3 Elite Canadian Banks For Dividends: Royal Bank Of Canada (Part 1 Of 3)

Written by Dirk S. Leach

It is difficult to find safe investments with 3%+ dividend yields and solid growth prospects.

Many equities today are priced on the rich side of valuations resulting in lowered dividend yields.Low interest rates have made bonds a poor value for income seeking investors.

The benefits of investing in high quality stocks with above average yields and good growth prospects – trading at fair or better prices – are well-known to long-term investors.

What if you could quickly identify an entire group of these stocks?This article takes a look at one such group the market is overlooking:

The Canadian banking sector.

There are 3 large Canadian banks that rank as a ‘Buy’.

This article gives an overview of the favorable investment prospects of the Canadian banking system.It also analyzes 1 of the 3 highly ranked Canadian Banks in detail:Royal Bank of Canada (RY).

Why Canadian Banks ?

With all the banking names in the United States, why focus on Canadian banks for potential investments?

The first considerations are stability and credit worthiness.

Moody’s Investors Services ranks Canada’s Banking System number 1 in the world for financial strength and safety. The World Economic Forum has dubbed Canada’s banking system best in the world for eight years running. During the 2009 global financial crisis no Canadian bank failed or required a bailout.

A quick review of the fraction of non-performing loans for the banks in the European Union (EU), the US, and for Canada tells us that Canada’s banking system is in better shape.

- 5.6% of loans at EU banks are non-performing

- ~3% of loans at United States banks are non-performing

- 0.6% of loans at Canada banks are non-performing

Canadian banks have non-performing loans factor five times lower than in the US.

Canada’s banks typically pay a higher dividend than do their US counterparts and they have been doing so for a very long time.For example, the Bank of Nova Scotia (BNS) has a flawless record of paying dividends every year since 1832.Only the Bank of Montreal (BMO) can top that with a track record extending back to 1829. Toronto Dominion Bank (TD) is not far behind having paid dividends since 1857.

Dividends are important to the Canadian investors and to the Canadian banks paying them.I like that.

Finally, if you are going to invest outside of the US, there is some comfort in investing in Canadian equities.While Canada is not the US, it is also not all that different in its business culture, laws, regulations, and values.

Narrowing the Field

I screened the 5 largest Canadian banks looking at 10 year compound annual growth rates for revenue, EBITDA, EPS, dividends paid, and the most recent dividend payout ratio.The list includes the previously mentioned banks BMO, BNS, and TD as well as the Royal Bank of Canada (RY) and the Canadian Imperial Bank of Commerce (CM).A summary of the basic screening data is provided below.

Source: Author

Based on this screening, I selected BNS, RY, and TD for further analysis.BNS, RY, and TD have consistently grown revenue, EBITDA, EPS and dividends paid out to investors by solid margins compared to BMO and CM.

Canadian oil producers are in no better shape than those in the US.I thought it prudent to look at the loan book exposure to crude oil production and production related companies.This proved very enlightening as I found that TD had the lowest exposure at about 1%, RY also low at 1.6%, BNS rather high at about 10%.

BNS’s 10% exposure to the oil and gas industry has been a challenge for BNS over the last couple of quarters and last quarter BNS raised its loan loss reserves by 40% primarily to cover expected defaults in the oil and gas industry.With BNS having taken a large reserve last quarter and the price of oil slowly on the rise over the last quarter, BNS appears to be well positioned to ride out this latest oil and gas downturn.

I plan to cover RY in detail in this article with the investment thesis for BNS and TD in future articles.

Royal Bank of Canada

RY is Canada’s largest bank by market capitalization at $92B in US dollars, the 6th largest in North America, and is ranked 18th globally.RY has offices in Canada, the US and in 38 other countries with a total of 79,000 employees serving more than 16 million clients.

Over the last 10 years, RY has managed to achieve healthy growth of its revenue, EPS, and dividend payments while maintaining a conservative dividend payout ratio.These metrics are shown in the updated charts below.Readers will note that the dip in EPS and the spike in the dividend payout ratio was due to the impact of the 2009 financial crisis.Note that the bank quickly recovered its EPS.

Source: GuruFocus

RY maintains a Common Equity Tier 1 of 10.1% well exceeding the Basel III accord requirement of 6% and carries an AA- credit rating from Standard and Poor’s.RY’s cash flow remains strong and RY just recently raised its quarterly dividend to $0.81 CDN from $0.79 CDN continuing its history of rewarding its share holders.As of Monday, February 29, RY’s annual dividend yield is a respectable 4.1%.

