2025 H2 Pound Outlook: Can GBP/USD Keep Rising?

Photo by Colin Watts on Unsplash

Introduction

GBP/USD saw its strongest quarterly rise in over two years in Q2 2025. The pair gained over 6.2% from March to June and is currently hovering around its highest level in almost four years as we head into the second half of 2025.

The pound's gains came amid notable USD weakness, as the US dollar traded 10% lower across the first half of the year, marking its worst H1 performance since 1973. The pound has seen a mixed performance against other major fears, falling against the euro but rising against the Japanese yen, the Aussie dollar, and the Canadian dollar.

GBP/USD Experienced substantial gains in the first half of the year, recovering from a low of 1.21 in early January to a peak above 1.37, an almost 4-year high heading into H2. While domestic challenges for the UK increase, the outlook for the US dollar remains weak, which could help the pair extend gains in the coming quarter.

UK economic outlook

- Inflation & wage growth

UK inflation was 3.4% YoY in May, which is still 1.4% above the Bank of England's 2% target level. CPI is expected to peak at 3.5% in Q3 before easing lower. Service sector inflation cooled by more than expected in May, easing to 4.7% down from 5.4% in April. The BoE closely monitors service sector inflation as a key indicator of domestic economic conditions and has highlighted sticky service sector inflation as an obstacle to cutting rates more aggressively. While service sector inflation cooled, the BoE will want to see this cooling continue to a level more in line with inflation at 2%.

The labour market is starting to show some signs of weakness. The unemployment rate has ticked higher to 4.6% its highest level in almost four years, whilst the number of workers on company payrolls fell by 109,000 in May, the most significant monthly decline since the COVID pandemic. BoE Governor Andrew Bailey acknowledged signs of a slowdown in the labour market. More UK businesses are responding to the government’s increase in National Insurance contributions by cutting hiring working hours and pay, according to BoE governor Bailey. This, he added, could help slow inflation.

Furthermore, many businesses are on alert for more tax increases in the autumn budget, given the perilous state of public finances. This could further slow the labour market.

- Growth

The UK economy grew 0.7% QoQ in Q1, marking the strongest growth since Q1 2024 and was the fastest-growing G7 economy. A combination of buyers rushing to beat a deadline on property purchases and manufacturers speeding up output ahead of U.S. President Trump's higher import tariffs drove the solid expansion.

However, this is not expected to be maintained across the rest of 2025. The Bank of England has said it expects economic growth of 0.25% in the second quarter of this year. Given the weakness that is starting to appear in the labour market, consumption could also take a hit as real disposable income is likely to be squeezed over the coming quarter. Any Bank of England interest rate reductions could help support household expenditure.

A meaningful threat to growth from trade tariffs has receded amid deals with the US and India, which could help marginally boost GDP.

- More tax hikes?

Attention will be on Rachel Reeves' autumn budget in the final quarter of the year, where she could raise taxes by up to £10 billion, according to Deutsche Bank. With an increase in defence spending and plans to ease the cuts on winter fuel payments, the chancellor's fiscal headroom has evaporated, and she could be forced to make another round of tax hikes on companies. This, combined with the high unemployment, highlights the struggles the UK economy could face in the latter part of H2.

BoE rate cut expectations.

The Bank of England has cut interest rates twice in 2025 and a total of five times since starting its monetary easing cycle in August last year. The central bank reduced rates by 25 basis points in March and June, taking the benchmark rate to its current level of 4.25%.

The central bank still considers a two-way risk to inflation and sees the need for a gradual, careful approach to rate cuts. We expect the Bank of England to cut rates twice more this year, in August and again in November. This aligns with market expectations. There is a potential for a third cut this year in December.

US economic outlook

The US dollar index has fallen over 10% since the start of this year, dropping from a high of 110.18 in January to a multi-year low of 97 in June. The double-digit decline marks the largest first-half loss since 1973, when Richard Nixon was President.

