5 Israeli Stocks To Consider For Passover

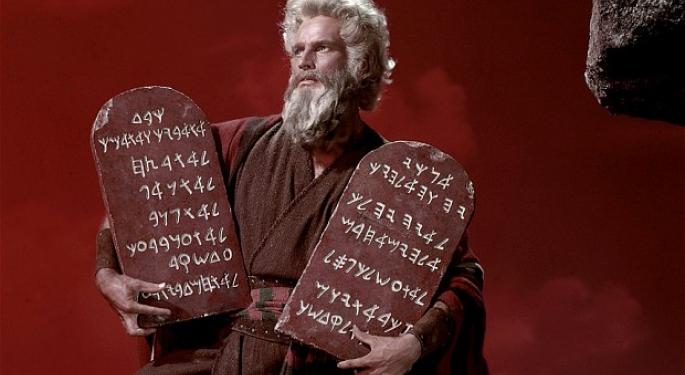

Photo of Charlton Heston as Moses courtesy Paramount Pictures.

Back in the days of the Exodus, investment opportunities in the Holy Land were limited to a pair of options. One choice was framed by draconian terms of service that were literally chiseled in stone and regulated by an often-severe oversight authority, although the return on investment was considered heavenly.

The other choice was a flashier vehicle that provided the unlikely combination of two important commodities — gold and cattle — into an eccentric concept that, in retrospect, probably should have stayed on the drawing board. In today’s Israel, investment opportunities are far more diverse and, admittedly, more secularized than the choices available to Moses and his friends.

But in view of the upcoming Passover holiday, perhaps we can do a mash-up of investing reviews and the traditional Seder question and ask, “Why are these stocks different from all other stocks?” The answer is that these stocks belong to some of the most intriguing and successful Israeli enterprises.

Bank Hapoalim BM (BKHYY)

This financial institution is one of Israel’s oldest and largest, founded in 1921 and with $167.9 billion in assets. Like other banks around the world, Bank Hapoalim has found itself dealing with ongoing shifts in the financial service world coupled with the challenge of the COVID-19 pandemic.

On the downside, the bank closed 26 branches last year, representing 12.1% of its network, and reduced its workforce by 400 employees. The bank also endured a public relations black-eye by agreeing to an $874 million settlement with the U.S. government to resolve charges that it helped U.S. taxpayers hide more than $7.6 billion in offshore accounts.

On the positive side, the bank saw its retail deposits increase 17.1% year-over-year in 2020, while its $622 million net profit represented a 14.3% year-over-year gain.

The bank also responded quickly to the changing Middle East environment by establishing platforms for Israeli companies to do business in the United Arab Emirates and Bahrain. Last month, it entered into the digital wallet sphere with Bit wallet, a payment platform open to customers of all banks, and Bitcard, a credit card.

“This past year has taught us that the unexpected can and will happen, but has also shown that financial robustness, sound judgment, and good leadership can overcome any crisis,” said Board Chairman Ruben Krupik. Bank Hapoalim shares over the past 52 weeks have traded from $25.18 to $38.60, closing on Friday at $37.20.

Caesarstone Ltd. (CSTE)

Anyone involved in remodeling or renovations will recognize this company’s Caesarstone brand of quartz surfaces and Lioli brand of porcelain products — the latter came under the company’s banner last August when it acquired a majority stake in India’s Lioli Ceramica Pvt. Ltd. for $12 million.

The company continued its acquisition activities in January when it paid $27 million to buy Omicron Granite and Tile, a stone supplier operating 17 locations across Florida, Ohio, Louisiana, Michigan, and Alabama.

Pandemic-related disruptions impacted Caesarstone’s 2020 performance. The company's $486.5 million in revenue was down 11.1% from the previous year’s $546 million. The 2020 gross margin of 27.5% exceeded the previous year’s 27.2%, which the company’s earnings report attributed to “improved efficiency, lower raw material costs, and improved product mix partly offset by the impact of lower sales volume, lower sale prices, and less favorable regional mix.” Operating expenses were down year-over-year, from $124 million in 2019 to $111.4 million in 2020.

“We were encouraged to finish 2020 with annual year-over-year improvement in gross margin and adjusted EBITDA margin,” said CFO Ophir Yakovian. “Following two quarters of significant cost-cutting, we increased operating expenses to a more normalized level to support our brand and future growth. Caesarstone’s strong balance sheet enabled us to successfully weather the challenges of 2020 and to further invest in accretive future growth.”

