Investors Feeling The Chill Of Long Crypto Winter Ahead, Akin To '1929 Stock Market Crash'

Cryptocurrencies are on a freefall and there seems to be no letup in the sell-off on Saturday. The sudden market-wide drop-off may foretell a long and tough winter for digital currencies after a fairly decent performance in 2021.

Bitcoin, Major Altcoins in Bear Market Territory

Bitcoin (BITCOMP) has lost over 20% in the year-to-date period, after ending 2021 with a fairly decent gain of nearly 60%. The sell-off started off in earnest in early November.

Bitcoin scaled to a new peak of $68,789.63 on Nov. 10, 2021 before moving southward, and the recent downtrend has taken the crypto to around $35,313.21 today. The peak-trough change is over 48%.

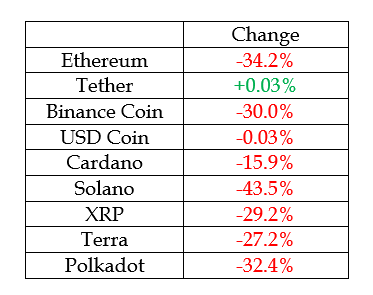

Other major altcoins such as Ethereum (ETH-X), Binance Coin (BNB-X), Cardano (ADA-X), and Solana (SOL-X) are also deep in the red. All the altcoins in the top ten cryptocurrencies in terms of market capitalization, barring stable coins such as Tether (USDT-X) and USD Coin (USDC-X), have plunged hard.

Here's how the top altcoins have performed in the year-to-date period.

Much of the weakness is attributed to the Federal Reserve's announcement that it is considering a Central Bank Digital Currency, Russia's proposed Bitcoin ban, and China's animosity toward all things crypto.

Tough Winter Ahead?

Following the crypto market crash, doomsday predictions have begun floating around. Analysts see a plunge similar to the crypto crash of 2018, when most coins fell by about 90%.

Far bleaker predictions point toward a situation similar to the 1929 stock market crash, which led to a collapse in stock prices and was among the chief reasons for the Great Depression that followed. The largest sell-off in the U.S. stock market history occurred on Oct. 24, 1929 – a day known as "Black Thursday."

Bitcoin could plunge below the $30,000 level in 2022, as the crypto bubble bursts, the Markets Insider reported, citing Paul Jackson, Invesco's global head of asset allocation. The analyst assigned a 30% probability of the apex currency breaching the level.

UBS analysts have also warned of a crypto winter – a protracted period of crypto weakness that could last for over a year, the Markets Insider report said. Fed tightening could make the cryptos lose their appeal, and Bitcoin has managed to alienate some investors due to the extreme volatility that has become the order of the day, along with its limited supply, the publication added.

At last check, Bitcoin was seen moving down to around $34,479.48.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.