Fintech Startup Robinhood Announces It Will Support Cryptocurrency Trading

Best known for its sleek smartphone app and commission-free trading, Robinhood is now breaking into the cryptocurrency game. Adding to its platform that already supports publicly traded companies’ stocks and exchange-traded funds, the fintech startup will start allowing users to exchange Bitcoin (BTC) and Ethereum (ETH) come February. The app has become a popular trading option for millennials, accumulating an active user body of over 3 million.

Backed by $176 million in venture capital funding by an impressive lineup of investors that includes Google Ventures and Andreessen Horowitz, the financial services company is now valued at over $1 billion and made a big splash with its announcement to support cryptocurrencies. Bitcoin and Ethereum, are the first and second most valuable digital currencies by market cap, respectively.

Robinhood earns revenue through collecting interest on cash and securities in user accounts and margin lending.

Those who visit the “Robinhood Crypto” landing page are greeted with a neon-lit headline beaming “Don’t sleep”, referencing the cryptocurrency market’s round the clock operating cycle in contrast to traditional markets that open and close at set times.

While Robinhood co-founder Vlad Tenev said in October 2017 he didn’t expect a major transition from traditional stock to cryptocurrencies, the move makes sense for the budding company on a number of levels. From a demand standpoint, Techcrunch reported, “100,000 of Robinhood’s users were regularly searching for crypto pricing and trading in the app, and 95% of those surveyed said they’d invest in cryptos if the product supported it.”

Further, cryptocurrencies, especially Bitcoin, are currently being used more as investment vehicles than they are true currencies for payments, so adding elements of the sector into its asset trading platform is seemingly a logical fit.

Most compellingly, perhaps, is the gaping market opportunity standing before Robinhood. While it’s too soon to say for certain, the development is likely to introduce some much-needed competition amongst user-friendly cryptocurrency marketplaces. For much of the recent past, Coinbase has singlehandedly dominated the entryway into retail cryptocurrency investing. The San-Francisco based unicorn has served more than 13 million customers and done $50 billion in digital currency exchanged.

(Click on image to enlarge)

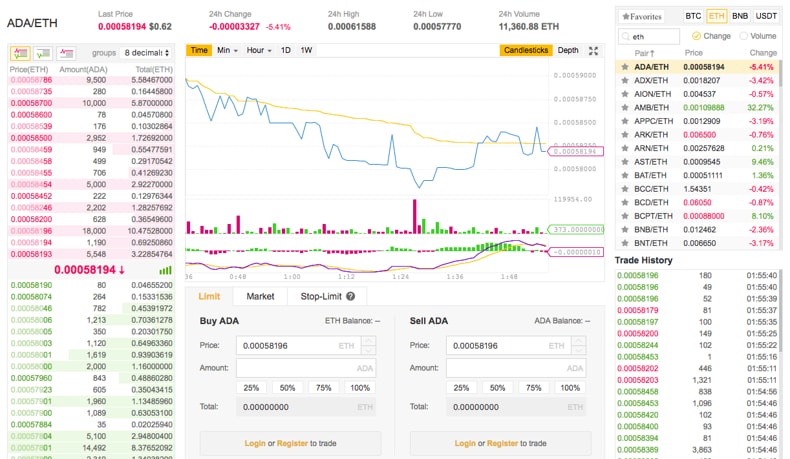

Even though hundreds of Bitcoin exchanges and even ATMs exist, what has allowed Coinbase to stand out from the rest is its platform’s clean finish and user-friendly emphasis, a far cry from the much more intricate looking industry standard. Coinbase’s simplistic approach affords casual investors and cryptocurrency speculators more confidence in making purchases, a higher likelihood of consumer satisfaction, and less need for customer support.

(Click on image to enlarge)

But the standout features that have enabled Coinbase to essentially monopolize mainstream retail cryptocurrency investing, especially in the US, are arguably equally as existent on Robinhood’s platform. In addition to similar graphical display, the two companies have comparable user-end functionality to draw the parallel one step further. And where Robinhood seemingly has the edge is that users won’t have to pay any commission when buying and selling, whereas Coinbase charges users in the US 1.5%-4% in fees per transaction.

Robinhood will be outsourcing its cryptocurrency operations to other large institutions and act as a broker on behalf of its users. It is therefore presumable, yet unconfirmed that prices may be slightly hiked to factor in the cost of Robinhood’s extension to these partners.

This development will likely benefit retail investors more than anyone else, as competition in the space will likely bring about a number of potential user-end benefits. For example, direct competition to Coinbase’s user body that craves the simple interface could result in the company lowering fees, adding more digital assets not offered on Robinhood, offering better customer support, or other increased user-end perks to retain its consumers.

Coinbase currently offers Bitcoin Cash (BCH) and Litecoin (LTC) in addition to Bitcoin and Ethereum.

At least initially, only users based in California, Massachusetts, Missouri, Montana, and New Hampshire will have access to the cryptocurrency component of the app. Robinhood’s website says more states are expected to be added in the near future.

In addition to Bitcoin and Ethereum, the app will allow users to track a number of other cryptocurrencies, including Ripple, Monero, NEO, Stellar, Bitcoin Cash, and Bitcoin Gold. In the coming months, these altcoins may become available for trading as well. At the time of this writing, nearly 400,000 people had signed up to receive early access to the crypto-enabled app.

The sector saw its market cap drop below $415 billion on January 17 but has rebounded 28% to $530 billion since.

