3 Top Canadian Large Cap Stocks To Buy In November

Large cap stocks are a critical part of every investors portfolio. If you've been investing primarily in mid to small-cap stocks, you might be taking on significantly more risk than you're comfortable with. The stock market is a device than can provide long term compounding returns. But contrary to popular belief, this is more often done with some of the best large cap Canadian stocks, and not speculative smaller options.

Fortunately here in Canada we have some of the top large cap stocks in North America. Ones capable of providing strong cash flow generation, economic moats, and pricing power, all of which will prove to be critical during periods of high inflation.

In this article, I'm going to go over 3 of the top large cap Canadian stocks to buy today. My focus will be on a value play, a growth play, and an income play. So, regardless of what type of investor you are, this article will likely have something for you.

With that being said, lets get started.

3 of the top large cap stocks to buy in Canada today

Canadian large cap for income - Enbridge (TSX:ENB) (NYSE: ENB)

When looking for large cap Canadian stocks, you're often going to run into a few specific sectors, those being financials, energy, and pipelines. Enbridge (TSE:ENB) is one of the largest companies in Canada today with a market cap in excess of $88 billion, and fortunately for investors it's also one of the best large cap dividend stocks to own in the country.

To give you an idea of the economic moat that Enbridge has, it ships over 20% of the United State's natural gas and 25% of the crude oil used in North America.

The company is also quietly amassing a renewable energy portfolio with 3.6 GW of contracted renewable power. Although this renewable portion makes up only 3% of EBITDA, it is still a step in the right direction.

The company has over 40 streams of income and has been extremely resilient when it comes to paying out its dividend. Not only did it maintain its dividend during the financial crisis, the oil collapse in 2014, the Alberta forest fires in Fort McMurray, and the COVID-19 pandemic, but it kept increasing it.

The company yields north of 6% and has consistently raised its dividend for more than two and a half decades. However, the company often gets cast away as an option for investors.

