3 American Companies Cashing In On The Rise Of The Chinese Consumer

China has been a watch item for most investors since the country’s stock market collapsed in late July and authorities devalued the Yuan soon thereafter. Those events were two of the key drivers of the significant increase in volatility that hit the market and that saw August post the poorest monthly equity performance in a couple of years.

Those worries have receded a bit as the stock market in China has stabilized and as the country’s central bank cut interest rates. Quarterly GDP growth recently came in at 6.9%, albeit adjusting for deflation that number would be 6.2%. However, industrial readings are still coming in extremely poor in the Middle Kingdom. Both exports and imports continue to show year-over-year declines. This is one reason commodities continue to be weak and the rally in early October in oil has faded.

The collapse in oil and commodity prices have put commodity-based economies like Canada and Brazil into recession. The slowdown in industrial activity in China have also played a major role in the poor results and earning declines at a variety of American industrial plays who depend on China for a significant portion of their demand. These include mining equipment makers Joy Global (NYSE: JOY) and Caterpillar (NYSE: CAT) as well as engine maker Cummins (NYSE: CMI).

On the flip side, the Chinese consumer seems to be holding up remarkably well. This strength was reflected in giant e-commerce play Alibaba (NASDAQ: BABA)’s recent stellar quarterly results that easily beat on the top and the bottom lines. This helped rally its shares as well as the stock of Yahoo (NASDAQ: YHOO) which holds a large stake in the giant Chinese online retailer.

Although I think it is way too soon to invest in stocks with large exposure to the industrial and manufacturing side of China, companies with exposure to the Chinese consumer should hold up well. Thursday’s announcement the country was dropping its “one child” policy should also boost long-term growth in consumer demand as well. Here are a couple of companies that are well-positioned to benefit from higher consumer spending in China.

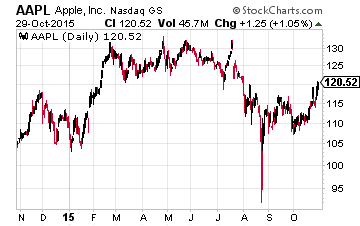

Let’s start with Apple (NASDAQ: AAPL) which is getting almost three-quarters of its overall growth right now from the Middle Kingdom. In the quarter just reported, the company stated it saw 120% year-over-year growth in mainland China. Tim Cook, Apple’s CEO, stated macro conditions remain good in China. He also talked up the potential for middle-class growth and rising 4G penetration to boost iPhone sales in China as well as other Asian markets. Over 50% of Chinese iPhone buyers were first-time buyers as the company continues to become a consumer brand juggernaut in China.

Most analysts thought Apple would face tough sledding when it first signed deals with China Mobile (NYSE: CHL) and other carriers as they believe that consumers would gravitate to lower priced handsets. This view was obviously in error and Apple is quickly growing market share in China. Apple is also seeing 25% growth in revenues from its AppStore. The stock is still cheap at under 11 times forward earnings with a 1.8% dividend yield. This valuation does not take into consideration the company’s over $150 billion in net cash either. This is a safe stock with many more years of growth ahead.

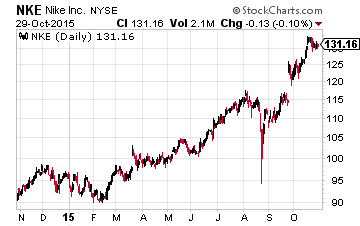

Another company benefitting from consumer demand growth in China is American marketing icon Nike (NYSE: NKE). They recently blew through top and bottom line expectations with its quarterly results powered by a 27% year-over-year sales increase from China. EBIT from the region increased 51% to $330 million during the quarter.

China along with the continued inroads with women and increases in e-commerce sales are core parts of the company’s recently announced plan to get to $50 billion in annual revenue by 2020. The company should deliver around $33 billion in revenue in 2015 in contrast. Nike continues to churn out earnings growth in the mid-teens annually on sales increases in the high single digits. The stock is never cheap and goes for around 25 times forward earnings. Long-term investors should use any dips in the overall market to build a position if they do not already have one.

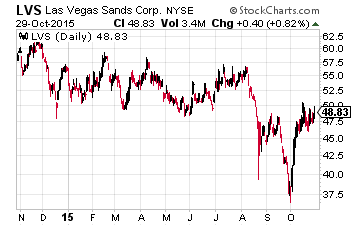

Finally, we have Las Vegas Sands (NYSE: LVS) which gets the vast majority of its revenues and profits from its operations in Macau. The region has seen a sharp slowdown in traffic this year as Chinese authorities have cracked down on corruption severely reducing the “VIP” segment traveling to Macau to gamble.

However, recent remarks from authorities around Macau indicate they realize that they may need to boost economic growth thereby loosening the recent regulations that have been placed. Also, the region’s main authority recently announced his resignation, therefore improving the environment for growth for the casino operators. The company is the least exposed to the VIP segment of the gaming market and the stock has been on the move recently.

Competitor MGM Resorts (NYSE: MGM) announced Thursday that it was going to put some of its facilities within a REIT structure which boosted its shares. Las Vegas Sands has luxury retail properties worth at least $10 billion that would be more richly valued by the market if the company chose to do the same. In addition, next year its 3,000 room Parisian Macao comes online. This will boost revenues and lower capital expenditure needs. Investors get paid to wait for fortunes in Macau to turn around via an over five percent yield. The amount of Chinese predicted to travel outside the country annually is predicted to double by 2020 to some 200 million. This development can only help the company’s operations in Macau over the long run.

Disclosure: more

Investing in China is a risky business. We saw that recently with the huge drop in Chinese stocks not too long ago. Having said that, there's a difference between Chinese stocks and stocks that invest in China. I believe there is a China effect that might cause volatility in the short term but stocks have a habit of bouncing back. I would agree with you therefore that the safest way to go is buying in the dips. Apple for example has a strange habit of sometimes dipping in price prior to earnings or new product Iphone) releases. That's the time to get into the stock. Nike is also a good long term choice with expected increased growth potential in the gigantic Chinese consumer market. Both are good choices, agreed. Good article!