Fed's Favorite Inflation Indicator Unexpectedly Jumped In June; Savings Rate Slumps

The broadly weak trend of US macro data was jolted yesterday by a hotter than expected GDP print - which prompted a hawkish shift in rate-cut expectations. This morning, the doves get another chance for some 'bad news' (disinflation) to support their 'we must cut' narrative (that Dudley et al. have exposed).

The Fed's favorite inflation indicator - Core PCE - instead came in slightly hotter than expected, rising 2.6% YoY (vs +2.5% YoY exp). The headline PCE dipped to +2.5%...

Source: Bloomberg

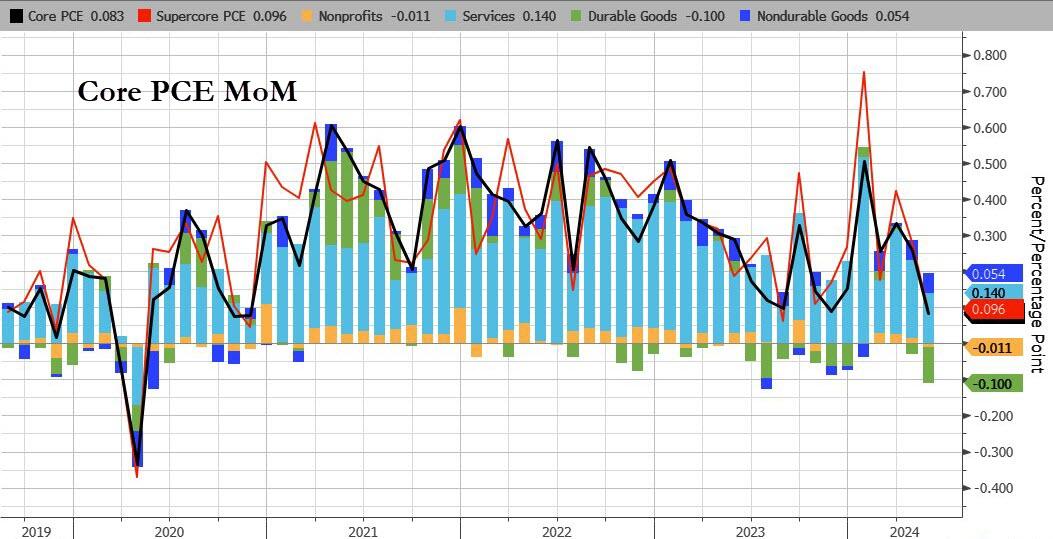

Under the hood, durable goods deflation continues to drag Core PCE lower while Services costs continue to rise...

Source: Bloomberg

Even more notably, the so-called SuperCore PCE rose 0.2% MoM, which saw YoY rise to 3.43%... which is awkwardly stagnant at elevated levels...

