What Does Bitcoin's Historical December Performance Tell Us About Its Potential Year-End Price?

Cryptocurrencies have had a bullish run this year, although there is no denying the fact that trading has been extremely volatile. Bitcoin (BITCOMP), the biggest of the cryptos in terms of market-cap, is no exception to this see-sawing trend.

A Roller-Coaster Year

Bitcoin broke out of a consolidation phase in Nov. 2020 and launched into a strong rally through most of 2021, interspersed by occasional corrections. After ending 2020 at $29,001.72, Bitcoin topped the $61,000 barrier in mid-March but pulled back amid profit taking. A period of consolidation followed before the crypto picked up momentum and rallied to a high of $64,863.10 on April 14.

From the peak, Bitcoin reversed course and plunged to a low of $29,360.96 on July 20, a peak-to-trough decline of about 55%, thus pushing the crypto into bear market territory. A mini rally followed the late July bottom, but it did not have enough strength to push Bitcoin past the previous peak.

In late October, the crypto took off yet again after hitting a double bottom and rallied to fresh highs. This time around, the optimism was fueled by the launch of the first Bitcoin-linked ETF – ProShares Trust – ProShares Bitcoin Strategy ETF BITO. Since hitting a record intraday high of $68,789.63 on Nov.10, Bitcoin has been recently pausing for a breather.

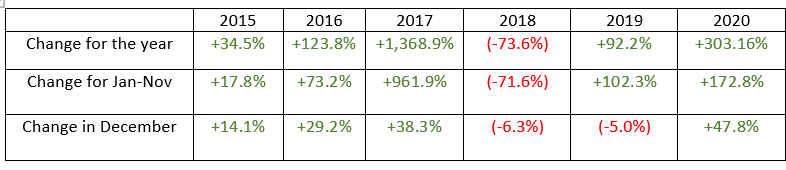

How Bitcoin has Fared Historically in December

Looking at Bitcoin's December price action since 2015, the digital currency has advanced in all the years, except for 2018 and 2019. Bitcoin went through a bearish phase in 2018, when it crashed from $19,783.21 at the end of 2017 to $3,742.7 at the end of 2018.

As the crypto rebounded in 2019, the run-up was largely confined to the first-half of the year, leaving it in red in December.

Thus far, in 2021, Bitcoin has advanced about 106%. If 2021 pans out to be a year similar to 2016, 2017, or 2020, when Bitcoin came into December with massive gains, a moderate run up could materialize in the final month of the year, adding on to the year's gain.

A scenario like 2018 is unlikely to materialize, given the crypto has run up significantly year-to-date, and it would take a pullback of over 100% to take it into negative terrain. A repeat of the trend seen in 2019 could not be ruled out. Even if Bitcoin corrects further, it could still end the year with decent gains.

What Experts Say

Bitcoin is set to peak at $80,021 in 2021 before ending the year at $71,415, according to a panel of 50 fintech specialists polled by price comparison website Finder.com. If the prediction is accurate, Bitcoin will end the year with a gain of about 146%.

Quant analyst PlanB on Nov. 14 reaffirmed his prediction for Bitcoin hitting $98,000 by the end of November and $135,000 by the year-end.

U.S. investment bank JPMorgan is turning increasingly positive on Bitcoin. The crypto could rally to $146,000 in the long-term, contingent on volatility subsiding and institutions gravitating toward it and preferring it over gold in their portfolios, Business Insider said, citing an analyst at the firm. The market is gradually warming to the idea that Bitcoin could evolve as a hedge against inflation.

The actual year-end trajectory, however, depends on a lot of other variables, including China's stance on mining, mainstream adoption, and volatility engendered by the trading of whales. At last check, Bitcoin was seen up at around $59,385.94.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.