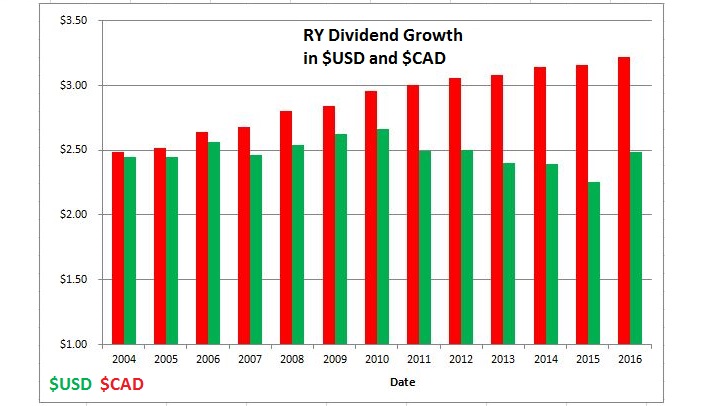

The reader should note that all of the above data is based on financials reported in US dollars and is therefore impacted by the exchange rate between the Canadian dollar and the US dollar.As an example, the dividends per share chart above shows the annual dividend paid in US dollars at $2.47 based on the current exchange rate.The annual dividend paid in Canadian dollars is $3.24 (latest quarter annualized).

This does have implications in understanding the charts above.While the charts show that revenue, EPS and dividends have all turned and headed south over the last several quarters, that result is true only in US dollars due to the recent strength of the US dollar compared to the Canadian dollar.

The bottom line is that the reader needs to factor in the impact of the exchange rate to fully appreciate the charts above.I was unable to find a comparable website to GuruFocus with data in Canadian currency but I’ve included a more complete discussion on exchange rate impacts and risks in the next section of this article.

This financial summary, while brief, indicates that RY is healthy and growing.

Is A Canadian Recession Likely?

Investments that are a “sure thing” seldom come along… I’ve yet to find one in 30+ years.

Investors should look at the possible risks of any potential investment.There may be other risks I’ve not identified but the following paragraphs summarize the risks I’ve considered.

In 2015 Q1 Canada’s GDP contracted 0.2% and contracted again by 0.1% in Q2.So, most economists would say Canada experienced a mild recession in 2015.

The GDP estimates for the third quarter are positive and the initial GDP readings for the first two months of Q3 show that Canada’s economy is growing again.There is a potential risk that Canada’s economy could slip back into recession putting a crimp on loan and deposit growth for the Canadian banks.

I see this as very low risk for a couple reasons.First, Canada is our largest trading partner and Canada’s economy is tied pretty closely to that of the US.While not growing leaps and bounds, the US economy is growing slowly but steadily and I believe it unlikely that Canada’s economy would suffer while the US economy continued to grow.

Secondly, the recession that Canada experienced was very mild and caused very little economic dislocation.Outside of mining and the crude production sectors, few Canadians were affected by the most recent recession.When I’ve asked my Canadian friends and colleagues about the impact of this recent downturn in GDP, the answer I generally get is “What recession?”.

I’ve already touched on the potential impact of low oil and natural gas prices on the loan books for the Canadian Banks.While a reversal of current crude price increases is possible, it looks more likely that crude prices will continue to rise albeit slowly.

Potential Risks:Housing Bubble In Canada?

Some people have expressed concern over a potential housing bubble in Canada, particularly in the larger metro areas of Toronto and Vancouver.Housing prices in both locations have definitely been on a tear lately and slowed down only a little during Canada’s most recent mild recession.

There are a couple of important mitigating factors that Canada’s housing market has over the US that makes it less likely that we will see any significant defaults out of the Canadian housing sector.

Canada has more conservative requirements for mortgage loan qualification for owner occupied homes, for home equity loans, and for investment/rental properties.The Canadian Housing and Mortgage Corporation [CHMC] requires mortgage insurance on all loans up to $500,000 CDN where the loan value is more than 80% of the property value. For mortgage loans over $500,000 CDN the down payment required to forego mortgage insurance was a little more relaxed at 20% of the first $500,000 CDN plus 5% of the amount over $500,000 CDN.The new liberal government in Canada recently tightened further the mortgage lending requirements for home mortgages over $500,000 CDN by raising the required down payment for amounts over $500,000 CDN to 10%.

This results in more initial owner equity in mortgaged properties.Additionally, mortgage interest is not tax deductable in Canada so owners have more incentive to pay off mortgage loans and no incentive to over mortgage their property.

