Ares Capital: Big Dividend, 3 Big Risks

Ares Capital (ARCC) is an attractive big-dividend (9.9%) Business Development Company (BDC) trading at a discounted price. As shown in our recent report, Big Dividend BDCs: Ranking the Best and Worst, Ares price dropped (-3.2%) during the recent market-wide selloff of big dividend securities, and it now trades at an 11% discount to its Net Asset Value (NAV). It just announced earnings a few days ago, and despite the risks, such as heightened short-interest, an increasingly hawkish fed, and management conflicts of interest, we believe Ares is an attractive long-term investment for income-focused investors because of its big dividend, recently discounted price, and attractive fundamentals.

About

Ares’ objective is to generate current income and capital appreciation through its debt and equity investments. It’s a regulated investment company and BDC, which means it’s required to distribute at least 90% of its taxable income to shareholders (note: distributing at least 90% allows Ares to avoid corporate income tax on distributed taxable income). As a side note, BDCs were created by Congress in 1980 to provide public investors another means to invest in private US business, typically small and middle market companies.

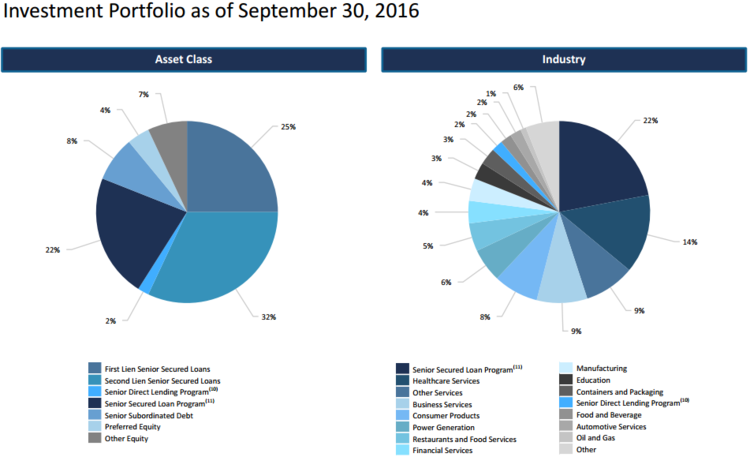

As shown in the following chart, Ares investments are diversified across multiple asset classes and industries.

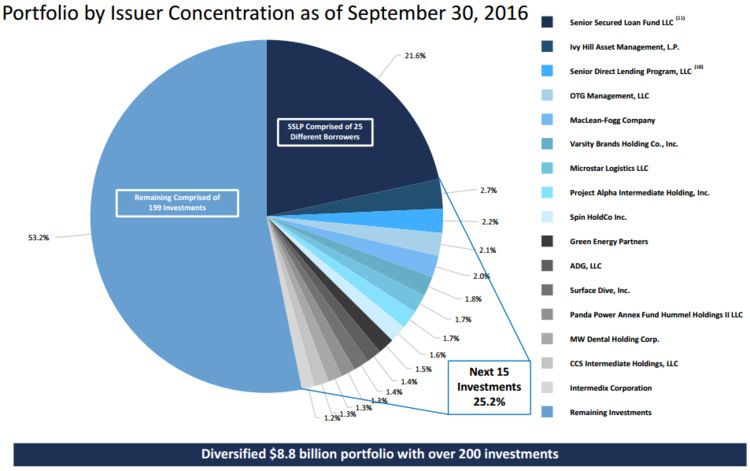

And for added perspective, this next chart shows Ares $8.8 billion investment portfolio is diversified across multiple issuers.

Also worth noting, Ares is externally managed by Ares Capital Management LLC, a subsidiary of Ares Management, L.P. (ARES), a publicly traded, alternative asset manager. We’ll have more to say about external management team later.

