4 Stocks With A Perfect Dividend Triangle

Audio Length: 00:41:00

The Dividend Triangle can’t be found in investment books as it has been created by me. It consists of looking at revenue growth, earnings growth, and dividend growth as a first set of filters in your stock research. We referred to that concept times and times again! So, today, we present 4 stocks with a perfect dividend triangle to illustrate how it leads to robust companies!

Can you guess any?

You’ll Learn

- 02:03 Why is focusing on these three metrics (revenue, EPS, and dividend growth)?

- 05:33 Why should you look at the 5-year trend when you set your dividend triangle filters?

- 09:20 What other filters come into play before pressing the buy button?

- 13:07 What are the numbers investors should look for in terms of revenue growth, earnings growth, and dividend growth?

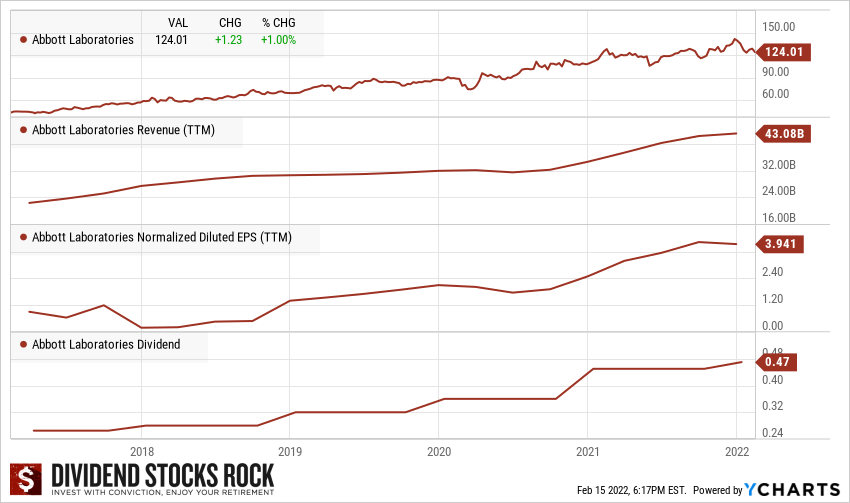

- 15:47 Why does Abbott Laboratories show an amazing dividend triangle despite a small decrease in revenue and earnings for 2020?

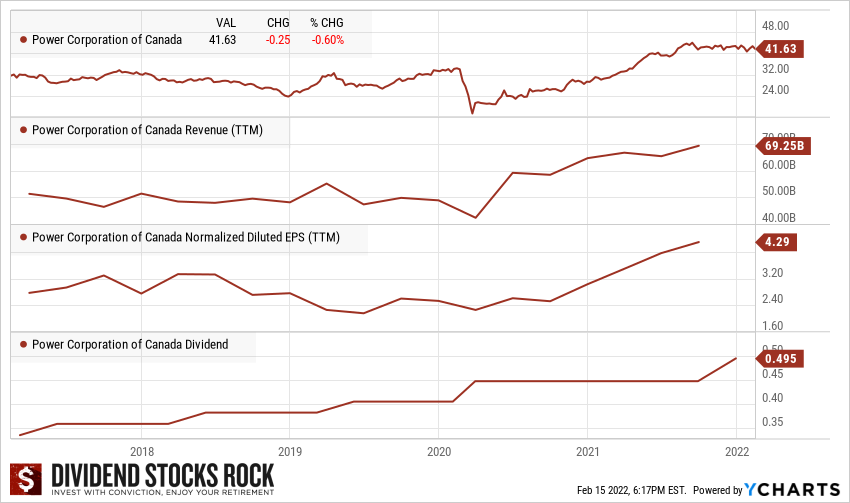

- 20:21 How Power Corp went from a company with boring results to an interesting play.

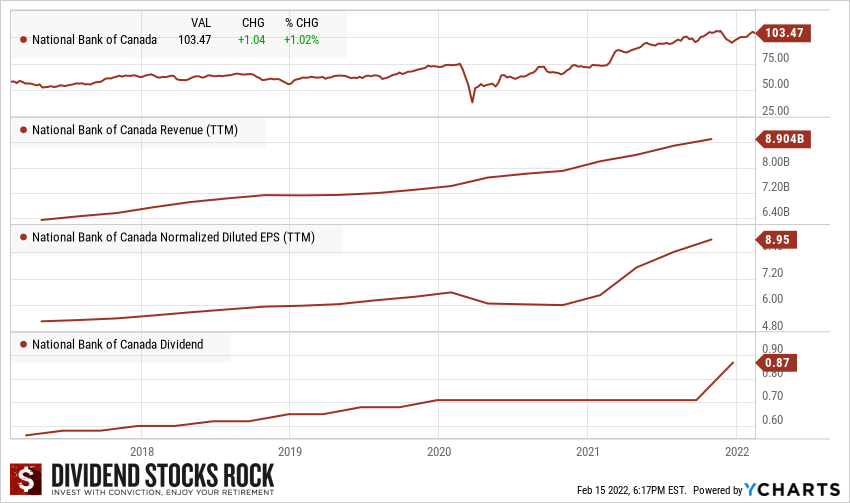

- 24:55 Canadian Banks were not allowed to raise their dividend payments in 2020. Is that a concern and why is National Bank still a great example?

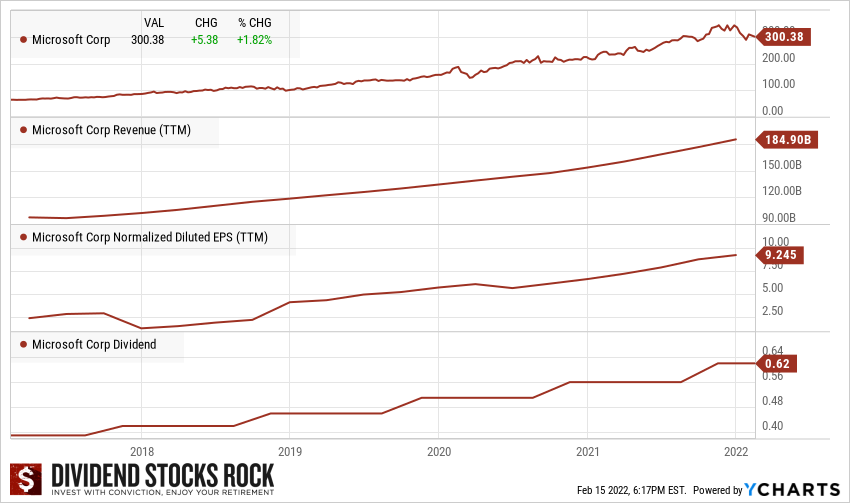

- 29:01 Microsoft shows the best dividend triangle we could find on Dividend Stocks Rock. How can investors make sure it is sustainable?

- 37:18 Can a great dividend triangle sometimes lead to a not-so-good company?

Below, you’ll find the Dividend Triangle of each company mentioned today.

Disclaimer: Each month, we do a review of a specific industry at our membership website; Dividend Stocks Rock. In addition to have full access to 12 real-life portfolio models, readers can also ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!