This results in a lower probability of a homeowner defaulting and walking away from their mortgaged property.If a homeowner does walk away from their mortgage, mortgage lenders in Canada generally have full recourse to collect on the mortgage loan from the borrowers assets and future earnings.For the interested reader, this linked article provides a bit more color and detail on the differences between the US and Canadian mortgage lending requirements.

The charts below provide a clear picture of the effect of Canada’s tighter mortgage qualifications and tax treatment of mortgage interest.

Source: Rbc.com

Even through one of the worst global financial crises in 2009, Canada’s mortgage delinquencies barely registered any impact.

During the height of the 2009 financial crisis, mortgage defaults in the US topped out at about 5% of all mortgage loans and at 20% in the subprime mortgage market.In Canada, mortgage loans also soared all the way up to 0.45% of all mortgage loans; a factor of 11 times less than in the US.

My take away on this is that while the housing bubble is a concern for continued healthy home sales and continued strong growth in owner occupied homes in Canada, the risk of significant impact to Canada’s banking system due to mortgage default risk is relatively low.

Potential Risks:Exchange Rate Risk

The last potential risk I’ve considered is the exchange rate risk.Today, the Canadian dollar is weak compared to the US dollar.This has had a couple of impacts that should be considered by US investors looking to invest in Canadian companies.

Canadian companies pay dividends in Canadian dollars.The strong US dollar has made those Canadian dividends worth less to us on the southern side of the border.However, the strong dollar has also lowered the share price of Canadian companies for US investors.Today, our strong US dollar buys us more equity or shares of Canadian companies.So, is this a risk or a benefit?

If a US investor bought shares of RY today and the US dollar continues to strengthen relative to the Canadian dollar, the dividends paid in Canadian dollars would be worth less and the principal value of the investment could also drop.However, if the Canadian dollar strengthens relative to the US dollar, those Canadian dollar denominated dividends will be worth more and the price of the equity would likely rise in US dollar terms.To take a look at a graphical representation of this I’ve included the charts below.

Source: Author

From these two charts one can see the impact of the strong dollar on the value of the dividends paid to US investors.While RY has continued to increase dividends paid out in Canadian dollars, the value to US investors in 2015 and beginning of 2016 actually fell.

This is due to the strong US dollar and the current exchange rate where $1 Canadian is worth only $0.785 US.Those US investors that bought into RY in 2014 are probably not pleased with the impact from the strong US dollar as the value of their investment is down in US dollars.

However, for those US investors that are considering an investment today, the reward potential has improved due to the rise in the value of the US dollar.The US dollar strength relative to the Canadian dollar has been higher in the past 10 years but not by very much.

The chart below shows the value of the Canadian dollar versus the US dollar over the last 10 years.While the dollar has fallen in the last couple of months we are still close to a 10 year peak in the value of the US dollar versus the Canadian dollar.

Source: Xe.com

The question each investor has to answer to determine if the exchange rate issue is a risk or a benefit is:

“Which way will future exchange rates go?”

As a result of the US Federal Reserve Open Market Committee [FOMC] finally figuring out that the global and US economies, while growing, are not sufficiently robust to warrant a series of interest rate increases, the upward pressure on the US dollar valuation against the Canadian dollar has recently dropped.

In the longer term, as the Canadian economy strengthens, I believe the Canadian dollar will strengthen relative to the greenback.So, long term, I believe the exchange rate will work in my favor as a US investor in RY.

As with most financial ratios and metrics, it is likely the USD/CAD exchange rate normalizes.

“Reversion to the mean is the iron rule of the financial markets.”

– John Bogle

Final Thoughts

The Canadian banking sector is strong, healthy, and conservatively managed.

Of the big five Canadian banks, I believe RY stands out as having better investment potential and the lowest risk of impact from oil and gas sector loans.

RY has shown the ability to grow revenue, EPS and their dividend payments while maintaining a conservative payout ratio.While past performance is not a guarantee of future performance, it is a good indication that the company is being managed well.

RY is the highest ranked international stock in the Sure Dividend newsletter.The company’s high dividend yield, growth prospects, safety, and reasonable price-to-earnings ratio make it a compelling investment.

Click here to download a free 1 page PDF summary of RY, including:competitive advantage analysis, 10 year total return, fair value, and much more.

I believe the potential risks of investment in RY to be low and, at least in the longer term, the exchange rate will work in favor of US investors.

Disclosure: None.