Valuation and Fundamentals

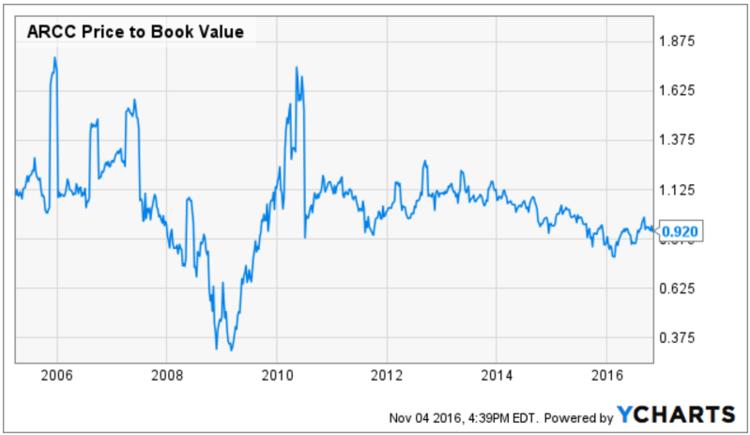

From a valuation standpoint, Ares is not unattractive. For example, the following chart shows that Ares is currently trading at a discount to its book value.

And while such a discount can be viewed as a risk (i.e. it can be more challenging for a BDC to raise capital when its Price to Book is low), we view it as a positive indication of stock price appreciation potential. For example, part of the reason the price has declined is due to near-term expectations surrounding its upcoming acquisition of American Capital (more on this later).

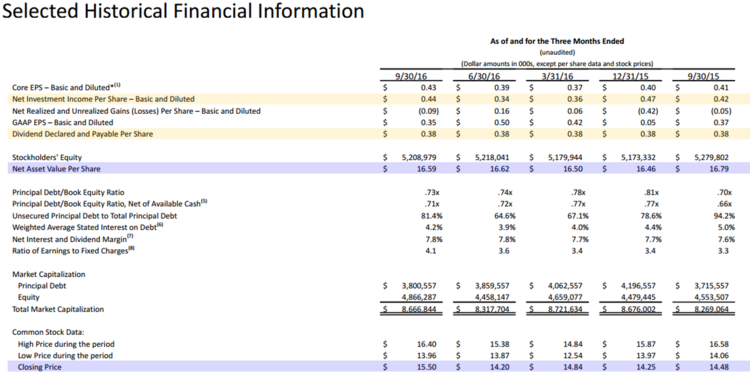

Ares’ consistent ability to cover its dividend payment is another attractive quality. For example, the orange highlights in this next table shows Ares quarterly Net Investment Income per share generally exceeds its quarterly dividend payment with a fair amount of consistency and low volatility (and the purple highlights are a reminder of Ares’s discount to NAV, which is attractive in our view).

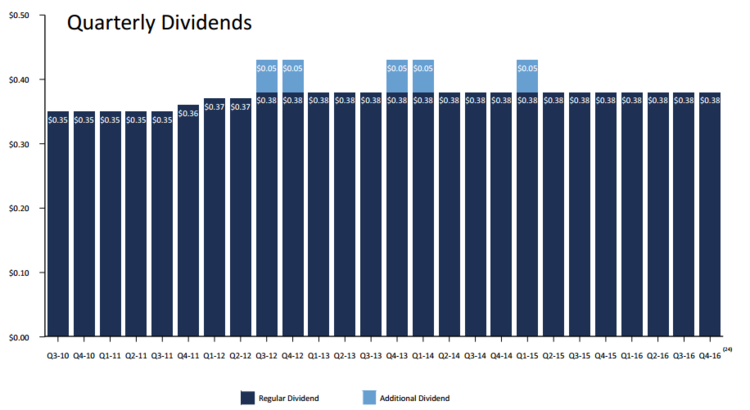

This next table shows Ares’s consistent big-dividend payments, which we consider attractive.

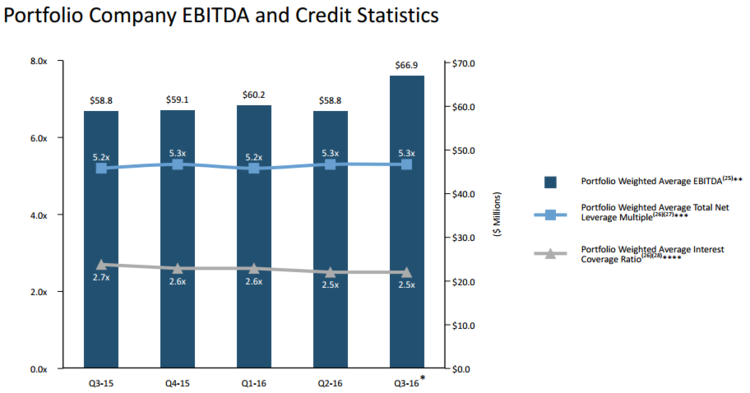

Other fundamentals worth considering are Ares’s growing earnings before interest taxes depreciation and amortization (EBITDA), its reasonable and consistent leverage multiple, and its healthy interest coverage ratio, as shown in the following graph.

