For ETF Providers, There Are Worse Things Than A Selloff

Summary

- It would be silly to say that ETF providers spend their days hoping for a drawdown.

- And yet, in a world where passive investing reigns, there are worse things than selloffs if you're on the "right" side of the epochal active-to-passive shift.

- When the next rout comes, you can be sure the dip-buying will be concentrated in ETFs and passive vehicles.

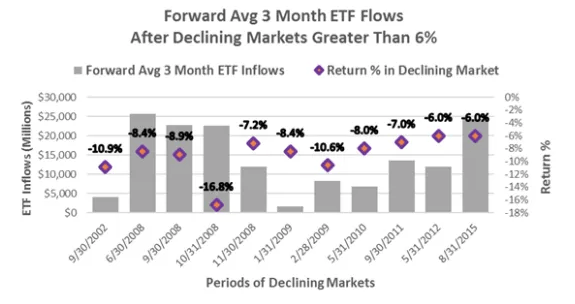

“When S&P 500 returns were worse than -6%, we calculated the average of the following three months ETF flows,” Toroso wrote, back in early 2018 when things were starting to crack following the post-tax-cut melt-up that preceded 'Vol-pocalypse.'

“Negative returns have actually been beneficial for ETF flows!,” they went on to exclaim.

Little wonder. If someone asked you to name two trends or themes that have played an important role in shaping the post-crisis investment landscape, among the first to pop into your brain would likely be the active-to-passive shift and investors’ propensity to buy the dip.

(Toroso)

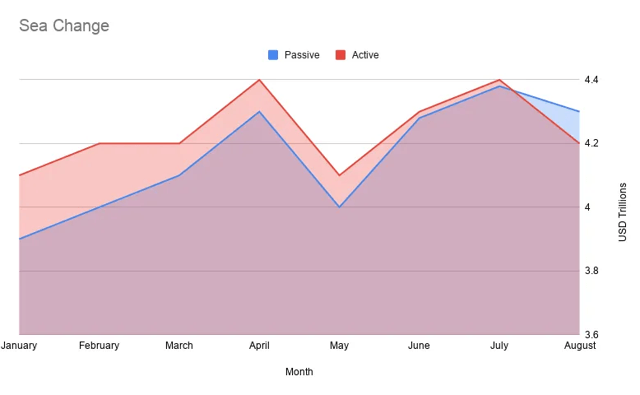

In August, assets in US equity index funds passed those held in active funds for the first time, marking the culmination of an epochal shift years in the making.

(Heisenberg)

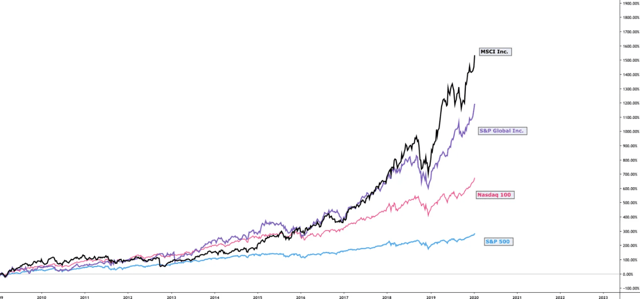

That helps explain why the stocks of the companies which created the indexes tracked by passive vehicles have performed so well. Have a look at the relative performance of S&P Global (SPGI) and MSCI (MSCI):

(Heisenberg)

This is pretty simple, really. The more popular indexing gets, the more money allocated to index funds. And the more money pegged to the indexes, the more revenue for their namesakes.

When you combine the two themes mentioned above (the popularity of passive investing and dip-buying) you’re left to ponder whether a significant drawdown for equities might actually be a wholly positive development for ETF providers.

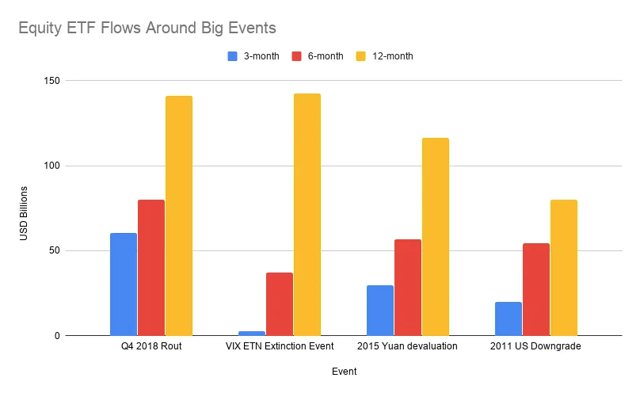

In keeping with the Toroso study cited here at the outset, it won’t surprise you to learn that ETF flows have been strong in and around some of the more harrowing episodes for markets in the post-crisis period. Have a look:

(Adapted from BBG data, as originally presented by Vildana Hajric here)

The overarching message: Pullbacks are good for business if you’re an ETF provider.

They’re not so great for active mutual funds, though.

Continue reading on Seeking Alpha.

Disclosure: None.