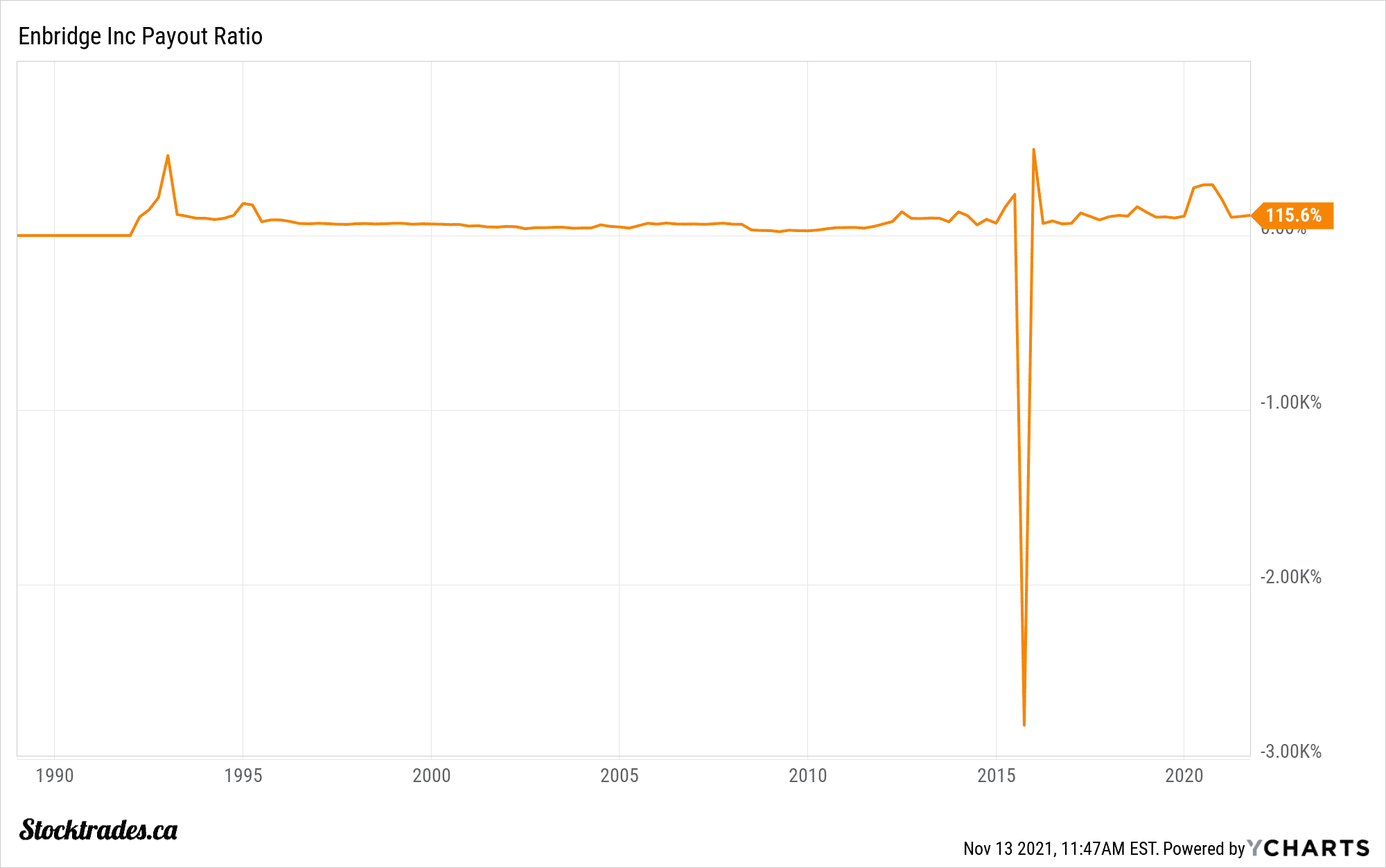

Why is that? It is because many don't understand the company's structure and avoid it due to its high payout ratios.

An important point for those just learning how to buy stocks especially. Enbridge's payout ratio has remained above 100% for more than a decade. Yet, it has consistently raised the dividend over this period of time. For those who simply follow the methodology that a high payout ratio is a warning sign, they miss out on this excellent income stock.

Enbridge's payout ratio should be looked at based on Distributable Cash Flow, a common metric among pipelines. Because these companies have high capital expenditures and maintenance costs, earnings per share can be inaccurate. When we look to Enbridge's forecast for $5 per share in DCF, we can see its $3.34 annual dividend is safe, making up around 65% of DCF.

If you're looking for a top large cap Canadian stock for income, it's hard to argue against Enbridge.

Top Canadian large cap stock for growth - Shopify (TSX:SHOP) (NYSE: SHOP)

If you're looking for a list of the top Canadian large cap stocks, it wouldn't make any sense to not list the largest company in the country, Shopify (TSE:SHOP). However, Shopify doesn't make the list simply because it's the largest publicly traded company in Canada. It makes the list because it is a large cap stock with explosive growth.

Shopify is an e-commerce company that primarily focuses on getting small to medium size businesses set up with online shops to drive more sales for their business.

The company operates under its subscription service, which is the utilization of its framework on numerous platforms to get stores up and running, and its merchant solutions, which include add-ons and utilities that allow merchants to not only sell, but sell more efficiently.

If we look to what businesses were impacted the most by the pandemic, we can see exactly why Shopify has flourished. Small to medium sized businesses were often shut down due to lockdown measures in an attempt to stop the spread of the virus, and many businesses who didn't sell online prior to the pandemic had virtually no choice but to head online. Make no mistake about it, Shopify was wildly successful pre-pandemic. But the pandemic brought brick and mortar stores online at an even faster rate.

Shopify bears would often state "once the pandemic subsides, these business owners will cancel their subscriptions," but this hasn't been the case. In fact, many who were hesitant to head online to sell found out that not only was it extremely easy with Shopify's platform, but the revenue generation was game changing for their business.

Despite growth slowing over the years, Shopify is still growing at a mid double-digit pace and is a company that is leading the charge here in Canada when it comes to e-commerce. The pandemic has changed the way business owners sell and consumers purchase. Both of these will prove to be tailwinds for Shopify as it moves forward in a more digital age.