Short Interest Considerations

As shown in the following chart, Ares’ short interest spiked earlier this year when it announced its planned acquisition of the second largest BDC by market capitalization, American Capital (ACAS).

Regardless of the specific motive for the short interest spike (e.g. it could be the result of hedging activity or it could be more speculative- perhaps a bet against high yield in general, or perhaps someone is short Ares and long a basket of other BDCs based on a perceived merger arbitrage opportunity), it will likely subside soon leading into the acquisition (which may close as soon as the first week of January 2017), and may put upward pressure on the stock price as shorts buy to close their positions.

For reference, here is a chart of the performance of ARCC relative to a BDC index following the acquisition announcement in May (we also included the NASDAQ- the exchange upon which ARCC trades).

Specifically, it will likely be good for Ares if/when the merger goes through because it has already sold off and the short-interest will likely return to normal levels and this may cause the stock price to increase. And if the merger falls apart, that too will likely be good for Ares stock price because with most large acquisitions (such as the American Capital acquisition) the shares of the acquirer often decline (as seems to be the case for Ares since the acquisition announcement). An abandonment of the merger could cause Ares shares to rise as well.

Risks

There are certainly other risks to Ares business that are worth considering. For example, the increasingly hawkish US Federal Reserve could impact Ares in a negative way. Ares describes this risk in their annual report as follows:

We are exposed to risks associated with changes in interest rates. General interest rate fluctuations may have a substantial negative impact on our investments and investment opportunities and, accordingly, may have a material adverse effect on our investment objective and rate of return on invested capital. Because we borrow money and may issue debt securities or preferred stock to make investments, our net investment income is dependent upon the difference between the rate at which we borrow funds or pay interest or dividends on such debt.

Additionally, low interest rates are intended to boost the economy, and raising rates could slow the economy and slow the activities of the companies to which Ares does business with.

As mentioned early, external management conflicts of interest pose a risk. Ares describes this risk in their annual report as follows:

There are significant potential conflicts of interest that could impact our investment returns. Certain of our executive officers and directors, and members of the investment committee of our investment adviser, serve or may serve as officers, directors or principals of other entities and affiliates of our investment adviser and investment funds managed by our affiliates. Accordingly, they may have obligations to investors in those entities, the fulfillment of which might not be in our or our stockholders' best interests or may require them to devote time to services for other entities, which could interfere with the time available to provide services to us.

In addition to potential conflicts of interest, externally managed BDCs (such as Ares) also often charge higher operational and management fees because they’re not properly incentivized to keep them lower.

As another risk example, we believe Ares involves a higher than average degree of risk, as described in the company’s annual report:

Investing in our common stock may involve an above average degree of risk. The investments we make in accordance with our investment objective may result in a higher amount of risk than alternative investment options and volatility or loss of principal. Our investments in portfolio companies may be highly speculative and aggressive and, therefore, an investment in our securities may not be suitable for someone with lower risk tolerance.

Conclusion

Overall, we like Ares Capital so much that we’ve ranked it #4 on our recent list of Four Big Dividend BDCs Worth Considering. Specifically, we like its big dividend, discounted price, and diversified business structure. We also believe short-term market activity (e.g. the proposed merger, and the recent selloff in high yield securities) has created a more attractive entry point for long-term investors. We’d have ranked Ares higher on our list if it wasn’t for the external management team and potential conflicts of interest. As an income investor, we believe Ares is worth considering for the higher risk portion of your diversified long-term portfolio. And if you are interested in additional big-dividend opportunities, consider our recent sister article: Big Dividend REITS: Ranking the Best and Worst.

Disclosure: None.