The US dollar has fallen sharply under President Trump's watch, weighed down by uncertainty surrounding his erratic policies on trade tariffs, Trump’s tax cuts and spending bill, and his push for Federal Reserve rate cuts.

Heading into the second half of the year, the USD trades at a multi-year low. While the sell-USD trade appears overstretched in the near term, USD weakness is likely to persist over the remainder of the year. Trump has been vocal in his disapproval of Powell and is reportedly looking to nominate Powell’s replacement some 6 months early. While Trump can't replace Powell early, the nomination of a more dovish Fed Chair could quickly see the market re-price Fed rate cut expectations, keeping the USD weak.

Federal Reserve rate cut path

Federal Reserve Chair Powell adopted a more dovish tone in his semi-annual testimony before Congress. This, combined with some signs of softer economic data, raised the likelihood that the Federal Reserve could cut rates in September. The final release of Q1 GDP basically showed a contraction of 0.5% quarter on quarter; meanwhile, consumer sentiment also tumbled in each one, and signs of weakness seeped into the labour market.

Markets are pricing in 25 basis-point rate cuts in the second half of the year, with the markets implying an 80% chance of a September cut and a 58% probability of another in October. We consider September and December as the likely months, given the year-end rate is expected to be between 3.75% and 4%.

Conclusion

As we enter the second half of 2025, the GBP/USD pair looks set to maintain its upward momentum, supported by persistent USD weakness and a relatively resilient UK economic outlook. While the UK faces domestic challenges—including elevated inflation, a softening labour market, and the potential for further tax hikes—the pound has benefited from a broader loss of confidence in the US dollar. With the Federal Reserve expected to cut rates further and trade tariff uncertainty in the US weighing on sentiment, the dollar may remain under pressure.

Meanwhile, although UK growth is expected to slow, the Bank of England’s cautious pace of rate cuts could lend support to the pound. Overall, while volatility is likely, the balance of risks suggests that the GBP/USD has further upside potential in the months ahead.

The more bearish scenario for GBP/EUR would be if the BoE were to ramp up the rate cuts to three, while the Federal Reserve cuts the rate just once. This scenario would pull GBP/USD lower towards 1.3450.

Meanwhile, if trade tariffs fail to have a meaningful impact on US inflation and the Fed cuts rates more aggressively, this could send GBP/USD towards 1.40.

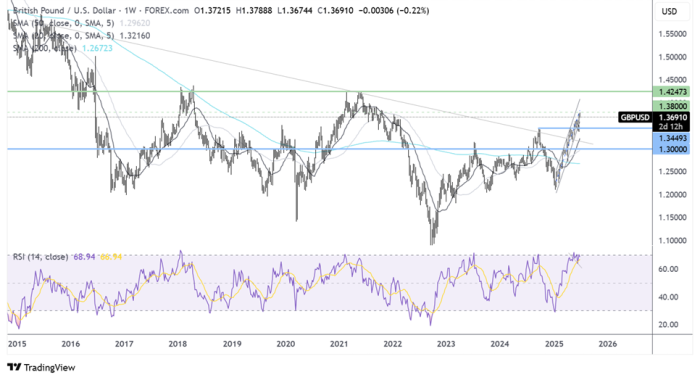

GBP/USD outlook - technical analysis (weekly chart)

GBP/USD has recovered from the 1.21 low in 2025, rising above the 200 SMA and the falling trendline dating back to 2015, reaching a high of 1.3770. The RSI is tipping into overbought territory, so a period of consolidation or a pullback may occur in the near term.

Buyers will look to extend gains towards 1.4250, the 2021 high.

Support can be seen at 1.3450 and 1.3150, which are the falling trendline and the 20 SMA.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, USD/JPY Forecast - Tuesday, July 1Two Trades To Watch: GBP/USD, DAX Forecast - Thursday, June 26

Two Trades To Watch: GBP/USD, USD/JPY Forecast - Wednesday, June 25

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more