Fed's Favorite Inflation Indicator Re-Accelerates In February As Savings Rate Soars

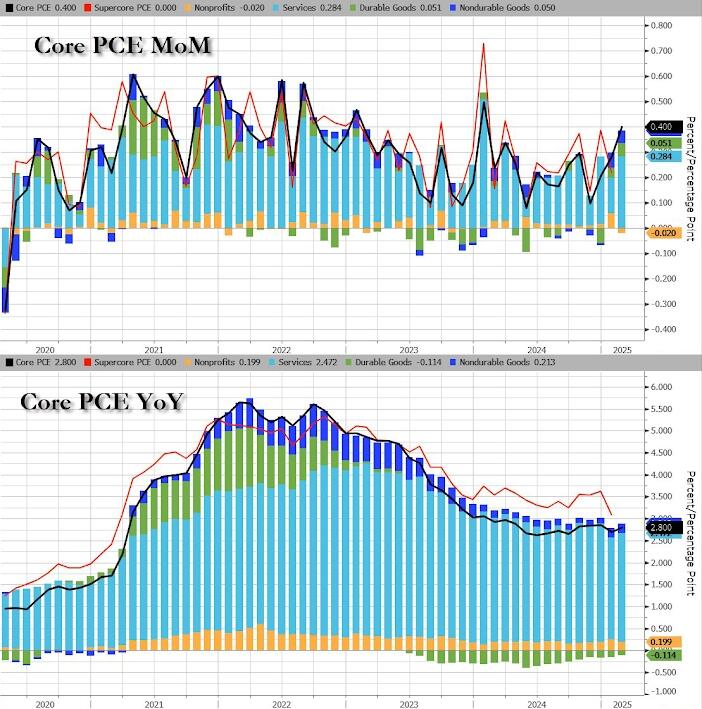

The Fed's favorite inflation indicator - Core PCE - printed hotter than expected in February, rising 0.4% MoM, bringing prices up 2.8% YoY...

Source: Bloomberg

"Core PCE was higher than expected, and it might be hard to go lower from here because incomes are high and tariffs are coming," said David Russell, Global Head of Market Strategy at TradeStation.

"We might be looking at the last remnants of the old economy before inflation expectations are permanently reset upward. This might be the opposite of Goldilocks, with incomes and inflation too high for the Fed to lower rates very much. Meanwhile, prospects for growth and profit margins are dimming."

For now there is no tariff-driven impact in the PCE data as it was Services costs that were the big driver of the reacceleration...

Source: Bloomberg

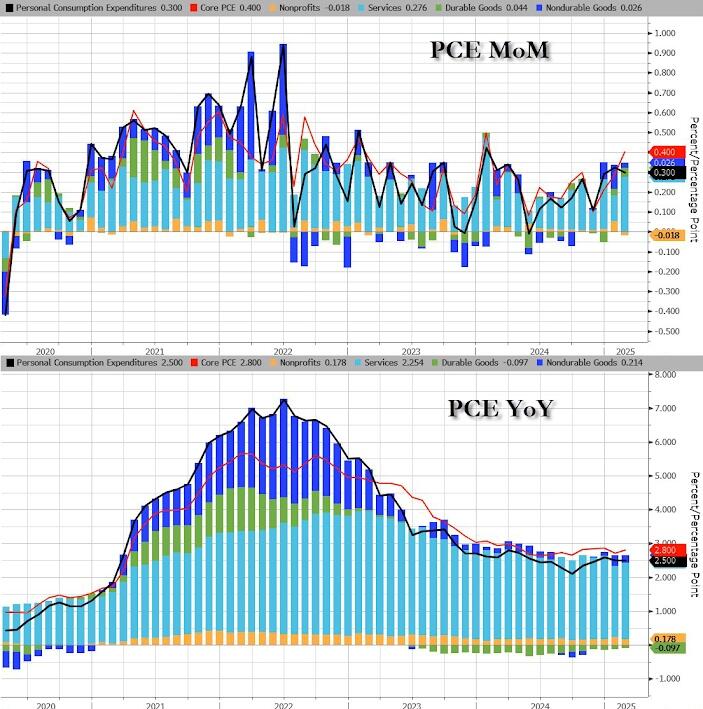

Disappointingly sticky is the phrase that comes to mind, while the headline PCE rose 0.3% MoM as expected with the YoY price change slowing modestly...