Source: Bloomberg

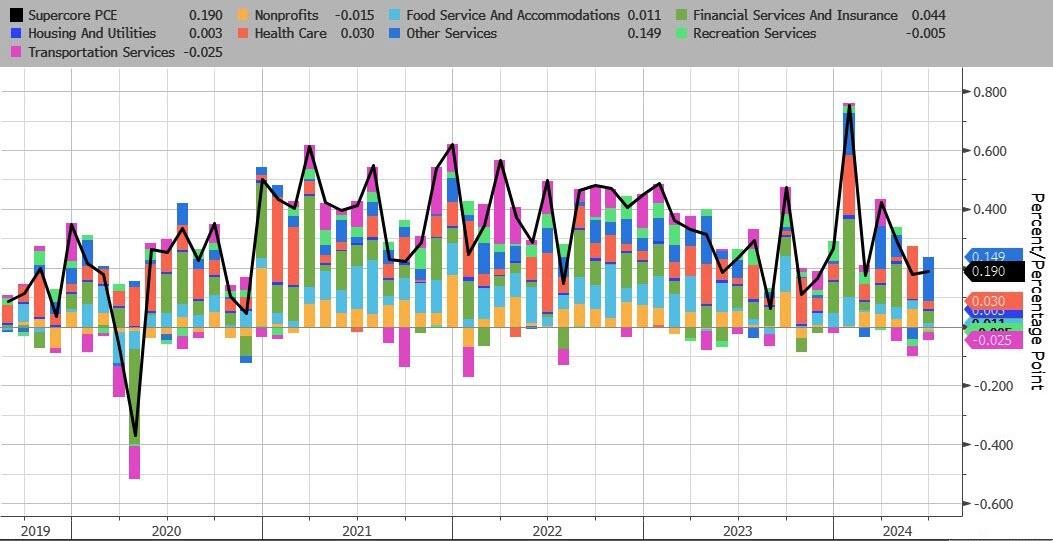

That is the 50th straight monthly rise in SuperCore prices with Healthcare costs soaring...

Source: Bloomberg

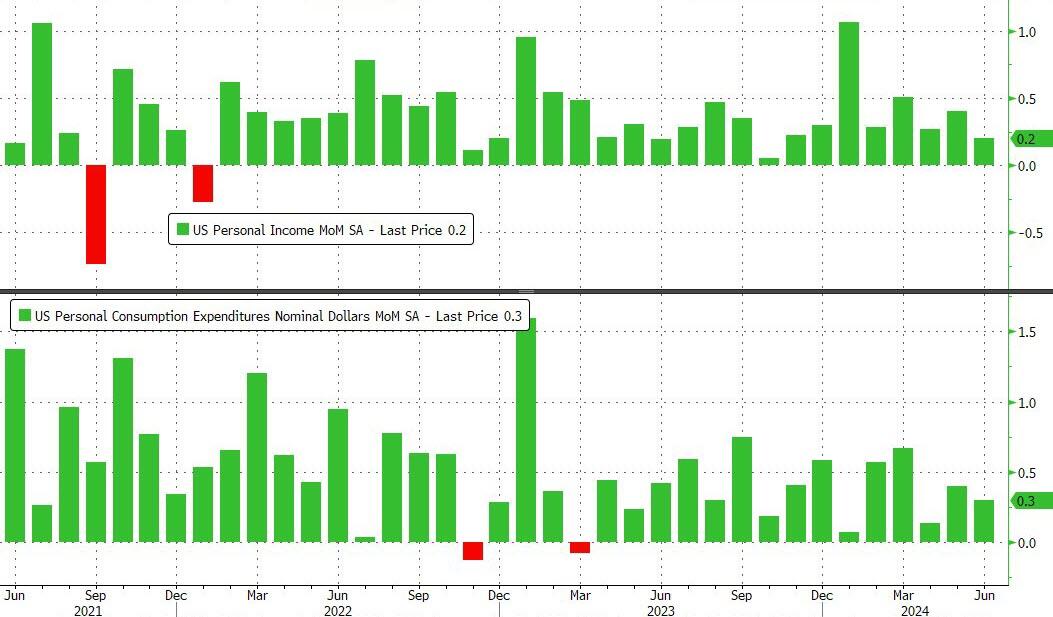

On A MoM basis, income growth was weaker than expected (+0.2% vs +0.4% exp), while spending was +0.3% as expected...

Source: Bloomberg

On a YoY basis, spending continues to outpace incomes...

