New Stock Buy: SEI Investments

SEI Investments (SEIC) is a leading global provider of technology-driven investment processing, investment management and investment operations solutions that help corporations, financial institutions, financial advisors and ultra-high net worth families create and manage wealth. As of March 31, 2020, SEI Investments managed, advised or administered $920.2 billion in hedge, private equity, mutual fund and pooled or separately managed assets, including $283.4 billion in assets under management and $632.3 billion in client assets under administration.

LEADING INNOVATOR

While working toward a PhD at the Wharton School, Alfred West developed the first computer-based commercial credit simulator to train bank loan officers. Enthusiastic adoption of the innovative product by bankers led West to forgo his educational pursuits in 1968 to launch Simulated Environments, Inc. By 1970, West’s simulators were used by 50 of the top 55 banks. The company soon launched an automated bank trust system, which ran over a networkof phone lines to streamline labor- intensive portfolio accounting functions.In 1972, the firm reincorporated as SEI Corporation and began automating the back offices of trust departments throughout the country using a then novel recurring revenue business model. West took SEI public in 1981 and branched out into investment advisory and money management. Today, SEI Investments delivers comprehensive investment platforms, services and infrastructure through its 3,820 employees serving more than 11,300 clients globally, including 11 of the top 20 banks and 45 of the top 100 investment managers. In 2019, SEI’s revenues topped $1.6 billion, of which ninety percent was recurring.

SEI Investments operates through five business segments: Private Banks, Investment Advisors, Institutional Investors, Investment Managers and Investments in New Businesses. In addition, SEI holds a 39% minority interest in LSV Asset Management, a value equity manager with $80 billion in assets under management. SEI’s Private Banks business provides investment-processing outsourcing services. In 2019, Private Banks contributed 28% of SEI’s revenues generating operating margins of 6%. SEI’s Investment Advisor segment offers investment management services to Registered Investment Advisors, financial planners and life insurance agents. In 2019, the Investment Advisor segment contributed 24% of SEI’s revenues with operating margins of 48%. The Institutional Investors segment provides outsourcing services for chief investment officers of retirement plans, endowments and foundations. In 2019, this segment contributed 20% of total company revenues with operating margins of 52%. SEI’s Investment Managers business provides operations outsourcing platforms to mutual funds, banks, family offices, hedge funds and private equity firms. During 2019, the Investment Manager business contributed 27% to SEI’s revenues with operating margins of 36%. SEI’s Investments in New Businesses (less than 1% of total revenues) includes IT services, business ventures on the cutting edge of fintech, private wealth management and R&D efforts to connect all of SEI platforms, a firm growth driver dubbed One SEI.

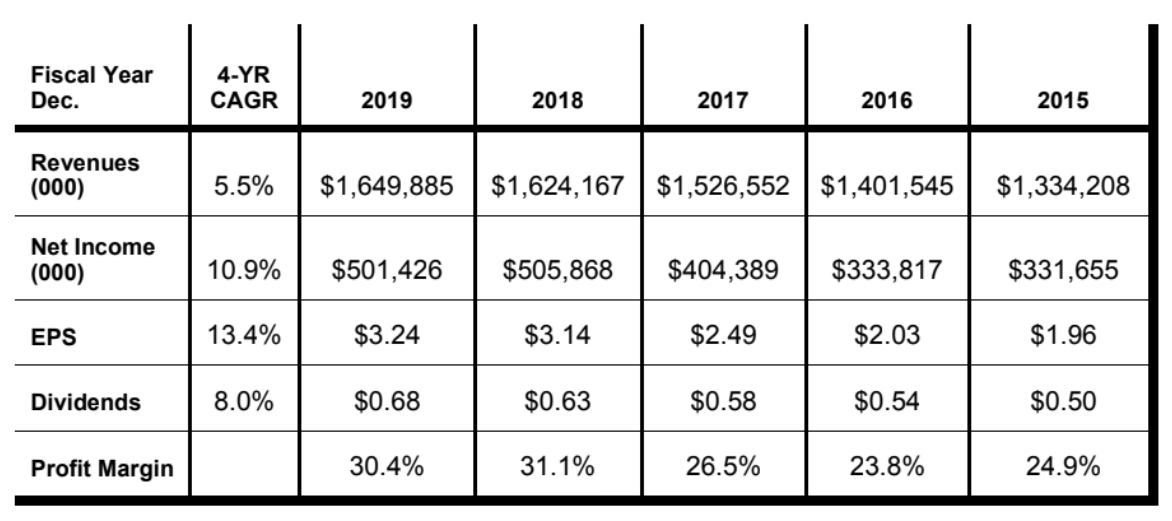

PROFITABLE GROWTH

With its business model focused on recurring revenue from assets under management and administration, SEI generates highly profitable operations. Net profit margins and return on shareholders’ equity have averaged over 27% and 28%, respectively, during the last five years. SEI is committed to long-term shareholder value creation through strong financial performance, dividends and share repurchases. SEI generates robust free cash flows, which have totaled about $2.3 billion over the last five years. SEI has paid dividends for 32 years. The dividend has increased for the past 13 years, compounding at an 8% annual rate during the last five years. SEI has also repurchased nearly $1.6 billion of its stock during the last five years.

FIRST QUARTER RESULTS

First quarter sales increased 3% to $415 million with operating income increasing 6% to $110 million and net income declining 4% to $109 million due to a loss on investments. . During the quarter, SEI returned $183 million to shareholders through dividends of $52 million and share repurchases of $131 million at an average cost of $52.37 per share. SEI ended the quarter with $747 million in cash and no long-term debt on its pristine balance sheet.

SEI Investments is a high quality company with a proven business model, profitable growth, robust free cash flows and a strong balance sheet which should position the firm well to weather the COVID-19 crisis. Investors should consider banking on SEI Investments for attractive long-term investment returns. Buy.

Certainly his is quite a success story.