Disclaimer: The ideas expressed in this writing are my own personal opinions and should not be taken as financial advice in any regard. Individuals or institutions seeking to invest in the any of the ...

more

Do you think #Robinhood was right to suspend trading on $GME?

I heard about this. Im also amazed that trades will be free for cryptocurrencies.

Aren't they the same price if you don't use cryptocurrencies?

I am very interested to see if #robinhood actually makes any money. Also it seems a little late to the crypto party which seems to be on the way out, with crypto prices stuck in a slump.

Why would you say #Robinhood is late to the #crypto party? Aren't they the first in their space to accept #digitalcurrency? Besides, while I personally haven't jumped on the #crtocurrency bandwagon (lead by #bitcoin), it seems to me that it has only recenlty started to go mainstream, but still has a while to go. I think it is far from the end of it's lifecycle.

Crypto currencies only attracted so much attention from speculators because of spectacular short term gains. As the bubble bursts, interest in crypto will decline. Does not mean the class is going away but it will by no means be as lucrative as it was just a couple a months ago.

I am not a #bitcoin or #crypto fanatic by any means and often recommend caution. By why are you so convined a bubble burst is imminent? I do believe one is inevitable, but do not expect one now.

Yes, so many people are just starting to learn about digital currencies. Many more have yet to but will in the near future. I expect it will go up further before it goes down. But I don't think it will every come crashing down completely.

Very solid points raised throughout this thread on both ends. Both those optimistic as well as pessimistic would be remiss not take take the time in these market conditions to study Bitcoin's historical price data. Volatility has been seemingly native to the digital currency over time, which has gone through more ups and downs over the years since it was launched circa 2010 than many realize. At this very moment, there are convincing arguments in favor of both trajectories for the crypto market (i.e. "this is only the beginning for cryptocurrencies," "the government-backed financial system is still flawed", "the markets have seen these dips and recovered strongly in the past," etc. VS "we are currently witnessing the bubble popping - just look at the prices," "cryptocurrencies have no real value," "they are impossible to regulate," etc,).

What seems clear, however, is that more players, like Robinhood named here, are still seizing the opportunity to break int the game. It will undoubtedly bring more competition to the table, but only time will tell where it goes from there.

#Bitcoin has been on an overall downward trend as of late.

Just like everything else.

Its not imminent its already happening. Have you guys looked at a chart of bitcoin or any other crypto recently? They are in serious down trends. And I know everyone is going to say crypto does this routinely but this time is different. This time its more prolonged while previous times any sell off ended within a day.

Michael, you wrote: "Have you guys looked at a chart of bitcoin or any other crypto recently?"

@[Adam Sharp](user:15144) addressed this exact point in his article here: www.talkmarkets.com/.../heres-why-crypto-is-correcting--and-why-its-temporary

I recommend you read it as he makes some good points. In particular, bitcoin is currently priced at close to $10k. Yet a year ago, it was selling for under $1k. "...despite the recent pullback, bitcoin is still up around 9X to 10X over the last 12 months."

Thats completely true, but #bitcoin is well below 10k now (according to investing.com it is currently below 7k). Also it doesnt look like the meltdown is going to let up, in fact the down trend has accelerated. If that doesnt sound like a bubble popping I dont know what is.

That's a bigger drop than I realized @[Michael Molman](user:50272), but still more than a 7x increase over last year. I'm sure you and I both wish we had bought up some #bitcoins back then.

It's a good point you raise. Robinhood actually openly said it doesn't plan to profit much directly from crypto trading per se, rather the value stems from offering more to its user body. The Techcrunch article I referenced in the article explains this nicely below:

"'We’re planning to operate this business on a break-even basis and we don’t plan to profit from it for the foreseeable future' says Robinhood co-founder Vlad Tenev. “The value of Robinhood Crypto is in growing our customer base and better serving our existing customers.'

By essentially using crypto trading as a loss leader instead of its primary business like Coinbase and other apps, Robinhood could substantially expand beyond the 3 million users it already has. Simplifying trading and tracking could bolster Bitcoin and Ethereum. And by combining it with traditional stock, ETF, and option trading in a single app, Robinhood could further legitimize the cryptocurrency craze. The two trading worlds could cross-pollinate, dragging even more people into the crypto scene."

However, I would argue that Robinhood is by no means late to the game, and that crypto is still in its infancy stage. The next couple years will be when much of the speculation and development up until now gets tested and potentially adopted. The current price slump, similar to recent all-time-highs are mainly just tethered to news stories and the press.

Yes Nathan, I agree and said something similar above.

Do you currently use Robinhood? If not, are you planning to get the app?

I've heard of Robinhood but do not use the app and had no plans to do so. Their decision to accept bitcoin as a method of payment does not do anything for me. Though I can understand why it might influence others.

At the very least, I agree that the move helped put the company on the radar for many investors who likely had never heard of them previously.

Yes, I believe it's obvious that #Robinhood did not do this for their bottomline. Rather it is a way for them to differentiate themselves from their more traditional competitors.

It is very clearly a branding and positioning move. A statement of "we are cutting edge and thinking of the future while our competitors are stuck in the past." And it gets them from free publicitiy to boot.

I think that strategty was a smart one as it won't really cost them much to accept the currency, but looks good for it nonetheless.

Very well said.

BTW, there's another good discussion about this here:

www.talkmarkets.com/.../heres-why-crypto-is-correcting--and-why-its-temporary