Domestic US Banks See Big Deposit Outflows Last Week But Loan Volumes Picked Up

Retail money-market funds continued to see inflows last week, and usage of The Fed's emergency fund facility remains near record highs (as The Fed's balance sheet shrank dramatically - most in 3 years).

But, with regional bank stock suddenly facing up to the balance-sheet-wrecking reality of soaring bond yields (plunging bond prices), all eyes are on bank deposits (after seeing inflows the prior week).

On a seasonally adjusted basis, total deposits fell $6.6BN - basically unchanged now since March and the initial SVB-driven crash...

Source: Bloomberg

On a non-seasonally-adjusted basis, total deposits tumbled $17BN...

Source: Bloomberg

For now, the trend of inflows favoring money-market funds over bank deposits is holding...

Source: Bloomberg

Overall, domestic US banks saw outflows ($35BN SA, $40BN NSA)...

Source: Bloomberg

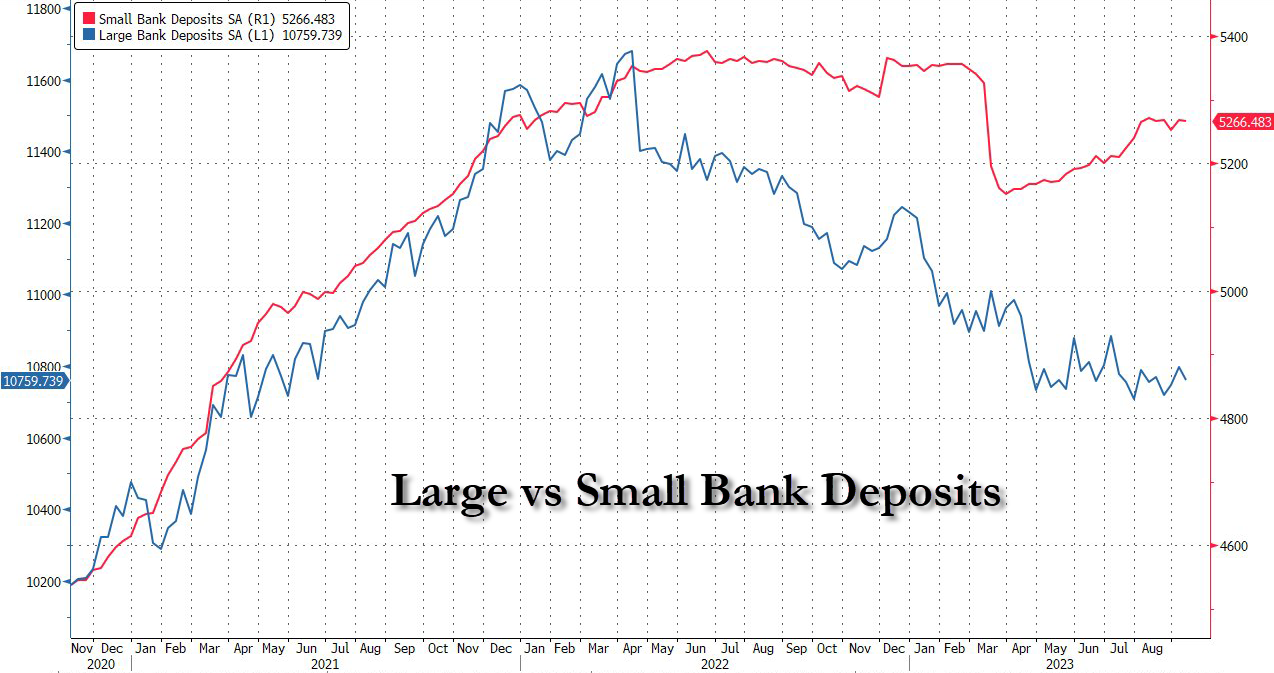

With Large Banks seeing a major $42BN (SA) outflow and Small Banks a $8BN SA outflow (as Foreign Banks gained $12BN)...

Source: Bloomberg

On the other side of the ledger, loan volumes picked up with both large ($6BN) and small ($3.5BN) seeing increases...

Source: Bloomberg

The key warning sign continues to trend lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now)...

Source: Bloomberg

We suspect the lack of Small Bank deposit outflows relative to Large banks will soon converge as balance sheets are wrecked by more bond bloodbathery...

Source: Bloomberg

As one veteran trader hinted, "It's almost time for another small bank failure so Jamie Dimon can soak up all their deposits... basically QT is directly impacting ONLY large banks... and when large bank cash drops enough a small bank has to be sacrificed."

Finally, we leave you with one thought - in 6 months and counting, America's 'smaller' banks will need to find that $100-billion plus from somewhere as that is when the BTFP bailout program ends (theoretically). Will regional bank balance sheets be stabilized by then?

Source: Bloomberg

Given the current bloodbathery in bond-land, we suspect we will know sooner rather than later.

More By This Author:

Oil, Cracks Soar After Russia Bans Diesel, Gasoline ExportsWall Street Reacts To The Fed's "Confused" 2024 Hawkish Shock

WTI Holds Bounce Above $90 After Across-The-Board Inventory Draws

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more