Game On - Online Esports And The NFT Economy Are Flourishing

TM Editors Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due diligence.

With recent stay-at-home orders, online gaming and esports are booming and will soon be a billion-dollar industry. Prize pools are in the millions and can often include unique digital assets worth thousands of dollars. These digital assets need protecting beyond a simple user name and password and this is where blockchain technology - specifically, non-fungible tokens (NFTs) that utilize cryptology to help with security, transparency, and asset ownership - can play a part. This article explains what the NFT economy is and how to "play" it.

According to Chris Thompson, Director of Equity Research at eResearch.com, the research arm of munKNEE.com Goldman Sachs projects that by 2022E viewership is expected to reach ~650M and the esports industry will be valued at $3.1B, implying a four-year CAGR of 35%

What Is Esports?

Esports is competitive video game playing in all genres including strategy, shooters, fighting games, sports, and other types of real-time online multiplayer games. Esports athletes compete independently or in teams at competitions live in stadiums, online, and streamed through TV, OTT, or mobile. Indeed, esports is not too different from traditional sports, as both are a form of entertainment that involves competing and watching others play games. Last July, for example, teenager Kyle Giersdorf won US$3.0M at the Fortnite World Cup in New York City.

What Are NFTs?

NFTs stands for Non-Fungible Tokens and are in-game digital assets that, when awarded or rewarded to a player, give the user, not the game developer, full ownership of the assets. (For the video gaming and esports neophytes, in-game rewards have been around since the birth of video games, and go back to the “free game” and other rewards in arcade games.)

NFTs were developed to create verifiable and provable digital ownership for unique digital items including artwork or in-game items, such as a magical sword or an avatar with their authenticity backed by blockchain technology, in this case, Ethereum.

What Is a Fungible Asset vs. a Non-Fungible Asset?

A fungible asset is an item that can be replaced or interchanged by an identical item. A dollar coin is a great example of a fungible asset - it can be exchanged with any other dollar coin of the same currency. Similarly, a bitcoin is also fungible and can be exchanged for any other bitcoin. NFTs, however, are a type of cryptographic tokens that are not fungible (i.e. are unique) and, as such, not mutually interchangeable.

(Click on image to enlarge)

Source: Medium.com

CryptoKitties – One of the First Viral NFTs

In 2017, NFTs erupted with the release of CryptoKitties, which allowed players to buy, collect, breed, and sell virtual cats using NFTs on the Ethereum network. Each virtual cat was a unique digital asset with its own digital genome that is stored in a smart contract. After one month of operations, CryptoKitties registered almost 200,000 users with 10 virtual cats selling for over $100,000.

Current Uses for NFTs

NFTs, representing a variety of assets, can be found on a large number of popular sites such as KnownOrigin, MakersPlace, and SuperRare for digital art; Mintbase and ROCKI for digital music; Gods Unchained and SoRare for digital trading cards; Axie Infinity and World of Ether for gaming assets and Cryptovoxels and Decentraland for virtual real estate.

NFTs With A Twist

This article was prompted by the announcement on January 11th of the plans by Fandom Sports Media Corp. (CSE: FDM; OTC: FDMSF; FSE: TQ43), an esports entertainment company that aggregates, curates, and produces unique fan-focused content for esports fans, to introduce unique digital assets (i.e. non-fungible tokens or NFTs) to reward fans playing on its platform. This is a first in the industry and Fandom expects it should cause users to spend more time on their platform (and possibly purchase more in-app offerings) to increase their chances of earning such tokens and that this increased activity could result in millions of dollars in additional revenue for Fandom.

While such increased activity on Fandom's platform should be a positive for its bottom line the benefits to the participants on the platform could be profitable too. Since each Fandom NFT will be unique, it will become a collectible - a crypto-collectible - and, since the user owns the asset, it will be able to be traded or sold, inside and outside of the Fandom platform, without permission from the game developer. An NFT can be sold or traded on websites such as OpenSea, VE-VE, and WAX, which have emerged as trading platforms for NFTs.

This article mentions the innovative approach Fandom Sports Media is taking to spur its growth, market share, and profitability in the sector but it has plenty of competition (go here for an extensive list - with links - of such companies). Please note, however, that many stocks on the list trade for less than $1/share (i.e. are penny stocks) and, as such, are susceptible to manipulation by unscrupulous speculators. Therefore, before you decide to invest in the sector, please do your own due diligence.

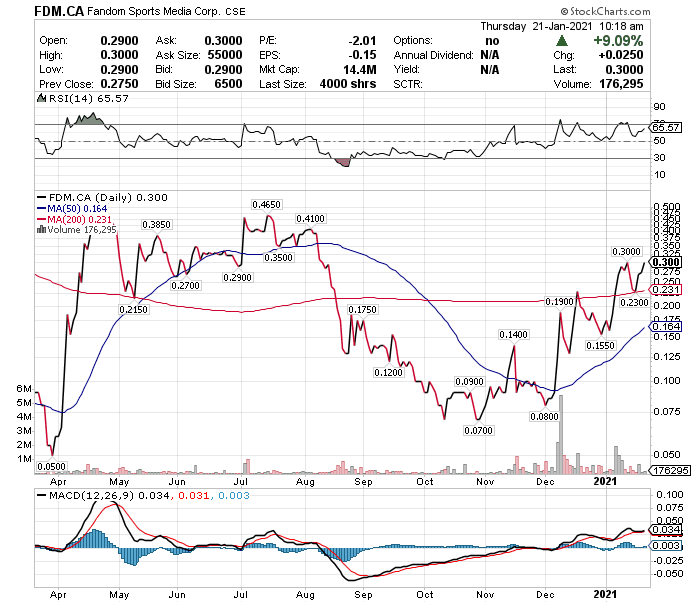

Chart of Fandom's Stock Performance (from the CSE In Canadian Dollars. Go here to convert to another currency.)

(Click on image to enlarge)

Final Thoughts

Like Fandom, most top companies in the space have recorded heightened player engagement amid social-distancing initiatives spurred by the coronavirus pandemic. This global demand for esports content is expected to continue to rise long after the world returns to a more normal state so now might be a good time to look at ways to invest in it.

Disclosure: I was not compensated for writing the above article. It was written as exclusive content for TalkMarkets to keep its readers informed as to the latest developments in the ...

more

Good article. It may have taken a pandemic to make all this go mainstream, but the time is now.