4Q24 GDP Grew Much Stronger Than Expected, Supporting BoJ Normalisation Ahead

Image Source: Pexels

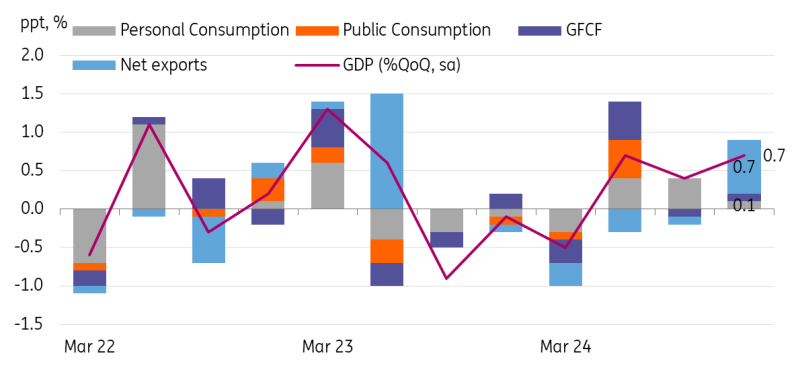

Japan’s GDP grew 0.7% QoQ sa in the fourth quarter (vs a revised 0.4% in 3Q24, 0.3% market consensus) thanks to solid external demand

Today's GDP data shows that the economy continues to grow steadily, with stronger-than-expected 4Q24 results and revised up 3Q24 growth (0.4% from 0.3%). Strong global demand for semiconductors appeared to have led to better exports and capex spending, while domestic demand softened a bit compared to the previous quarter.

- Private consumption growth moderated to 0.1% after solid growth of 0.7% in 3Q24, but it was stronger than the market consensus of -0.3%. In 4Q24, real wage growth turned positive, as did household spending. As such, we believe that solid wage growth is clearly leading the consumption recovery. Both durable goods consumption (3.6%) and services consumption (0.1%) are behind the resilient growth of household consumption. However, we believe that faster inflation growth (CPI 2.93% YoY 4Q24 vs 2.77% 3Q24) will weigh on consumption going forward.

- Meanwhile, business spending rebounded 0.5% (vs -0.1% 3Q24, 0.9% market consensus) mostly due to increases in tech investment related to semiconductors.

- The contribution of net exports to GDP was 0.7 ppt as exports rose 1.1%, while imports contracted -2.1%. A notable increase in exports of services (4.1%) seems largely due to inbound tourism and 0.1% growth in exports of goods due to strong IT exports.

4Q24 GDP grew stronger than expected mostly due to strong external demand

Source: CEIC

BoJ watch

Today's results are better than the BoJ's current GDP forecast (0.6% YoY for FY24 GDP). On the inflation front, headline prices are expected to jump to 4.0% YoY in January and remain at a high level of 3% for some time. Growth and inflation conditions point to faster-than-expected rate action by the BoJ. Current market pricing dynamics suggest a rate hike in July, but we believe that the BoJ may act as early as May. According to a local news report, the outcome of Spring wage negotiations is likely to be as strong as last year.

However, the main risk to our call is US President Trump’s tariff policy. Tougher-than-expected reciprocal tariffs on Japanese goods could complicate the BoJ's growth outlook. But, in our view, the BoJ’s policy priority in the near term should be to contain excessive inflation. Thus, we maintain our BoJ forecast of a hike in May and October in 2025 and an additional hike in 2026.

More By This Author:

The Commodities Feed: Potential Restart In Kurdish Oil ExportsNational Bank Of Romania Set To Remain Cautious This Year

FX Daily: Don’t Chase The Dollar Correction

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more