3 Stocks Set To Crush An ‘Unbelievable’ Earnings Season, Say Top Analysts

There is no doubt that the markets have been choppy recently. But according to one market expert the future still looks bright. “The market moves with the direction of earnings,” Canaccord Genuity’s chief strategist Tony Dwyer told CNBC. “As long as the economy is positive, that direction of earnings is going up.”

In fact, Dwyer believes that we are set up for an “unbelievable” earnings season. “This quarter alone we’re probably going to be close to 24 percent growth rate versus a year ago in S&P operating profits,” he said.

And for those investors who remain skeptical, Dwyer has this advice: “Outside of a very clearly identified recession period, you don’t want to sell weakness,” Dwyer said. “You want to buy it.”

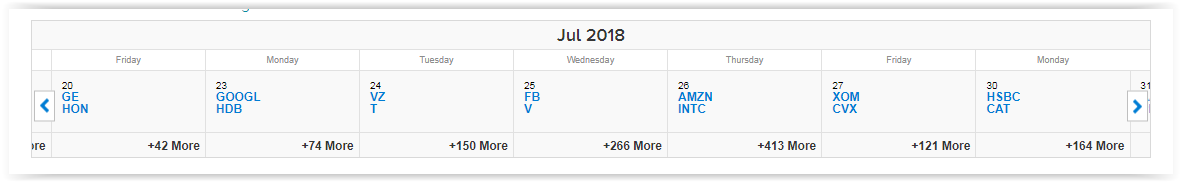

So with this bullish analysis in mind, we turned to TipRanks’ Earnings Calendar to pinpoint three of the most promising stocks for you to track this earning season.

This nifty calendar enables you to find stocks with upcoming earnings that have a ‘Strong Buy’ rating from the Street’s best-performing analysts. As well as the stock’s consensus rating, you can also filter by market cap and sector.

Let’s take a closer look at how that works out here:

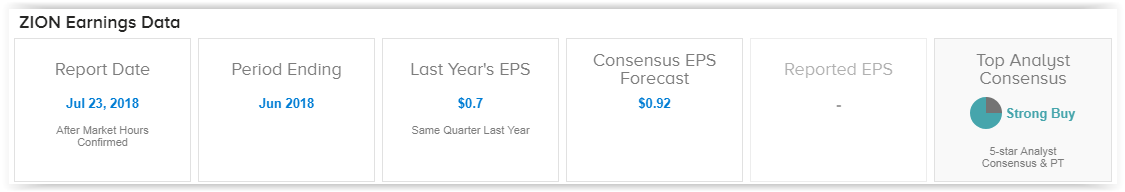

1. Zions Bancorp (NASDAQ:ZION)

This Utah-based bank, which boasts assets of over $65 billion, is out with its earnings results on July 23.

Five-star Vining Sparks analyst Marty Mosby is impressed by large-cap bank earnings results so far. He highlights Zion as a stock set to bounce on its announced earnings.

“We believe a wave of potentially favorable earnings announcements started today, and should play out over the next 2 weeks of continuous earnings announcements.We look forward to hopefully being able to highlight the beginning of a rebound in the stock prices for the Super Regional and Trust Banks, especially over the next couple of weeks” Mosby wrote on July 14. As we can see from TipRanks, Mosby is one of the Street’s best analysts. For his precise stock picking ability, he ranks a very impressive #49 out of over 4,800 tracked analysts.

Moreover, he’s not just positive on this quarter. Mosby sees the stock’s out-performance continuing for the whole year. “Given ZION’s strong asset sensitivity to the short end of the yield curve and a significantly lower tax rate, we estimate that ZION could increase its operating earnings per share by another 40% in 2018E. This continued improvement in earnings should enable ZION to trade at around a 17x price-to-earnings multiple, pushing its stock price up above $60 before year-end 2018E” the analyst cheered. Indeed, he has a ‘Strong Buy’ rating on Zion with a $65 price target (26% upside potential).

2. Facebook (NASDAQ:FB)

Social media giant Facebook is out with its second quarter data on July 25. So far the signs are bullish that this is going to be another killer earnings season for FB. Note that this is a stock already up 18% since its Q1:18 earnings call (after increasing 9% on the print), while the S&P 500 is up only 4%.

In his earnings preview, top RBC Capital analyst Mark Mahaney picks FB as his Top Large Cap Long. Mahaney explains: “We still view FB as among the Best Growth Stories in Tech. According to our Ad Surveys, FB ranks as one of the highest ROI platforms & has intrinsically one of the most positive Spend Intentions skews.” Plus he adds “we now see FB Messenger Monetization happening.”

The best part is that FB is still trading at discount prices. “On valuation, FB currently trades @ 20X 19E P/E (~19X excl. cash) — cheap for what is a 30%+ EPS CAGR” writes Mahaney. He has a $250 price target on the stock indicating 21% upside potential from current levels. Encouragingly, this is an analyst that has so far achieved remarkable success with his FB ratings. On FB specifically, Mahaney is currently tracking a 100% success rate and 29.2% average return per rating.

3. Raytheon (NYSE:RTN)

Top RBC Capital analyst Matthew W. McConnell (Profile & Recommendations) singles out Raytheon as one of his two favorite Aerospace and Defense stocks going into earnings. Raytheon is the last defense prime with a pristine balance sheet levered at just 0.4x net debt/EBITDA, points out the analyst.

“We see upside to the 2018 bookings target, solid international demand, and margin upside at Integrated Defense Systems (IDS)” he writes. As a result, he now expects a boost to guidance on 2Q18 from better operating performance, particularly in IDS. This comes with a $262 price target on the stock, indicating over 30% upside from the current share price.

Plus his upbeat conclusion suggests the good times will keep rolling. According to McConnell, Raytheon is “one of the most favorably positioned defense primes based on its leading market positions in missile defense systems, missiles, and cyber which are seeing intense investment that we expect to continue for the foreseeable future.”

TipRanks’ earnings calendar provides users with a simple and effective way to find stocks with upcoming earnings dates that have been recommended by the best-performing sell-side analysts.

Find new investment inspiration by tracking companies’ earnings announcements. Earnings announcements are a time of stock price volatility as crucial results are released revealing how the company is performing and giving guidance for the year ahead. Investors can see if earnings match a stock’s hype and, if they choose, take advantage of this stock volatility to buy or sell stocks.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more

Some interesting pics here. Thanks.