Source: Bloomberg

Under the hood, Services costs dominated the headline gains...

Source: Bloomberg

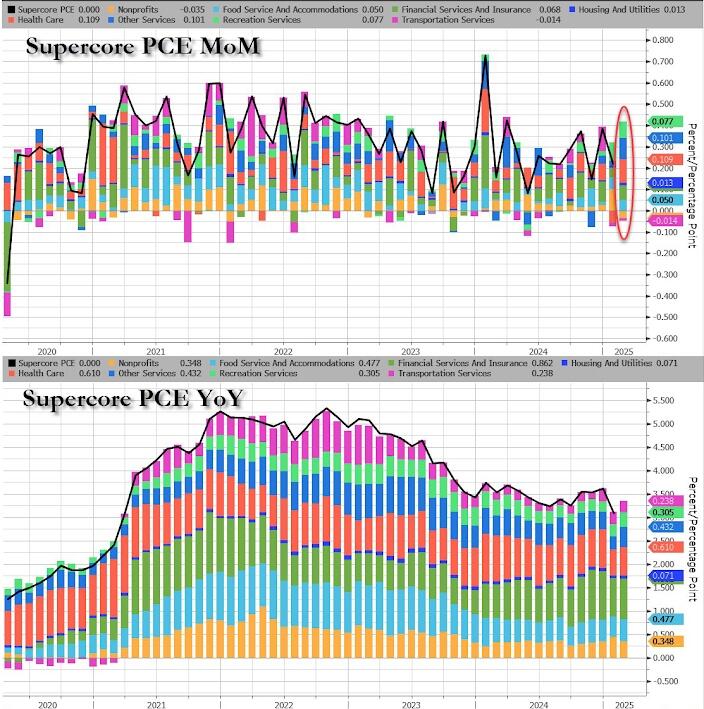

Perhaps most troubling was the sizable rebound in so-called SuperCore PCE (Services Ex Shelter)...

Source: Bloomberg

With Housing and Non-Profits seeing prices surge MoM...

Source: Bloomberg

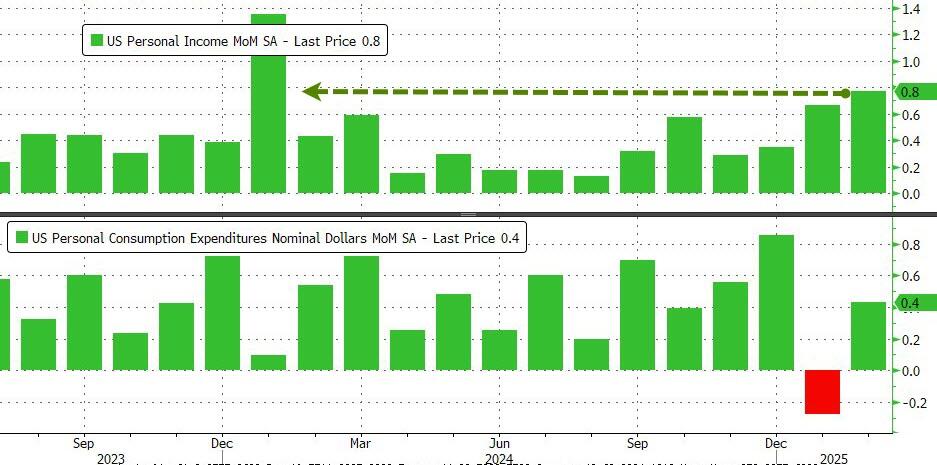

Meanwhile, as prices rose, so did personal income, jumping 0.8% MoM - the most since Jan 2024, considerably outpacing the 0.4% rise in personal spending...

