GDPplus Big Positive Revisions Decrease Likelihood A Recession Happened

I am a big fan of GDPplus as a recession indicator. But it’s subject to revisions. The revisions today were major and to the upside.

GDPplus data from the Philadelphia Fed, chart by Mish

The Philadelphia Fed GDPplus It’s a blend, but not an average, of Gross Domestic Product (GDP) and Gross Domestic Income (GDI).

Improving GDP Measurement: A Measurement-Error Perspective

Please consider a 2013 working paper on GDPplus, Improving GDP Measurement: A Measurement-Error Perspective

Aggregate real output is surely the most fundamental and important concept in macroeconomic theory. Surprisingly, however, significant uncertainty still surrounds its measurement. In the U.S., in particular, two often-divergent GDP estimates exist, a widely-used expenditure-side version, GDPE [widely called GDP], and a much less widely-used income-side version, GDPI [GDI].

Nalewaik (2010) and Fixler and Nalewaik (2009) make clear that, at the very least, GDPI deserves serious attention and may even have properties in certain respects superior to those of GDPE. That is, if forced to choose between GDPE and GDPI , a surprisingly strong case exists for GDPI. But of course one is not forced to choose between GDPE and GDPI, and a GDP estimate based on both GDPE and GDPI may be superior to either one alone.

The rest of the paper is for Geeks only. The important points are as follows.

A strong case can be made for accepting GDI as a better measure of GDP but a blend, not an average, would be even better.

I put that theory to test by looking at every recession since 1960, 9 cases in all as shown by the lead chart.

GDPplus Recession Signals

In 100 percent of the cases, with no false signals, no misses, and no lead times more than two quarters, every time GDPplus had two consecutive quarters of negative growth, the economy was in recession.

And with a single exception of a negative 0.1 print in 2012, every time GDPplus was negative for even one quarter, the economy was in recession or headed there within two quarters.

I see today that the -0.1 percent in 2012 was revised lower to -0.5 percent. The BEA made huge revisions today dating back years.

GDPplus Chart from Second Revision (Previous Release)

The GDPplus numbers for 2022 Q4, 2023 Q1, and 2023 Q2 went from -1.2%, -0.7%, and +0.6% to -0.6%, +0.6%, and +1.1% respectively.

Don’t lay this on the Philadelphia Fed, this is entirely due to BEA revisions.

GDPplus vs recession Since 2007

GDPplus data from the Philadelphia Fed, chart by Mish

In addition to providing a better signal (note the 2008 and 2020 arrows), GDPplus is a much smoother chart month to month.

Many people believe Covid caused the 2022 recession. GDPplus shows that a recession was baked in the cake anyway. Covid certainly made things much worse.

Question of the Day

Q: So, was there a recession in 2022 or not?

A: I will tell you the answer if you tell me what the revisions look like in a few months.

GDPplus is a very reliable indictor once the BEA revisions are in place.

The Fed Is Making Decisions on Poor, Untimely Data, Frequently Revised

On September 1, I commented Jobs Rise by 187,000 But 110,000 Negative Revisions and Unemployment Soars by 514,000

Accounting for negative revisions, jobs effectively increased by 77,000 while unemployment surges as people looking for work can’t find it. Bloomberg labeled this “Goldilocks”.

Full time employment is down by 150,000 since January of 2023.

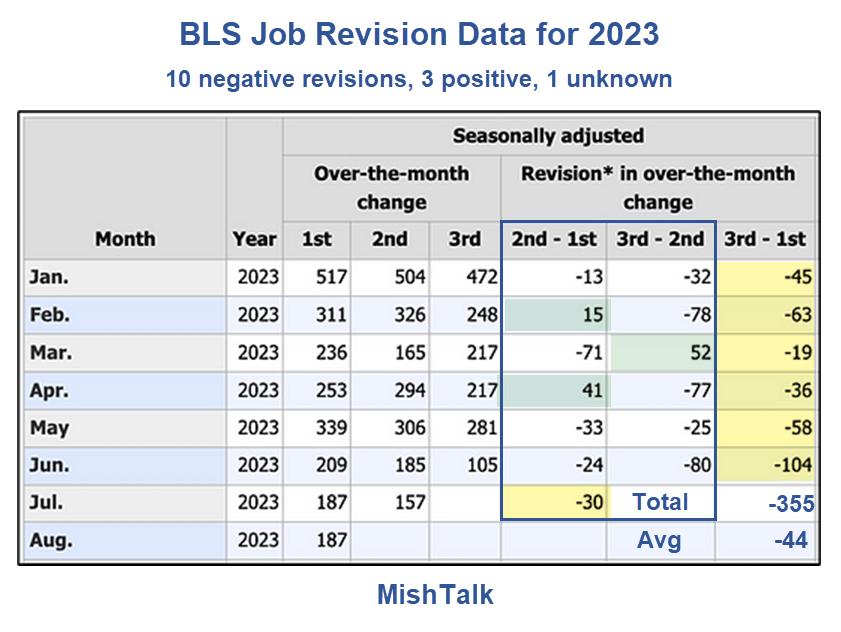

BLS Job Revision Data

Meanwhile, please note The Fed Is Making Decisions on Poor, Untimely Data, Frequently Revised

As you can see, the third revisions are negative for all of 2023. And worse yet, the Fed is clueless about what inflation really is.

More By This Author:

BEA Revises Spending Lower, Income Higher, With GDP Unchanged For 2023 Q2Oil Price Tops Highest Level Since Summer Of 2022, What About The SPR?

UAW Strike Has The Big 3 Automakers Scrambling For Parts

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more