Fed's Favorite Inflation Indicator Slides To 30 Month Lows, Savings Rate Ticks Higher

One of The Fed's favorite inflation indicators - Core PCE Deflator - fell to +3.5% YoY in October from +3.7% in Sept (its lowest since April 2021). Headline PCE tumbled to +3.00% YoY (below the 3.1% exp)...

Source: Bloomberg

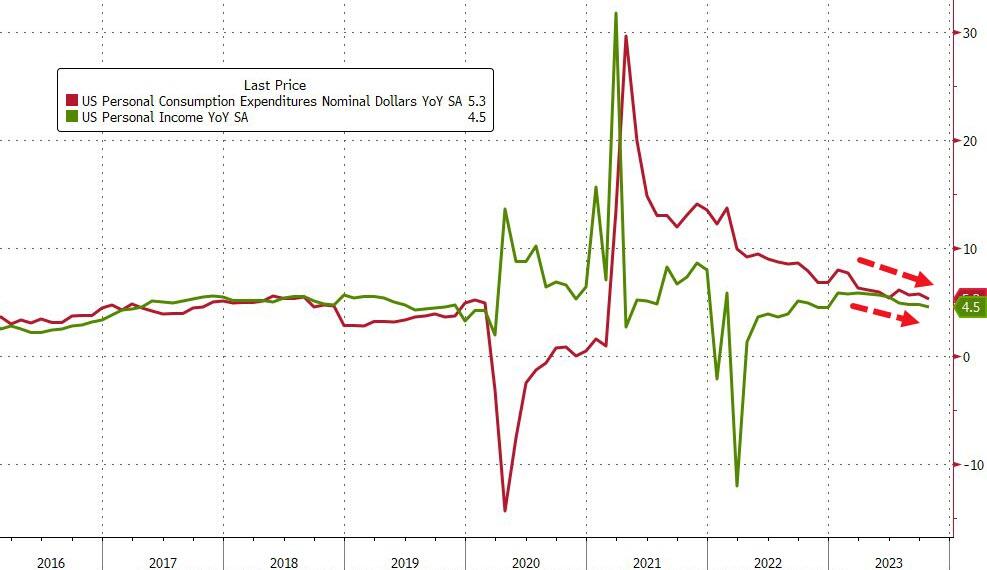

Both income and spending growth slowed on a MoM basis (both +0.2% MoM)...

Source: Bloomberg

Income growth at 4.5% YoY is the slowest since Dec 2022 and Spending growth at +5.3% YoY is the slowest since Feb 2021...

Source: Bloomberg

The savings rate ticked up from an upwardly revised 3.7% of DPI to 3.8% in October...

Source: Bloomberg

Is the consumer finally pulling back... or just reaching the limit on every source of credit?

More By This Author:

Bullion, Bonds, & Black Gold All Bid As Rate-Cut Hopes Ramp-UpDownbeat Beige Book Finds Economic Activity "Slowing", Brings Fed One Step Closer To Rate Cuts

WTI Extends Losses After Across-The-Board Inventory Builds, Record Crude Production

Disclosure: None

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!