Source: Bloomberg

Inflation-adjusted consumer spending edged up 0.1% after falling in January, with goods outlays bouncing back and services spending falling.

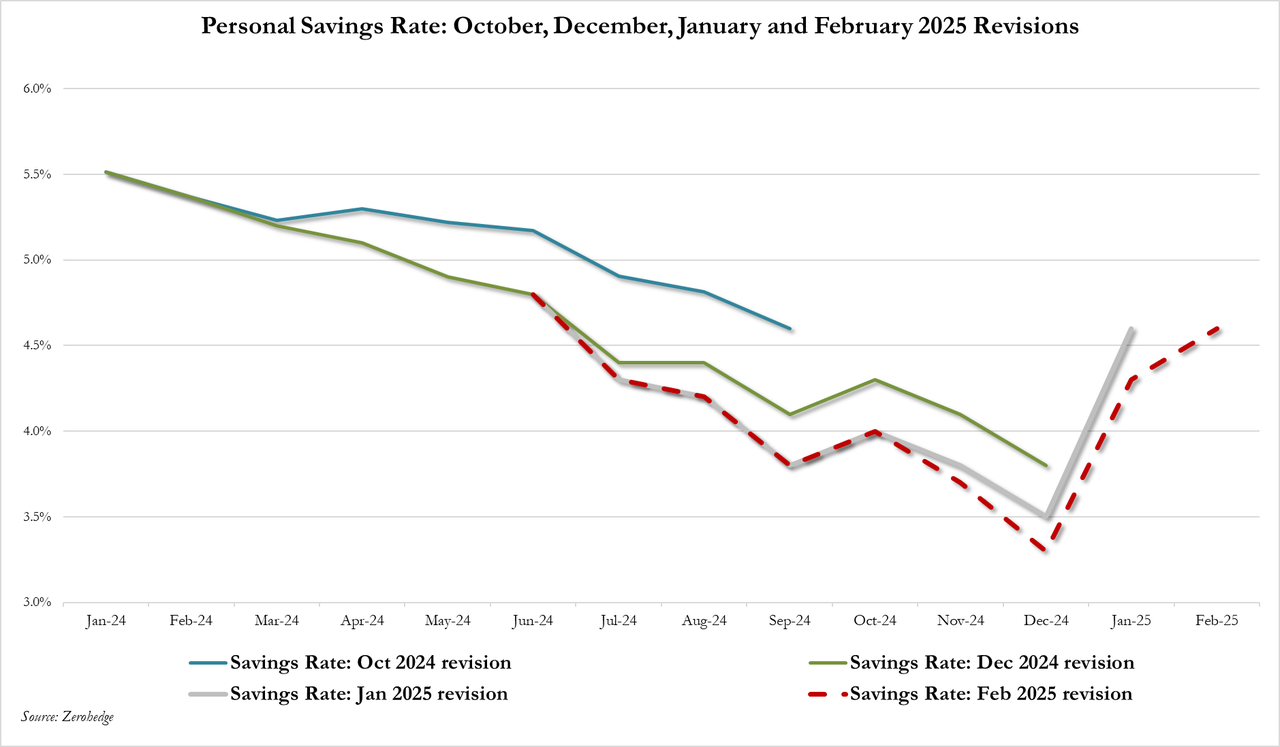

The income to spending differential sent the savings rate to its highest since June 2024

Source: Bloomberg

Finally, is this the start of the 70s-esque rebound in inflation?

Source: Bloomberg

Does this look like it's going to be 'transitory' again?

More By This Author:

Ugly, Tailing 7Y Auction Sees Lowest Foreign Demand In 3 YearsJapanese Carmakers Face Catastrophic Profit Hit From Trump's Auto Tariffs

5Y Auction Tails Despite Stellar Foreign Demand

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more