US Bank Loan Volumes Dwindled Last Week Despite Sizable Deposit Inflows

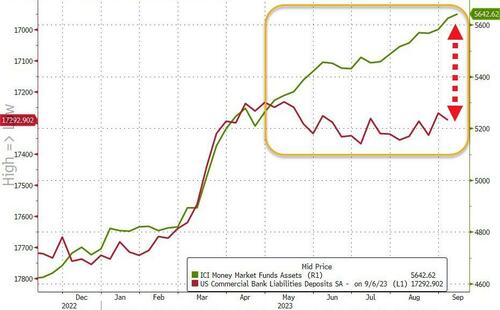

A big jump in inflows last week to Money-Market funds (and increased us of The Fed's emergency funding facility) would suggest that banks suffered some deposit outflows. But as we have seen numerous times recently, the 'adjustment' by The Fed is all that matters.

On a seasonally-adjusted (SA) basis, total bank deposits rose by $23BN (only around a third of the $70BN loss the prior week)...

Source: Bloomberg

Non-seasonally-adjusted (NSA) deposits also rose by $51BN (up for the 2nd week in a row)...

Source: Bloomberg

All of which leaves the gap between bank deposits and money-market funds gaping as wide as ever...

Source: Bloomberg

Large Banks saw $20.4BN (SA) deposit inflows last week and Small Banks $14.4BN (SA) inflows, while Foreign Banks suffered $11.6BN of outflows...

Source: Bloomberg

For once, Domestic US banks saw deposit inflows last week (both SA and NSA)

Source: Bloomberg

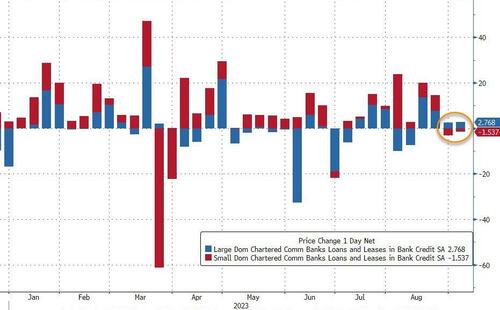

On the other side of the ledger, we saw a very small net increase in lending (for the second week) with Large banks loan volumes rising $2.7BN while Small Banks saw loan volumes decline $1.5BN...

Source: Bloomberg

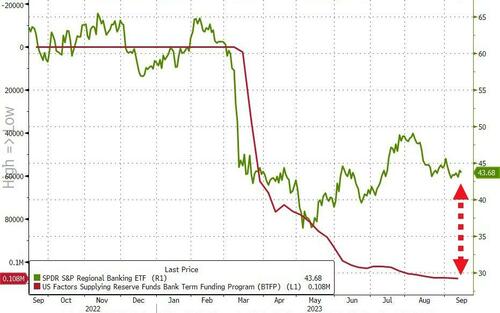

Finally, we note that Small Banks are leaking back towards their 'reserve constraint'...

Source: Bloomberg

And it gets worse as within 6 months and counting, America's 'smaller' banks will need to find that $108-billion plus from somewhere as that is when the BTFP bailout program ends (theoretically).

So we got a slight problem here folks pic.twitter.com/LvoZs4XnSF

— zerohedge (@zerohedge) September 10, 2023

Maybe it's time for Regional bank stocks to start reverting to reality?

The last best hope for their balance sheets is a recession - that crushes bond yields (and pumps their TSY-stuffed balance sheets back up). Be careful what you wish for.

More By This Author:

Japanese Panic Buy Gold As Yen Implodes And Inflation SoarsInitial Jobless Claims Plunge Near 12-Month Lows (Thanks To Ohio's Fraud Fix)

ECB "Surprises" With Tenth Consecutive Hike To A Record 4.00%

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more