Source: Bloomberg

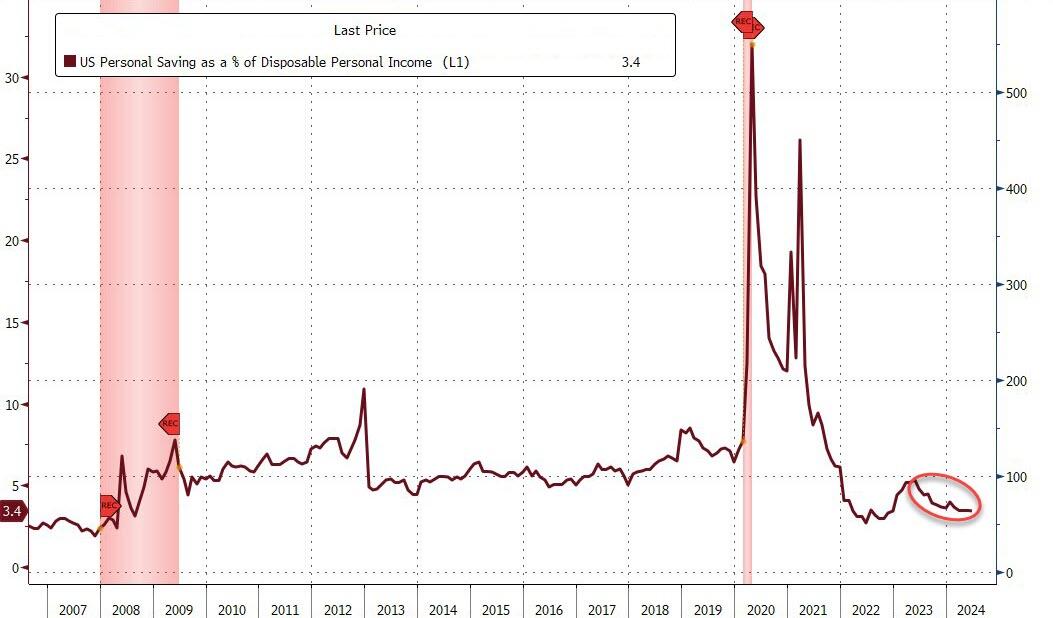

Which dragged the savings rate down further...

Source: Bloomberg

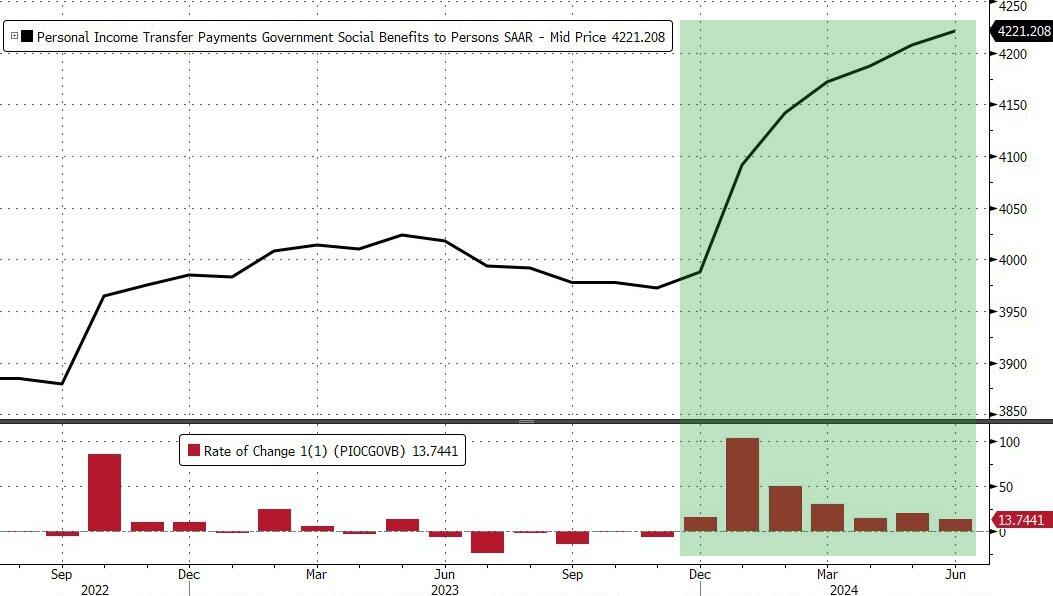

All of which takes place against a background of the seventh straight month of rising government handouts (well it is an election year after all)... (which means the savings rate would have puked even more without it)

Source: Bloomberg

Not enough there for the doves...

More By This Author:

Tesla And BYD Claim A Third Of Global EV MarketMega-Cap Meltdown Continues As 'Good News' Sends Rate-Cut Hopes Reeling

US Durable Goods Orders Plunged In June As Non-Defense-Spending Crashed

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more