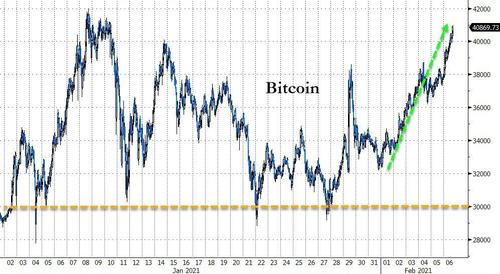

Bitcoin Bursts Back Above $40k, Ethereum Open Interest Hits New Highs

Renewed interest on the part of institutional money in the last week, such as Ray Dalio’s Bridgewater Associates, which manages $150 billion in investor money, and the Miller Opportunity Trust., has sparked a rotation back into Bitcoin (BITCOMP), sending the price of the biggest cryptocurrency back above $40 thousand.

Source: Bloomberg

It may also be getting a boost from MicroStrategy's WORLD.NOW BTC-themed conference this past week.

"'Bridgewater’s piece out last week had a sensitivity analysis which showed their estimates of BTC price, should private holders of gold switch to BTC,' states a weekly investor note Friday from quantitative trading firm QCP Capital.

'They forecasted that should 50% of capital in gold move into BTC, that would result in a price of $85,000 per 1 BTC.'"

Additionally, Bloomberg’s senior commodity strategist Mike McGlone is convinced that Bitcoin is currently in a consolidating bull market, and $50,000 is the “initial target resistance” level.

"'It would be naïve not to expect bumps in the road with the new technology, but unless human advancement, electrification and digitalization backpedal, Bitcoin is poised to eventually become a worthy substitute for gold in investment portfolios,' wrote McGlone."

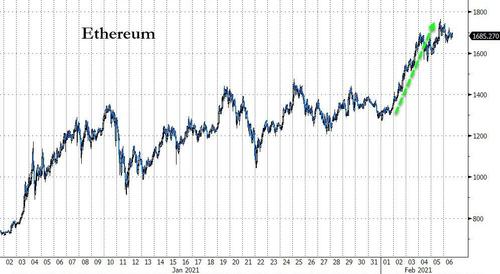

Ethereum (ETH-X)'s recent surge has stabilized.

Source: Bloomberg

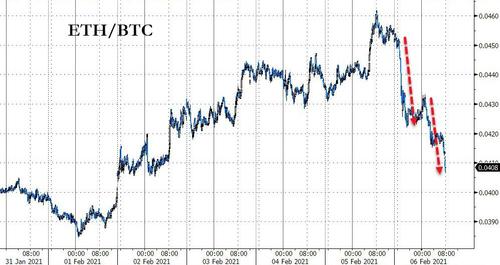

Yet, BTC's gains have erased the relative ETH outperformance of the past week.

Source: Bloomberg

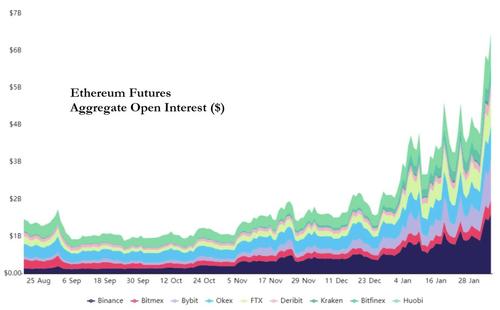

Ethereum's recent gains have been supported by an ever-increasing level of futures open interest. As CoinTelegraph reports, open interest on Ether futures reached a record $6.5 billion, which is a 128% monthly increase.

This suggests short-sellers are likely fully hedged, taking benefit of the futures premium instead of effectively expecting a downside.

Professional investors using the strategy described above are essentially doing cash and carry trades, which consist of buying the underlying asset and simultaneously selling futures contracts. These arbitrage positions usually do not present liquidation risks. Therefore, the current surge in open interest during a strong rally is a positive indicator.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Such a nonsense, this #ethereum interest. Absolutely no reason, simple pump like $gme

How many you holding? 🤣🤣😂😂