Citigroup's Living Will Plan Refused By US Regulators

Citigroup, Inc.’s (C - Free Report) ‘living will,’ which outlines the company's plans for winding down in the event of a catastrophic event, was rejected by U.S. banking regulators. In a meeting, most of a five-member Federal Deposit Insurance Corporation (“FDIC”) board decided not to approve the company’s resolution plan, citing ‘deficient’ data controls.

As part of the measures implemented after the 2008 financial crisis, the largest banks in the country are mandated to have these kinds of plans in place to protect the financial system and taxpayers from the consequences of their failure. The Federal Reserve and the FDIC recertify them every other year.

Citigroup's data controls were deemed ‘deficient’ by the FDIC. That represented a drop from the previous rating two years prior when the Fed and the FDIC approved the company's ‘living will’ while criticizing its data controls as a ‘shortcoming.’

The banking regulator's decision raises concerns about the bank's ability to be securely resolved and its ongoing attempts to improve data governance.

Per Citigroup’s management, the company continues to make considerable investments to revolutionize its infrastructure, including data automation and regulatory reporting processes. Its balance sheet and financial health remain strong, with robust capital, liquidity and reserves.

The Fed is likely to release its analysis of large bank ‘living wills’ by the end of June.

While a living will deficiency opens the door for regulators to eventually take more drastic measures, such as imposing business restrictions or requiring banks to divest particular assets, the process only begins if the Fed and the FDIC find a bank's plan to be inadequate.

Of late, C is undertaking organizational realignment to simplify its governance structure by eliminating various management layers. This resulted in a streamlined and straightforward management structure that is aligned with and supports the bank's strategy. The reorganization trimmed management layers and now operates under eight layers rather than 13. With fewer layers, increased spans of control, significantly reduced bureaucracy and unnecessary complexity, the company will now be able to operate more efficiently.

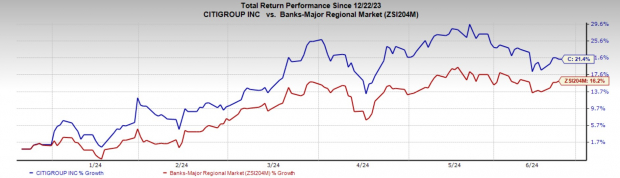

In the past six months, the stock has gained 21.4% compared with the industry’s rise of 6.2%.

Image Source: Zacks Investment Research

More By This Author:

Airline Stock Roundup: Delta Boosts Dividend Payout, JetBlue Introduces Flights

Delta Air Lines Cheers Investors With Dividend Payout

Are Microcaps A Good Proxy For Private Equity?

Citigroup currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 ...

more