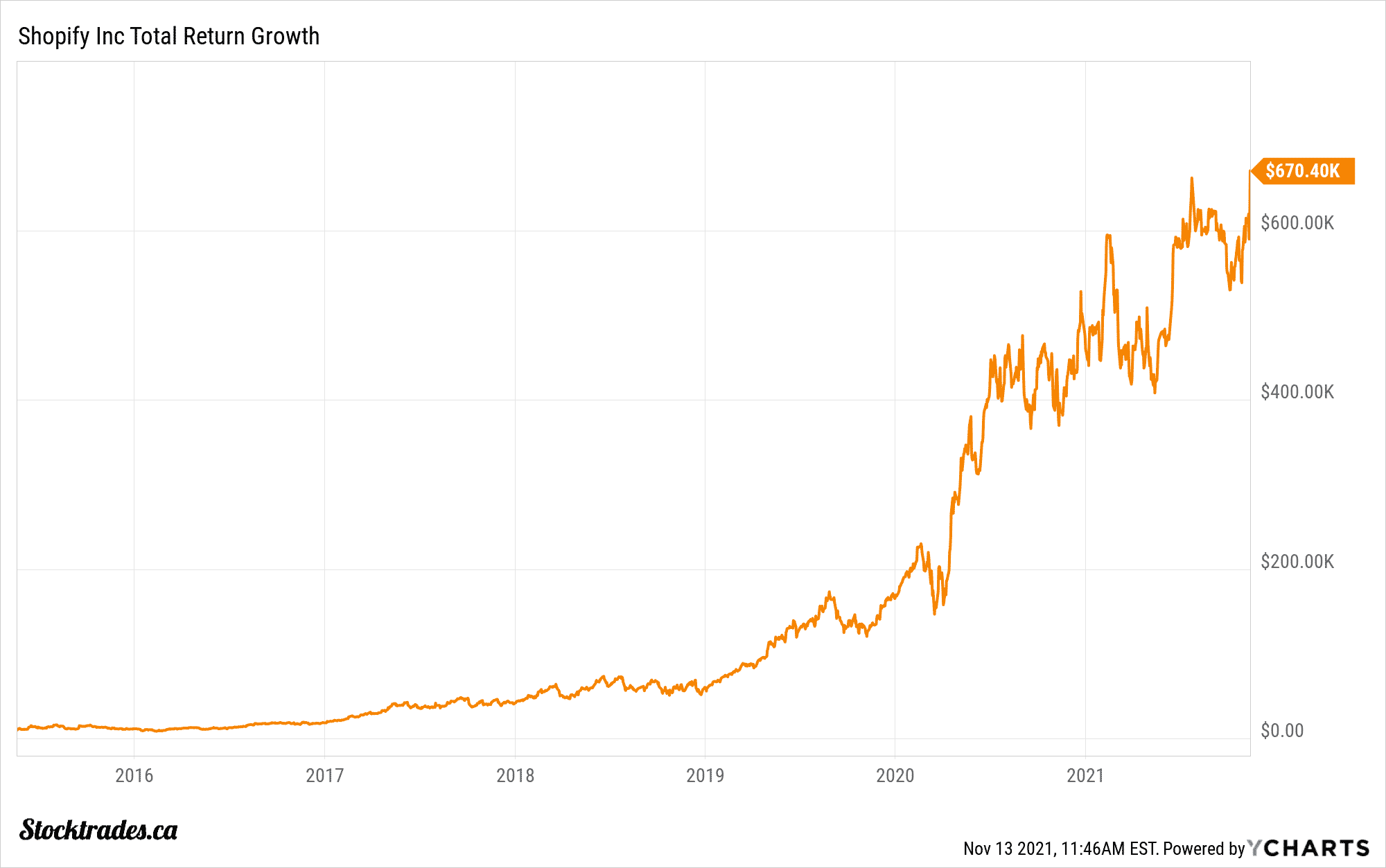

The company pays no dividend, but considering it has turned $10,000 into over $660,000 for investors since its IPO in mid 2015, we shouldn't be too worried about the lack of income.

Top Canadian large cap for value - Canadian Natural Resources (TSX:CNQ) (NYSE: CNQ)

Before the COVID-19 pandemic, Suncor Energy was the largest oil producer in the country, and was generally thought of as a blue-chip option. We've always preferred Canadian Natural Resources (TSE:CNQ) here at Stocktrades. In fact, it was a highlight on our Dividend Bull List over at Stocktrades Premium and has outperformed Suncor.

Why? The company is just one of the best oil and gas operators in North America, plain and simple.

The company operates in western Canada, the North Sea, and Offshore Africa. It produces light, medium, and heavy oil along with bitumen, synthetic oil, and natural gas liquids. Last year, despite the global pandemic the company produced over 1.16 million barrels a day, and has reserves of over 11.5 billion barrels.

Canadian Natural's break even costs are in the $35~ WTI range, which make it one of the lowest cost producers in the country. This proved to be absolutely critical during the pandemic and oil collapse of 2020. While dividend cuts came from major producers like Suncor and many other junior producers, Canadian Natural not only continued to pay its dividend but raised it.

The company has one of the longest running dividend growth streaks in the country at 20 years, and has consistently raised the dividend at a double-digit clip. We certainly don't expect to see this pace reduced in the coming years, as at $70~ WTI, Canadian Natural will be generating a significant amount of free cash flow.

