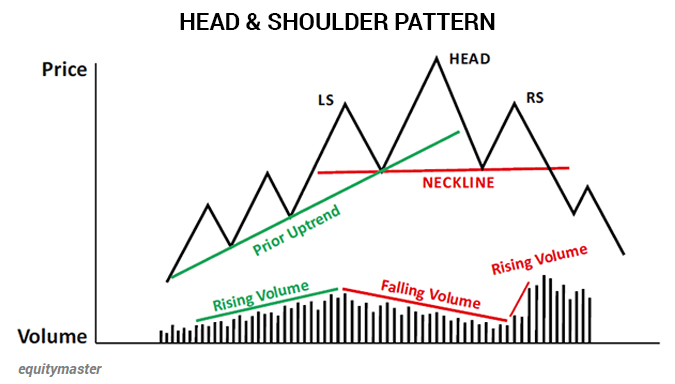

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

Moving on to news from the IPO space...

Anand Rathi IPO Subscribed 5.21 Times on Final Day

The initial public offering (IPO) of Anand Rathi Wealth, one of the leading non-bank wealth solutions firms in India, was subscribed 5.21 times today, garnering bids for 44.1 m equity shares against the IPO size of 8.5 m equity shares.

The reserved portion for qualified institutional buyers was subscribed 60%, and that of non-institutional investors saw 8.19 times subscription.

Retail investors continued to provide strong support to the issue with their allotted quota being subscribed 6.82 times, and employees have put in bids 1.05 times the portion set aside for them.

Half of the offered size is reserved for qualified institutional investors, 35% for retail investors, and the remaining 15% for non-institutional investors. The company has reserved 2.5 lakh equity shares for its employees, at a discount of Rs 25 per share to the final offer price.

Anand Rathi Wealth is planning to garner Rs 6.6 bn through its public issue that is entirely an offer for sale (OFS). The price band for the offer, which opened on 2 December 2021, has been fixed at Rs 530-550 per equity share.

The company is mainly into wealth management, via its private wealth (PW vertical), with total assets under management of Rs 294.7 bn as of 31 August 2021.

How this IPO performs on a listing day remains to be seen.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more