Caesarstone shares over the past 52 weeks have traded from 9.02 to 14.87, and it closed Friday at 13.73.

Fiverr International Ltd. (FVRR)

One of the most recognized Israeli brands in today’s economy is Fiverr, an online marketplace for freelancers offering their services. Since its beginning in 2010, the Fiverr marketplace has been a go-to platform for the members of the gig economy, and with the vast numbers of furloughs and layoffs over the past 12 months, Fiverr’s appeal intensified.

Fiverr reported $189.5 million in revenue during 2020, a 77% year-over-year spike, and the company offered FYQ1 and FY2021 guidance of $63 million to $65 million and $277 million to $284 million, respectively. Moving into 2021, the company went in two very different directions: its first Super Bowl advertisement — at a cost of $8 million — and the launch of a vertical dedicated to data-related services, its first new vertical in more than nine years.

“Our marketplace significantly scaled during 2020 and we achieved the important milestone of turning EBITDA positive as well,” said CFO Ofer Katz. “We believe the strong momentum is carrying into 2021 and the increased awareness and adoption of digital freelancing services will continue to provide tailwinds for our business. We are excited about the year ahead as reflected by our strong financial outlook for 2021.”

Fiverr shares over the past 52 weeks have traded between $22.52 to $336, and it closed on Friday at $201.88.

Playtika Holding Corp.

This Israeli company develops mobile games for both casual and casino-oriented players. The company’s most notable products are Bingo Blitz, Epic Jackpot, Pirate Kings, Slotomania, and World Series of Poker.

Playtika was acquired in 2016 for $4.4 billion by a consortium led by China’s Giant Investment Group through the subsidiary Alpha Frontier. It is one of the newest Israeli companies to transition from privately held to publicly traded. The company's Jan. 15 initial public offering raised $1.9 billion that gave it a valuation near $11 billion. (Giant owner Shi Yuzhu still maintains a controlling stake.)

The stock got off to a better-than-expected start: Playtika offered 69.5 million shares at $27, higher than the estimated range of $22 to $24, soaring 17.1% on its debut day to close at $31.62.

In its first earnings report from February, Playtika reported $2.3 billion in revenue for 2020 versus $1.8 billion a year earlier. This marked the first time the company’s revenue stream surpassed the $2 billion mark. Net income was $92.1 million compared to $288.9 million in the prior year. And two of its most popular games achieved record revenues in 2020: Solitaire Grand Harvest at $147 million, up 95% year-over-year, and June’s Journey at $168 million, up 90% year-over-year.

“Our relentless focus on data and expertise in live operations is the foundation of our success and will continue to provide a competitive advantage as we look forward with optimism to 2021 and beyond,” said CEO Robert Antokol. Since going public in January, Playtika shares have traded between $24.41 and $35.09, and it closed Friday at $25.27.

RedHill BioPharma Ltd (RDHL)

This Israeli biopharmaceutical firm is developing solutions for gastrointestinal and infectious diseases. Its products include Movantik, which treats opioid-induced constipation in adults with chronic non-cancer pain; Talicia, which is aimed at addressing Helicobacter pylori infection in adults; and Aemcolo for mitigating travelers' diarrhea in adults.

COVID-19 treatments are also on the company’s slate, with two oral therapy drugs: opanganib, which is also being evaluated for prostate cancer treatment, and RHB-107, which is being tested for outpatient treatment of COVID-19. Dr. Terry Plasse, medical director for RedHill Biopharma, explained that the oral therapies for use outside the hospital has the "potential to be a game-changer in managing this disease.”

For 2020, the company reported net revenues of approximately $64 million, an increase of $58 million from one year earlier — the commercialization of Movantik and Talicia initiated in 2020 fueled this growth. Gross profit was approximately $27.5 million, an increase of $23.5 million from the previous year compared to the year ended Dec. 31, 2019, primarily due to the increase in net revenues.

“With strong momentum across both commercial and R&D operations, we expect 2021 to be a breakout year,” said CEO Dror Ben-Asher. Redhill BioPharma shares have been trading between $4.20 and $11.52 over the last 52 weeks, and it closed Friday at $7.30.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.