Fire Your Investment Manager And Get Uncorrelated To Everything

Getting uncorrelated to stocks and to bonds is hard. It may intuitively seem to be about return generation, but in practice, it is about hedging. Everything else being equal, multiple forms of effective downside protection are key to getting uncorrelated.

Here are the refined strategy's rules:

1. Buy ZIV (NASDAQ:ZIV) with 10% of the dollar value of the portfolio.

2. Buy SPLV (NYSEARCA:SPLV) with 65% of the dollar value of the portfolio.

3. Buy TMF (NYSEARCA:TMF) with 10% of the dollar value of the portfolio.

4. BUY UUPT (NYSEARCA:UUPT) with 10% of the dollar value of the portfolio.

5. Buy VXX (NYSEARCA:VXX) with 5% of the dollar value of the portfolio.

6. Rebalance annually to maintain the 10%/65%/10%/10%/5% dollar value split between the positions.

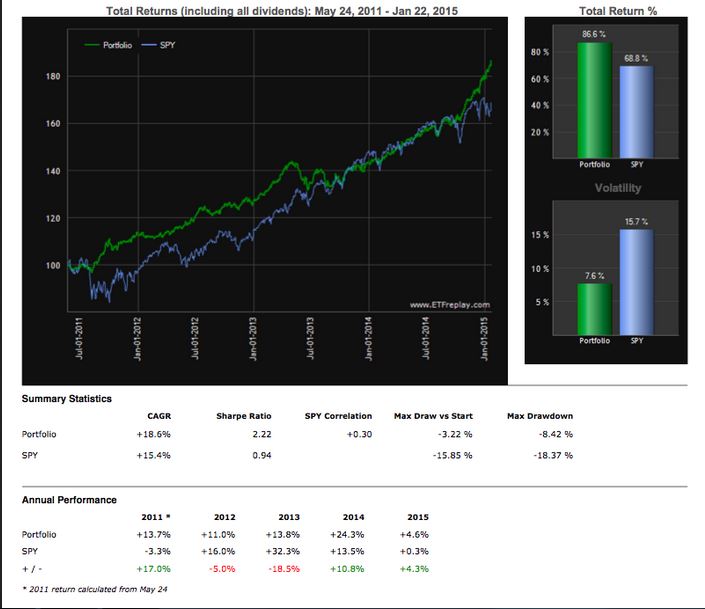

The strategy's results in a linear scale show a low 0.30 correlation to SPY (NYSEARCA:SPY).

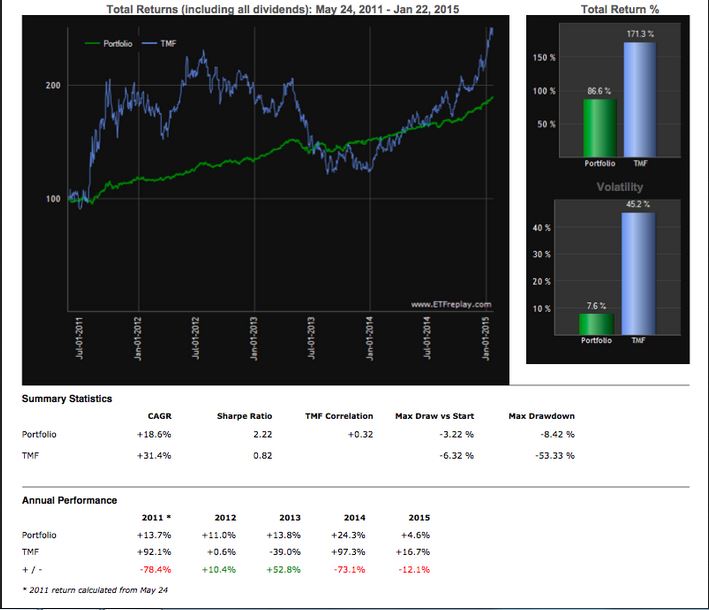

And the strategy is only 0.34 correlated to TMF :

We can understand how this strategy reduces correlations to both stocks and to bonds by breaking down the strategy into its return-generating components and its hedging components.