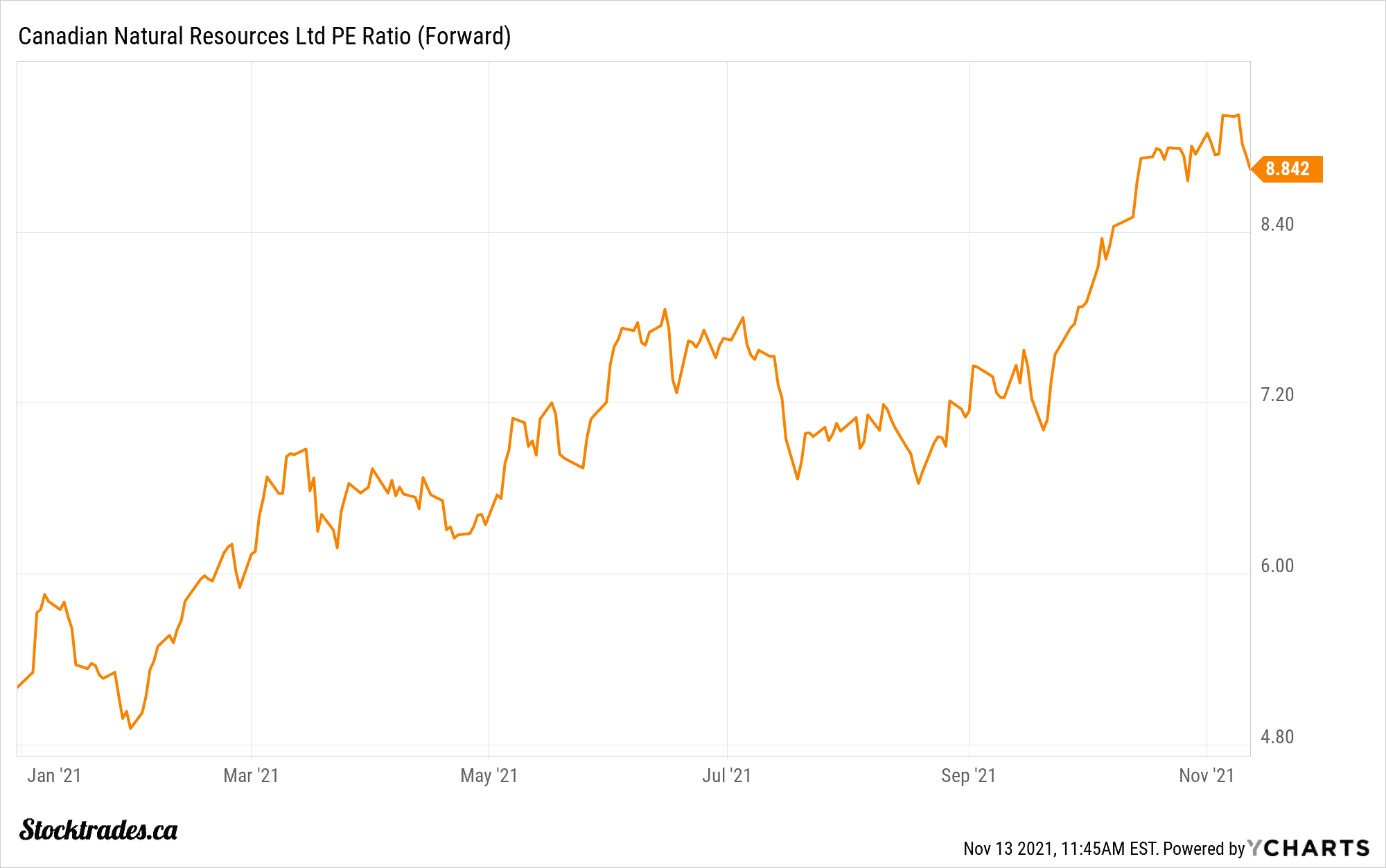

Canadian Natural remains a strong value play for investors looking for cheap Canadian large cap stocks. The company is trading at only 8.25 times forward earnings, 2 times forward sales, and less than 6 times expected forward cash flow.

The company is trading at a near 40% discount to its historical averages, and is one of the best operators in the country. Although it's unlikely capital appreciation will be significant with these oil and gas companies as the cyclical nature of the industry tends to have them trading cheap at all times, there is no doubt that there is a value gap here, and investors will likely be rewarded with significant increases to the company's dividend.

Disclaimer: You can read our full disclaimer here.