Eyes Open, Investors - Crisis Can Bring Opportunity

Time to Brace for a Financial Crisis & Lots of Volatility

A financial crisis could be upon us. Don’t be shocked if, in the coming months and quarters, you see a significant increase of volatility in the financial markets, be it stocks, bonds, real estate, or commodities.

Here’s what investors need to know.

Not too long ago, a relatively small bank called SVB Financial Group (fmr Nasdaq:SIVB)—better known as Silicon Valley Bank—said it was having liquidity issues.

What happened? The technology-sector-friendly bank had invested money in bonds, and as interest rates rose, the bank’s bond portfolio crumbled in value. This caused panic, and more than $170.0 billion worth of Silicon Valley Bank’s customers’ deposits were jeopardized in a matter of hours.

Then, worries became bigger as the noise got louder that a bank run could be at play. Individuals also started to take their money out of other banks, and the stocks of small U.S. regional banks tumbled.

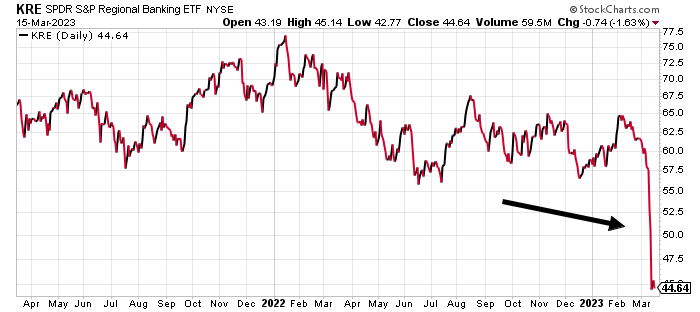

Take a look at the chart below. It plots the SPDR S&P Regional Banking ETF (NYSEArca:KRE), an exchange-traded fund that tracks U.S. regional bank stocks. It nosedived.

Chart courtesy of StockCharts.com

Thankfully, the U.S. government and the Federal Reserve jumped in to backstop withdrawals from Silicon Valley Bank by announcing a facility that would protect deposits. However, in the midst of all this, Signature Bank (fmr. Nasdaq:SBNY) also became a victim, and the U.S. government took it over.

As the debacle among U.S. regional banks was being soothed a bit, we heard the news that a reputable bank in Europe, Credit Suisse Group AG (NYSE:CS), could have liquidity problems as one of its major stakeholders refused to invest any more money in the bank.

History Lesson: How Do Financial Crises Work?

To see how a financial crisis actually works, look back at the financial crisis of 2008–2009.

It all started with the Federal Reserve raising its interest rates to cool down inflation (and the U.S. economy). At that time, the housing market was white-hot. Predatory lending and mortgage-backed securities were ripe for a fall.

Eventually, the interest rate hikes started to work: the economy slowed down, job losses mounted, and banks started to see losses on their investments. This situation affected interbank lending. Small banks started to suffer, and eventually, bigger banks also got hurt.

The financial services firm Lehman Brothers Inc.'s collapse was the crux of the 2008-2009 financial crisis. Its troubles had begun a few quarters before that. There was a snowball effect; the problems started small but eventually turned into something that threatened the survivability of the global financial system.

Where Does the Financial System Stand Now?

Cracks have started to appear in the worldwide financial system. Investors should watch the situation closely to see how it plays out. Higher interest rates have led to major losses on certain categories of investments by Silicon Valley Bank and other banks.

The Federal Reserve has been raising interest rates for some time, and we’ve been starting to see cracks in the financial system. Could the Fed pause its rate hikes soon? Or, if things get worse for the financial sector, could the Fed actually start cutting interest rates again?

What Should Investors Do If a Financial Crisis Becomes a Reality?

A financial crisis essentially happens when money isn’t where it’s needed. In the past, whenever a financial crisis has happened, investors sold almost everything in their portfolios to raise cash for various reasons, be it to fulfill margin calls or to just cut their losses.

If a full-blown financial crisis becomes a reality, it wouldn’t be shocking to see the stock market sell off a lot more than it already has. This, however, would mean that shares of great companies would go on steep discounts.

Moreover, investors could initiate a flight to safety. The U.S. dollar tends to act as a safe-haven investment. Other assets, like gold and high-quality government bonds, could also shine as investors seek safety.

More By This Author:

U.S. Housing Market Outlook For 2023: Pain For Homeowners & InvestorsCentral Banks’ Gold-Buying Skyrocketed In 2022: Gold Price Outlook Gets Brighter

2023 Stock Market Outlook: Charts Say It’s Bullish, But Fundamentals Call For A Crash

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more