Synthetically selling Mid-Term Volatility and holding a low-volatility S&P 500 stocks create the return-generating components of the strategy.

Then, holding a leveraged Long Bond position and holding a Short-Term Volatility position, and holding a leveraged long Dollar position create the hedging components of the strategy. Often when the dollar rises strongly, stocks drop, so a long dollar position can be an effective component of a hedging strategy, in addition to the volatility and the bond hedge.

The strategy uses multiple markets for both return generation and hedging, smoothing returns, and increasing the strategy's robustness to shocks in both the equity and the fixed income markets.

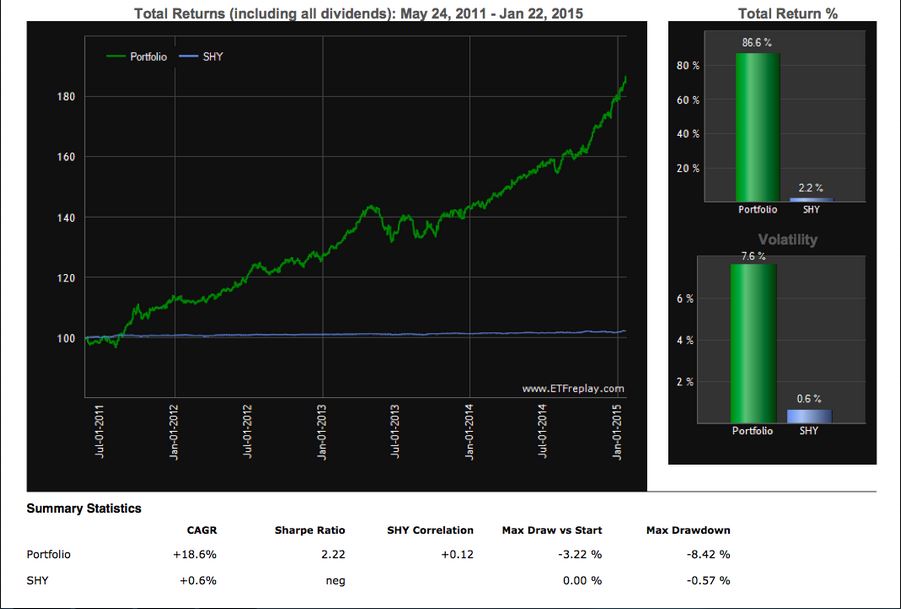

This graph of the strategy vs. low duration treasuries really highlights the high Sharpe and smoothness of the equity curve:

Not bad at all. And often, reducing correlation to broad stock and bond markets can increase correlation to another exposure. In this case, the entire strategy is 0.49 correlated to its SPLV component.

![]()

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long ...

more

it would be interesting to see a comparison of performance and fees for owning a diversified stock portfolio consisting of each of the following: 1) stocks, 2) ETFs, and 3) mutual funds vs a managed broker account. I know that in terms of fund brokerages, Vanguard has some of the least expensive managed funds to own. For example the Vanguard 500 index fund (VFINX) expense ratio is only 0.17% - around 84% lower than the average expense ratio of funds with similar holdings. The problem with the investment manager approach is that you pay them fees whether the stock goes up or down and this can seriously eat away at profits.

Sounds like an interesting approach. IMHO I think for most people who want exposure to stocks and weigh the volatility, it might just make sense to stick with an Index fund that follows the S&P like VTI (stock index) along with VBTIX (bond index). VTI is up 84% in the past ten years!! Some yrs its up 20%, some yrs its down 30%. Overall, an index fund should bring in 8% returns or more. Your idea sounds a lot like trying to time the market. Yes your portfolio had good gains of over 50%, but it also lost over 70% some yrs too. Can you tell us what the total cumulative rate of return is for the life of the portfolio YTD?

Great post.

This sounds like good advice for someone who is smart enough to be their own investment manager; I don't think I'm there yet, but I can aspire.